FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

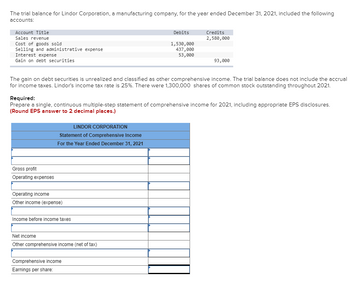

Transcribed Image Text:The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2021, included the following

accounts:

Account Title

Sales revenue

Cost of goods sold

Selling and administrative expense

Interest expense

Gain on debt securities

Gross profit

Operating expenses

LINDOR CORPORATION

Statement of Comprehensive Income

For the Year Ended December 31, 2021

The gain on debt securities is unrealized and classified as other comprehensive income. The trial balance does not include the accrual

for income taxes. Lindor's income tax rate is 25%. There were 1,300,000 shares of common stock outstanding throughout 2021.

Operating income

Other income (expense)

Required:

Prepare a single, continuous multiple-step statement of comprehensive income for 2021, including appropriate EPS disclosures.

(Round EPS answer to 2 decimal places.)

Income before income taxes

Debits

Net income

Other comprehensive income (net of tax)

1,530,000

437,000

53,000

Comprehensive income

Earnings per share:

Credits

2,580,000

93,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Frederickson Office Supplies recently reported $12,500 of sales, $7,250 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges and no non-operating income. It had $8,000 of bonds outstanding that carry a 7.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's taxable income, or earnings before taxes (EBT)? * 3935.93 3748.50 3400 3230 4000arrow_forwardThe B/S and I/S for Company ABC are below. At the beginning of year 1, all B/S items are zero except for a Factory, that begins year 1 at 200,000. All inventory is sold by the end of each year (EOY), but some sales and some expenses are “on account”. EBT for tax purposes is the same as the EBT on the Income Statement. Corporate taxes are 21%, and are paid in cash at EOY. All cash the company has at EOY is paid as cash dividends to shareholders. Calculate the dividends issued by the company each of the four years. End Of Yr1 EOY 2 EOY 3 EOY 4 Balance Sheet (B/S) Accounts Receivable 5,000 15,000 15,000 10,000 Accounts Payable 4,000 6,000 8,000 10,000 Cash 0 0 0 0 Factory 175,000 150,000 125,000 100,000 Income Statement (I/S) Revenues 190,000 200,000 200,000 200,000 COGS + SG&A (110,000) (90,000) (70,000) (50,000) Depreciation…arrow_forwardFor each of the following situations, indicate the amount shown as current or long-term liability on the balance sheet of Anchor, Inc., at December 31: a. Anchor's general ledger shows a credit balance of $125,000 in Long-Term Notes Payable. Of the amount, a $25,000 installment becomes due on June 30 of the following year. b. Anchor estimates its unpaid income tax liability for the current year is $34,000; it plans to pay this amount in March of the following year. c. On December 31, Anchor received a $15,000 invoice for merchandise shipped on December 28. The merchandise has not yet been received. The merchandise was shipped F.O.B. shipping point. d. During the year, Anchor collected $10,500 of state sales tax. At year-end, it has not yet remitted $1,400 of these taxes to the state department of revenue. e. On December 31, Anchor's bank approved a $5,000, 90-day loan. Anchor plans to sign the note and receive the money on January 2 of the following year. Current Liability Long-Term…arrow_forward

- An inexperienced accountant for Crane Transport Corporation showed the following in Crane Transport's 2021 income statement: income before income taxes of $446,000; and unrealized loss on available-for-sale debt securities (before taxes) of $73,000. The unrealized loss and the income before income taxes are both subject to a 20% tax rate. Prepare a corrected partial income statement and a statement of comprehensive income CRANETRANSPORT CORPORATION Partial Income Statement and Statement of Comprehensive Income $arrow_forwardCollette's Cookie Company provided the following account balances from its year-end trial balance. During the year, Collette issued no-par common stock. The proceeds of the new issue were $20,000 . The company is subject to a 40% income tax rate. The beginning balance in common stock was $460,000 . Collette’s Cookie CompanyTrial Balance (Selected Accounts)For the Current Year Ended December 31AccountDebitCreditRetained Earnings, Beginning Balance $1,100,300Accumulated Other Comprehensive Income, Beginning Balance$52,350 Dividends54,000 Sales 1,100,000Interest Income 3,300Dividend Income 3,650Gain on Sale of Property 6,500Gain on Disposal of Plant Assets 85,000Unrealized Gain on Trading Investments 27,350Unrealized Gain on Available-for-Sale Bonds before Tax 3,400Gain on Sale of Discontinued Operations before Tax 50,600Cost of Goods Sold400,000 Selling Expenses33,000 Office Supplies Expense56,700 Amortization Expense11,500 Sales Salaries Expense24,000 Advertising Expense23,000…arrow_forwarddog subject-Accounting Sanders Inc. reported net income of $880,000 for the year ended December 31. The company had a pretax unrealized holding gain on debt securities of $22,400 and a pretax loss on foreign currency translation adjustment of $64,000. The company’s tax rate is 25%. Prepare a separate statement of comprehensive income beginning with net income. Use a negative sign to indicate a loss. Sanders Inc. Statement of Comprehensive Income For the Year Ended December 31 Net Income Answer Unrealized holding gain on debt security investment, net of tax Answer Loss on foreign currency translation adjustment, net of tax savings Answer Comprehensive income This is a table questionarrow_forward

- The trial balance of Plano Company included the following accounts as of December 31, 2024: Debits Credits Sales revenue $ 622,000 Interest revenue 76,000 Gain on sale of investments 126,000 Cost of goods sold $ 440,000 Selling expense 134,000 Interest expense 24,000 General and administrative expenses 88,000 Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a single-step income statement with earnings per share disclosure. Note: Round earnings per share answer to 2 decimal places.arrow_forwardXYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. XYZ corporation Income statement For current year Book Income Revenue from sales $ 40,000,000 Cost of Goods Sold (27,000,000) Gross profit $ 13,000,000 Other income: Income from investment in corporate stock 300,0001 Interest income 20,0002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,0003 Miscellaneous income 50,000 Gross Income $ 13,369,000 Expenses: Compensation (7,500,000)4 Stock option compensation (200,000)5 Advertising (1,350,000) Repairs and Maintenance (75,000) Rent (22,000) Bad Debt expense (41,000)6 Depreciation (1,400,000)7 Warranty expenses (70,000)8 Charitable donations (500,000)9 Meals (all at restaurants) (18,000) Goodwill impairment (30,000)10…arrow_forwardThe following are partial income statement account balances taken from the December 31, 2024, year - end trial balance of White and Sons, Incorporated: restructuring costs, $ 450,000; interest revenue, $55,000; before - tax loss on discontinued operations, $550,000; and loss on sale of investments, $65,000. Income tax expense has not yet been recorded. The income tax rate is 25 % . Prepare the lower portion of the 2024 income statement beginning with $875, 000 income from continuing operations before income taxes. Include appropriate EPS disclosures. The company had 150,000 shares of common stock outstanding throughout the year. Note: Loss amounts should be indicated with a minus sign. Round "EPS" answers to 2 decimal places.arrow_forward

- The following information is available for Hunt Company after its first year of operations: Income before taxes $250,000 Federal income tax payable $104,000 Deferred income tax (4,000) Income tax expense 100,000 Net income $150,000 Hunt estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was £95,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?arrow_forwardThe following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2021 ($ in thousands): sales revenue, $15,700; cost of goods sold, $6,400; selling expenses, $1,320; general and administrative expenses, $820; interest revenue, $80; interest expense, $200. Income taxes have not yet been recorded. The company’s income tax rate is 25% on all items of income or loss. These revenue and expense items appear in the company’s income statement every year. The company’s controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 ($ in thousands). All transactions are material in amount. Investments were sold during the year at a loss of $240. Schembri also had an unrealized gain of $360 for the year on investments in debt securities that qualify as components of comprehensive income. One of the company’s…arrow_forwardAn inexperienced accountant for Culver Corporation showed the following in the income statement: income before income taxes $395,000 and unrealized gain on available-for-sale securities (before taxes) $92,100. The unrealized gain on available-for-sale securities and income before income taxes are both subject to a 25% tax rate. Prepare a correct statement of comprehensive income. CULVER CORPORATION Partial Statement of Comprehensive Income Textbook and Modi V v $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education