FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

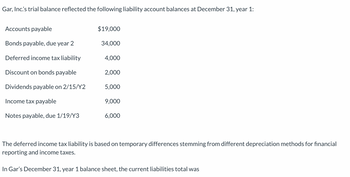

Transcribed Image Text:Gar, Inc.'s trial balance reflected the following liability account balances at December 31, year 1:

Accounts payable

Bonds payable, due year 2

Deferred income tax liability

Discount on bonds payable

Dividends payable on 2/15/Y2

Income tax payable

Notes payable, due 1/19/Y3

$19,000

34,000

4,000

2,000

5,000

9,000

6,000

The deferred income tax liability is based on temporary differences stemming from different depreciation methods for financial

reporting and income taxes.

In Gar's December 31, year 1 balance sheet, the current liabilities total was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5arrow_forwardAmong the following transactions: municipal bond income. accrual of a loss contingency. a balance in the Unearned Rent account at year end. a fine resulting from violations of regulations. Which one(s) will result in a permanent difference in pretax financial income and taxable income? Enter 1, 2, 3, or 4 that represents the correct answer. b & c. d only. a & d. a, c, & d.arrow_forward6arrow_forward

- Which of the following statements concerning the classification of deferred tax assets and liabilities is true? Multiple Choice A deferred tax asset is classified as noncurrent only if the company expects the future tax benefit to be received more than 12 months from the balance sheet date. All deferred tax assets and liabilities are treated as noncurrent. A deferred tax asset related to a bad debt reserve is classified as current if the related accounts receivable is classified as a current asset. A deferred tax asset related to inventory capitalization is classified as noncurrent only if the company uses a FIFO accounting method and the inventory to which the deferred tax asset relates will not be treated as sold within 12 months from the balance sheet date.arrow_forwardSave & Exit Subm Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: SITUATION Taxable income Amounts at year-end: Future deductible amounts 2. $46,000 $86,000 5,600 10,600 0 5,600 Future taxable amounts Balances at beginning of year, dr (cr): Deferred tax asset, Deferred tax liability $ 1,000 $ 3,180 0 1,000 The enacted tax rate is 30% for both situations. Required: For each situation determine the: SITUATION 2. (a.) Income tax payable currently. (b.) Deferred tax asset - balance at year-end. (c.) Deferred tax asset change dr or (cr) for the year. (d.) Deferred tax liability - balance at year-end. (e.) Deferred tax liability change dr or (cr) for the year. (f.) Income tax expense for the year. Next > 31 of 39arrow_forwardRecording Income Tax Expense Rangee Rover Inc. had taxable income of $218,500 for the year. The GAAP basis of accounts receivable (net) is $13,800 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts. • Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Cr. Dec. 31 Income Tax Expense Deferred Tax Liability Income Tax Payable N/A To record income tax expense. > > Dr. 54,625 0 0 O 0x 13,800 * 40,825 * 0arrow_forwardRecording and Reporting Multiple Temporary Differences The records of Cross Corporation provided the following income tax allocation data. Taxable income Depreciation expense Bad debt expense Pretax GAAP income Required • The depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. • The bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivable. o The deferred tax accounts have a zero balance at the start of 2020. Tax rate is 25%. a. Journal Entries a. Record the income tax journal entry on December 31, 2020. b. Record the income tax journal entry on December 31, 2021. c. Record the income tax journal entry on December 31, 2022. d. Record the income tax journal entry on December 31, 2023. • Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. • Note: If the journal entry includes an extra…arrow_forwardEarnings (loss) Depreciation (assets have a cost of $390,000) CCA Non-deductible expenses Tax rate Taxable income 1. What is the amount of the taxable income or loss in each year? (Negative amounts and deductible amounts should be indicated by a minus sign.) Accounting earnings Permanent difference: Accounting income subject to tax Temporary difference: Taxable income 20X7 20X7 (first year of operations) $99,000 $50,000 $65,000 $19,000 25% 20X8 20X8 $ (168,000) $ 50,000 $ 75,000 $ 19,000 25%arrow_forwardDo not give image formatarrow_forwardPlease do not Give image formatarrow_forwardInterperiod Tax Allocation Quick Company reports the following revenues and expenses in its pretax financial income for the year ended December 31, 2013: Revenues 229,600 Expenses (160,100) Pretax financial income 69,500 The revenues included in pretax financial income are the same amount as the revenues included in the company’s taxable income. A reconciliation of the expenses reported for pretax financial income to the expenses reported for taxable income, however, reveals four differences: 1. Depreciation deducted for financial reporting exceeded depreciation deducted for income taxes by $11,000. 2. Percentage depletion deducted for income taxes exceeded cost depletion deducted for financial reporting by 15600. 3. Warranty costs deducted for income taxes exceeded warranty expenses deducted for financial reporting by 8900. 4. Legal expense of $9,800 was deducted for financial reporting; it will be deducted for income taxes when…arrow_forwardConcerning accounting for warranties, which of the following statements is true? Federal income tax regulations require companies to accrue warranty expense in the year of the sale. The modified cash basis method is required for tax reporting. The modified cash basis method uses a percentage of completion approach to warranty revenue recognition. The modified cash basis recognizes warranty expense when cash is received on the sale.arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education