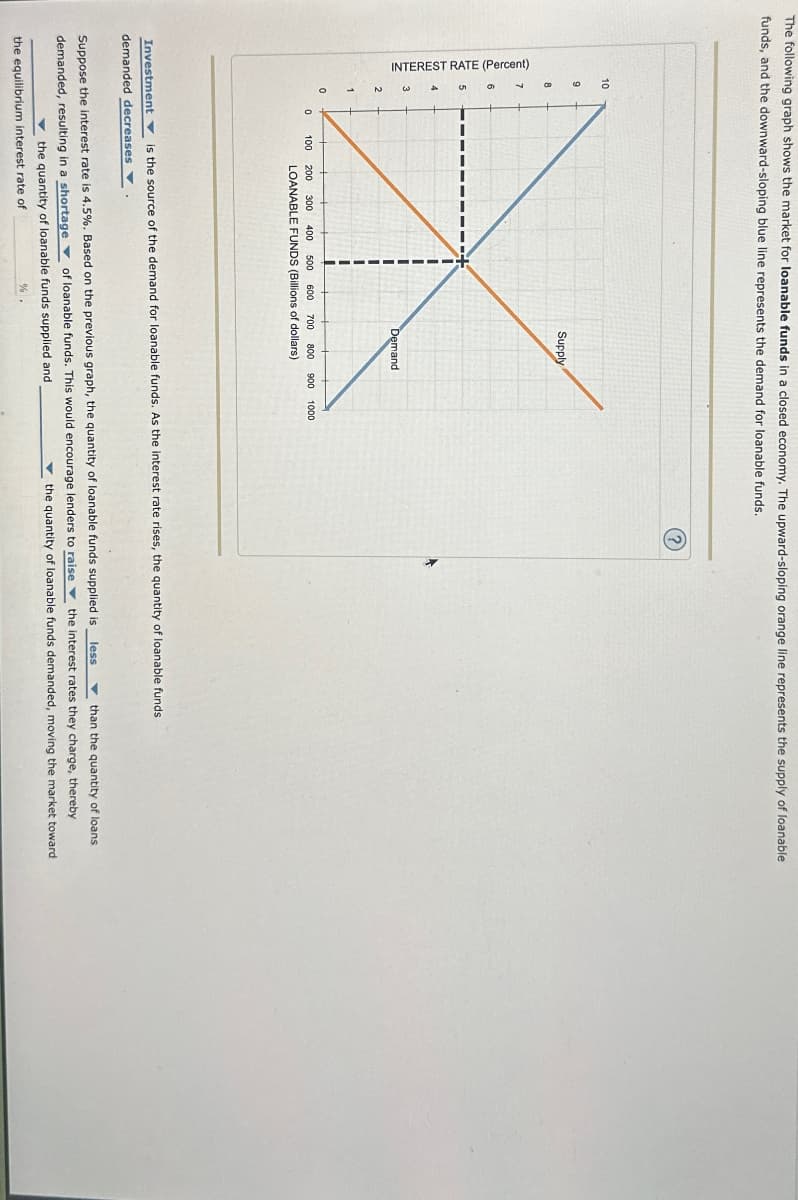

The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. INTEREST RATE (Percent) 2 1 10 9 Supply 0 0 100 Demand 200 300 400 500 600 700 800 900 1000 LOANABLE FUNDS (Billions of dollars) ? Investment is the source of the demand for loanable funds. As the interest rate rises, the quantity of loanable funds demanded decreases Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is demanded, resulting in a shortage of loanable funds. This would encourage lenders to raise the interest rates they charge, thereby the quantity of loanable funds supplied and the equilibrium interest rate of % less than the quantity of loans the quantity of loanable funds demanded, moving the market toward

The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. INTEREST RATE (Percent) 2 1 10 9 Supply 0 0 100 Demand 200 300 400 500 600 700 800 900 1000 LOANABLE FUNDS (Billions of dollars) ? Investment is the source of the demand for loanable funds. As the interest rate rises, the quantity of loanable funds demanded decreases Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is demanded, resulting in a shortage of loanable funds. This would encourage lenders to raise the interest rates they charge, thereby the quantity of loanable funds supplied and the equilibrium interest rate of % less than the quantity of loans the quantity of loanable funds demanded, moving the market toward

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable

funds, and the downward-sloping blue line represents the demand for loanable funds.

INTEREST RATE (Percent)

2

1

10

9

Supply

0

0

100

Demand

200 300 400 500 600 700 800 900 1000

LOANABLE FUNDS (Billions of dollars)

?

Investment is the source of the demand for loanable funds. As the interest rate rises, the quantity of loanable funds

demanded decreases

Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is

demanded, resulting in a shortage of loanable funds. This would encourage lenders to raise the interest rates they charge, thereby

the quantity of loanable funds supplied and

the equilibrium interest rate of

%

less

than the quantity of loans

the quantity of loanable funds demanded, moving the market toward

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning