FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

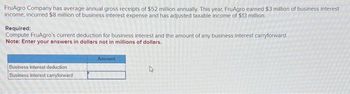

Transcribed Image Text:FruAgro Company has average annual gross receipts of $52 million annually. This year, FruAgro earned $3 million of business interest

income, incurred $8 million of business interest expense and has adjusted taxable income of $13 million.

Required:

Compute FruAgro's current deduction for business interest and the amount of any business interest carryforward.

Note: Enter your answers in dollars not in millions of dollars.

Business interest deduction

Business interest carryforward

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Berry Company reported the following on the company's income statement in two recent years: Current Year Prior Year Interest expense $499,000 $598,800 Income before income tax expense 7,435,100 $9,101,760 a. Determine the number of times interest charges were earned for current Year and prior Year. Round to one decimal place. Current Year Prior Year b. Is the number of times interest charges are earned improving or declining?arrow_forwardYou have calculated the adjusted profit for the company to be $2,000,000. Capital allowance was $20,0000 . The tax rate is 25%. Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is non-refundable) is $700,000. The tax refundable for this company is. Question 5Answer a. $1,100,000 b. $500,000 c. $200,000 d. $750,000arrow_forwardStaycate Travels Inc. reports a gross profit of $35,000, interest expense of $4,000, a tax rate of 30% and earnings after taxes of $8,610. What is Staycate’s depreciation expense?arrow_forward

- Staycate Travels Inc. reports a gross profit of $35,000, interest expense of $4,000, a tax rate of 30% and earning after taxes of $8,610. What is Staycate’s depreciation expensearrow_forwardRequired Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forwardJackel, Inc. has the following information for the current tax year: Gross sales $350,000 Cost of goods sold 50,000 Dividends received from 10% owned domestic corporation 40,000 Operating expenses 30,000 Charitable contributions 45,000 What is Jackel's taxable income? Correct Answer should be $259,000arrow_forward

- Iacouva Company reported the following on the company’s income statement for two recent years: Please see the attachment for details: a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place.b. What conclusions can you draw?arrow_forward1. If a company has a pre - tax accounting income of $1, 000, with interest revenue from municipal bonds totaling S500, and operates under a 20% tax rate, how would you record the journal entry?arrow_forwardWoods Company reports income before taxes in the amount of $925,000. The current tax expense is $365,375 and the effective tax rate is 27%. What is the conservatism ratio for Woods Company? Group of answer choices 0.45 0.19 0.40 0.68arrow_forward

- ZYX Inc has average gross receipts of $40 million per year over the last several years. In the current year, ZYX has $2,000,000 of taxable income before considering interest.ZYX has $150,000 of business interest income, S1, 200,000 of interest expense, and no floor plan financing. How much interest expense can ZYX deduct?arrow_forwardYou have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forwardThe trial balance of Plano Company included the following accounts as of December 31, 2024: Debits Credits Sales revenue $ 622,000 Interest revenue 76,000 Gain on sale of investments 126,000 Cost of goods sold $ 440,000 Selling expense 134,000 Interest expense 24,000 General and administrative expenses 88,000 Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a single-step income statement with earnings per share disclosure. Note: Round earnings per share answer to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education