FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

XYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below.

| XYZ corporation Income statement For current year | Book Income |

|---|---|

| Revenue from sales | $ 40,000,000 |

| Cost of Goods Sold | (27,000,000) |

| Gross profit | $ 13,000,000 |

| Other income: | |

| Income from investment in corporate stock | 300,0001 |

| Interest income | 20,0002 |

| (4,000) | |

| Gain or loss from disposition of fixed assets | 3,0003 |

| Miscellaneous income | 50,000 |

| Gross Income | $ 13,369,000 |

| Expenses: | |

| Compensation | (7,500,000)4 |

| Stock option compensation | (200,000)5 |

| Advertising | (1,350,000) |

| Repairs and Maintenance | (75,000) |

| Rent | (22,000) |

| (41,000)6 | |

| (1,400,000)7 | |

| Warranty expenses | (70,000)8 |

| Charitable donations | (500,000)9 |

| Meals (all at restaurants) | (18,000) |

| (30,000)10 | |

| Organizational expenditures | (44,000)11 |

| Other expenses | (140,000)12 |

| Total expenses | $ (11,390,000) |

| Income before taxes | $ 1,979,000 |

| Provision for income taxes | (400,000)13 |

| Net Income after taxes | $ 1,579,000 |

- XYZ owns 30% of the outstanding Hobble Corporation (HC) stock. Hobble Corporation reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata share of HC’s earnings for the year. HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the actual dividend received as income, not the pro rata share of HC’s earnings.

- Of the $20,000 interest income, $5,000 was from a City of Seattle bond, $7,000 was from a Tacoma City bond, $6,000 was from a fully taxable corporate bond, and the remaining $2,000 was from a

money market account. - This gain is from equipment that XYZ purchased in February and sold in December (i.e., it does not qualify as §1231 gain).

- This includes total officer compensation of $2,500,000 (no one officer received more than $1,000,000 compensation).

- This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers).

- XYZ actually wrote off $27,000 of its

accounts receivable as uncollectible. - Tax depreciation was $1,900,000.

- In the current year, XYZ did not make any actual payments on warranties it provided to customers.

- XYZ made $500,000 of cash contributions to qualified charities during the year. The donations are qualified charitable contributions for purposes of determining the charitable contribution limitation.

- On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $300,000 of goodwill. At the end of the year, XYZ wrote off $30,000 of the goodwill as impaired.

- XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes.

- The other expenses do not contain any items with book–tax differences.

- This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes.

Estimated tax information:

XYZ made four equal estimated tax payments totaling $360,000 ($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows:

| Quarter-end | Cumulative taxable income (loss) |

|---|---|

| First | $ 400,000 |

| Second | $ 1,100,000 |

| Third | $ 1,400,000 |

Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.)

a. Compute XYZ’s taxable income.

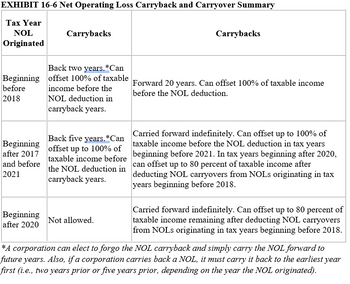

Transcribed Image Text:EXHIBIT 16-6 Net Operating Loss Carryback and Carryover Summary

Tax Year

NOL

Originated

Beginning

before

2018

Beginning

after 2017

and before

2021

Beginning

after 2020

Carrybacks

Back two years. *Can

offset 100% of taxable

income before the

NOL deduction in

carryback years.

Back five years.*Can

offset up to 100% of

taxable income before

the NOL deduction in

carryback years.

Not allowed.

Carrybacks

Forward 20 years. Can offset 100% of taxable income

before the NOL deduction.

Carried forward indefinitely. Can offset up to 100% of

taxable income before the NOL deduction in tax years

beginning before 2021. In tax years beginning after 2020,

can offset up to 80 percent of taxable income after

deducting NOL carryovers from NOLs originating in tax

years beginning before 2018.

Carried forward indefinitely. Can offset up to 80 percent of

taxable income remaining after deducting NOL carryovers

from NOLS originating in tax years beginning before 2018.

*A corporation can elect to forgo the NOL carryback and simply carry the NOL forward to

future years. Also, if a corporation carries back a NOL, it must carry it back to the earliest year

first (i.e., two years prior or five years prior, depending on the year the NOL originated).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hunt Taxidermy, Inc., is concerned about the taxes paid by the company in 2021. In addition to $7.5 million of taxable income, the firm received $614,000 of interest on state-issued bonds and $340,000 of dividends on common stock it owns in Oakdale Fashions, Inc. (Use corporate tax rate of 21 percent for your calculations.) Calculate Hunt Taxidermy’s tax liability. (Enter your answer in dollars not in millions. Round your answer to the nearest dollar amount.) Calculate Hunt Taxidermy’s average tax rate. (Round your answer to 2 decimal places.) Calculate Hunt Taxidermy’s marginal tax rate.arrow_forwardRequired information [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $148,000 in current E&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E&P was $17,760. Lone Star declared $44,400 in cash distributions on each of the following dates: April 1, July 1, October 1, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. b. Suppose that Matt owned all Lone Star's shares at the beginning of the year and sold half of the shares to Chris on June 1st for $59,200. How much dividend income will Matt recognize this year? Dividend recognizedarrow_forwardnet income? Find net incomearrow_forward

- EFG, an accrual basis calendar year corporation, reported $742,000 net income before tax on its financial statements prepared in accordance with GAAP. EFG’s records reveal the following information: The allowance for bad debts as of January 1 was $79,000. Write-offs for the year totaled $14,800, and the addition to the allowance for the year was $12,800. The allowance as of December 31 was $77,000. EFG paid a $25,970 fine to the state of Delaware for a violation of state pollution control laws. EFG was sued by a consumers' group for engaging in false advertising practices. Although EFG’s lawyers are convinced that the suit is frivolous, its independent auditors insisted on establishing a $74,200 allowance for contingent legal liability and reporting a $74,200 accrued expense on the income statement. EFG received a $244,860 advanced payment for 10,000 units of inventory on October 20. EFG reported the payment as revenue the following February when the units were shipped.arrow_forwardCalculate the amount of corporate income tax due and the net income after taxes for the following corporations. Name Taxable Income Tax Liability Net Income after Taxes 20. All City Plumbing, Inc. $352,100 $73,941 $278,159 21. Universal Holdings, Inc. $88,955 $18,680.55 $70,274.45 22. Evergreen Corp. $14,550,000 blank 3 blank 4 23. Bioscience Labs, Inc. $955,000,000 $200,550,000 $754,450,000arrow_forwardRadnor Corporation reports the following results for the current year: Gross profits on sales $135,000 Long-term capital loss $ 15,000 Short-term capital loss $4,000 Dividends from 60% owned domestic corporation $20,000 Operating expenses $ 55,000 Charitable contributions $15,000 What are Radnor's taxable income and income tax liability? What carrybacks and carryovers are available? If any?arrow_forward

- Explain when an accounting period starts for corporation tax purposes. 3.2 - Using all the relevant information provided above, calculate Harrogate Chocolate Ltd taxable total profit for the six months ended 31 March 2023. 3.3 - Calculate the corporation tax payable by Harrogate Chocolate Ltd assuming the maximum group relief is surrendered from Suggar Ltd to Harrogate Chocolate Ltd. 3.4 - State the dates on which Harrogate is required to file the CT 600 corporation tax return for the six months period to 31 March 2023 and when any tax payment(s) will be due for the period.arrow_forwardForm 1120 and complete pages 1 and 2 (Schedule C) to the best of your ability . The Sunra Corporation had the following data available for the current year : Gross profit on sales $ 0, 000 Dividend income from nonaffiliated domestic corporations (not debt financed 20%-owned) 2,000 Operating expenses ( exclusive of charitable contributions) 28,000 Charitable contributions 1,500 Sunra's taxable income for the current year is 11,300arrow_forwardSt. George, Incorporated reported $711,800 net income before tax on this year’sfinancial statement prepared in accordance with GAAP. The corporation’s recordsreveal the following information:Four years ago, St. George realized a $283,400 gain on the sale of investmentproperty and elected the installment sale method to report the sale for taxpurposes. Its gross profit percentage is 50.12, and it collected $62,000 principaland $14,680 interest on the installment note this year.Five years ago, St. George purchased investment property for $465,000 cash froman LLC. Because St. George and the LLC were related parties, the LLC’s $12,700realized loss on the sale was disallowed for tax purposes. This year, St. George soldthe property to an unrelated purchaser for $500,000.A flood destroyed several antique carpets that decorated the floors of corporateheadquarters. Unfortunately, St. George’s property insurance does not coverdamage caused by rising water, so the loss was uninsured. The carpets’…arrow_forward

- Required information [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $148,000 in current E&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E&P was $17,760. Lone Star declared $44,400 in cash distributions on each of the following dates: April 1, July 1, October 1, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. c. If Matt's basis in the Lone Star shares was $10,360 at the beginning of the year, how much capital gain will he recognize on the sale and distributions from Lone Star? Capital gain recognized on the sale and distribution 32arrow_forwardIn the year 2019, a corporation made $18.5 Million in revenue, $2.4 Million of operating expenses, and depreciation expenses of $7.5 Million. The state income tax rate is 9% and the federal income tax rate is 21%. How much (a) state income tax, and (b) federal income tax will this corporation pay in this tax year? Assume that the state income tax is a tax-deductable expence when filing federal income tax. The approximate state income tax is $ Million (Round to three decimal places.) The approximate federal tax is $ Million. (Round to three decimal places.) The combined effective income tax rate is%. (Round to the nearest decimal.) The ATCF for the year 2019 is $ Million. (Round to three decimal places.) 31-arrow_forwardFull Tax Co. is incorporated and tax resident in Barbados. The audited financial statements for Full Tax Co. for year-end December 31, 2022, show an accounting profit after tax of $5,500,000 after charging the following: Depreciation $1,500,000 Tax for the year $500,000 Property Tax $900,000 Interest Expense $15,000 Preference Dividends $40,000 Legal Fees $1,110,000 Insurance $750,000 Bad Debts $40,000 Foreign Travel $20,000 Repairs and Maintenance $1,500,000 General Expense $600,000 Other information 1. Property Tax of $600,000 was paid for the property on which the company’s factory is located; $300,000 for the office premises and $100,000 for the director’s home. 2. The insurance was paid for the factory and office premises. 3. The bad debt expense includes a general provision of $10,000 and a specific provision of $30,000. 4. The company paid interim ordinarily dividends totaling $100,000. 5. Repairs and Maintenance include for $500,000 removing the office ceramic floor…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education