ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

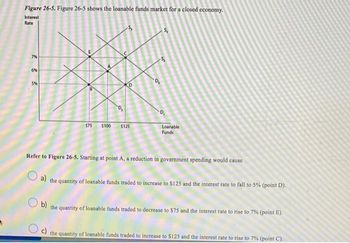

Transcribed Image Text:Figure 26-5. Figure 26-5 shows the loanable funds market for a closed economy.

Interest

Rate

7%

6%

5%

D

S

$75 $100

$125

Loanable

Funds

Refer to Figure 26-5. Starting at point A, a reduction in government spending would cause

a) the quantity of loanable funds traded to increase to $125 and the interest rate to fall to 5% (point D).

b)

the quantity of loanable funds traded to decrease to $75 and the interest rate to rise to 7% (point E).

c) the quantity of loanable funds traded to increase to $125 and the interest rate to rise to 7% (point C).

Transcribed Image Text:Refer to Figure 26-5. Starting at point A, a reduction in government spending would cause

a) the quantity of loanable funds traded to increase to $125 and the interest rate to fall to 5% (point D).

b) the quantity of loanable funds traded to decrease to $75 and the interest rate to rise to 7% (point E).

c) the quantity of loanable funds traded to increase to $125 and the interest rate to rise to 7% (point C).

d) the quantity of loanable funds traded to decrease to $75 and the interest rate to fall to 5% (point B).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the loanable funds market, if firms become more optimistic about future profitability, then the a demand for loanable funds will increase, interest rates will increase, and private sector investment spending will increase. b demand for loanable funds will decrease, interest rates will decrease, and the equilibrium quantity of borrowing will decrease. c supply of loanable funds will increase, interest rates will decrease, and the equilibrium quantity of borrowing will increase. d supply of loanable funds will increase, interest rates will increase, and private sector investment spending will increase.arrow_forwardHomework (Ch 23) 5. Impact of budget deficits The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that the financial industry is close to bankruptcy and the U.S. government decides to implement a bailout plan of several billion dollars without increasing taxes, causing a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both. INTEREST RATE LOANABLE FUNDS Based on this model, the budget deficit leads to D $ 6 m D/ in the level of investment and in the interest rate.arrow_forwardAssume the country’s government increased spending and as a result, the nation ran a deficit. Explain how the increase in government spending will affect real interest rates and show the change on the loanable funds market graph.arrow_forward

- The current market rate of interest is 10 percent. At that rate of interest, businesses borrow $300 billion per year for investment and consumers borrow $50 billion per year to finance purchases. The government is currently borrowing $150 billion per year to cover its budget deficit. a. Derive the market demand for loanable funds, and show how investors and consumers will be affected if the budget deficit increases to $250 billion per year. Draw a graph to show your conclusion. b. Assuming taxpayers do not anticipate an increase in the future market rate of interest due to the increase in budget deficit, show the impact of the increase in the budget deficit on the market for loanable funds.arrow_forwardShow the effect on the real interest rate and equilibrium quantity of loanable funds of a decrease in the demand for loanable funds and a smaller decrease in the supply of loanable funds. Draw a demand for loanable funds curve. Label it DLF0. Draw a supply of loanable funds curve. Label it SLF0. Draw a point at the equilibrium real interest rate and quantity of loanable funds. Label it 1. Draw a curve that shows a decrease in the demand for loanable funds. Label it DLF1. Draw a curve that shows a smaller decrease in the supply of loanable funds. Label it SLF1. Draw a point at the new equilibrium real interest rate and quantity of loanable funds. Label it 2.arrow_forward27) What is the most likely impact of an increase in the government budget deficit on the market for loanable funds? a) Overall demand for loanable funds decreases. b) Overall supply of loanable funds increases. c) Real interest rates fall. d) Private investment spending decreases.arrow_forward

- Indicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift? Interest rate 24% 22 20 ' 18 16 14 12 10 a 6 4 2 Y S ° $200 $400 600 D 800 1,000 1,200 Quantity of leanable funds (billions of dollars) Indicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift?arrow_forwardEconomists who favour balanced budgets argue that increases in government spending, without any corresponding increase in taxes, will have a certain effect in the market for loanable funds. Modify the graph to show this effect. Real interest rate demand X Quantity of loanable funds As a result, this impact on the market for loanable funds reduces imports. labour productivity. capital inflows. domestic investment.arrow_forwardQUESTION 10 Suppose a new tax bill has just been passed that raises taxes for the majority of people in a country. As a result of the tax increase, explain how interest rates will be affected using the loanable funds theory. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U S Paragraph Arial 14px A v Ix X O 8 OQ x2 X, +, RBC 田用区 因arrow_forward

- Only typed answer and please answer correctlyarrow_forwardQuestion 7 Refer to the following graph to answer the following questions: Line 1 Vertical Axis C Horizontal Axis a shift from line 1 to line 4. movement from B to A a shift from line 2 to line 3 D Assuming the figure represents the market for loanable funds, which of the following would represent a cut in corporate tax rates, causing business owners and managers to become more optimistic? movement from A to B a shift from line 3 to line 2 Line 4 Line 2 Line 3 Ⓡarrow_forwardDraw the graph of the effect on the equilibrium in the loanable funds market when corporate taxes increase. Does the demand for loanable funds increase or decrease? Does the interest rate increase of decrease?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education