FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

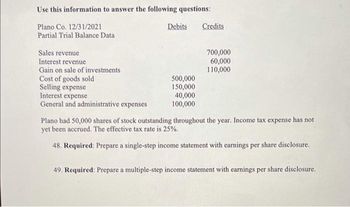

Transcribed Image Text:Use this information to answer the following questions:

Plano Co. 12/31/2021

Partial Trial Balance Data

Sales revenue

Interest revenue

Gain on sale of investments

Cost of goods sold

Selling expense

Interest expense

General and administrative expenses

Debits

500,000

150,000

40,000

100,000

Credits

700,000

60,000

110,000

Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not

yet been accrued. The effective tax rate is 25%.

48. Required: Prepare a single-step income statement with earnings per share disclosure.

49. Required: Prepare a multiple-step income statement with earnings per share disclosure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Esposito Import Company had 1 million shares of common stock outstanding during 2021. Its income statement reported the following items: income from continuing operations, $10 million; loss from discontinued operations, $2.3 million. All of these amounts are net of tax. Required:Prepare the 2021 EPS presentation for the Esposito Import Company. (Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places.)arrow_forwardThe trial balance of Plano Company included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Debits Credits $ 612,000 77,000 127,000 Cost of goods sold Selling expense Interest expense General and administrative expenses $ 455,000 133,000 23,000 86,000 Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a single-step income statement with earnings per share disclosure. Note: Round earnings per share answer to 2 decimal places. PLANO COMPANY Income Statement For the Year Ended December 31, 2024 Revenues and gains: Total revenues and gains Expenses: Total expenses Income before income taxes Eamings per sharearrow_forwardBerry Company reported the following on the company's income statement in two recent years: Current Year Prior Year Interest expense $499,000 $598,800 Income before income tax expense 7,435,100 $9,101,760 a. Determine the number of times interest charges were earned for current Year and prior Year. Round to one decimal place. Current Year Prior Year b. Is the number of times interest charges are earned improving or declining?arrow_forward

- You have calculated the adjusted profit for the company to be $2,000,000. Capital allowance was $20,0000 . The tax rate is 25%. Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is non-refundable) is $700,000. The tax refundable for this company is. Question 5Answer a. $1,100,000 b. $500,000 c. $200,000 d. $750,000arrow_forwardCougar’s Accounting Services provides low-cost tax advice and preparation to those with financial need. At the end of the current period, the company reports the following amounts: Assets = $16,200; Liabilities = $13,600; Revenues = $25,200; Expenses = $31,600. Required: 1. Calculate net loss. 2. Calculate stockholders' equity at the end of the period.arrow_forwardi have completed this in excel but would like to compare my answersarrow_forward

- An inexperienced accountant for Culver Corporation showed the following in the income statement: income before income taxes $395,000 and unrealized gain on available-for-sale securities (before taxes) $92,100. The unrealized gain on available-for-sale securities and income before income taxes are both subject to a 25% tax rate.Prepare a correct statement of comprehensive income. CULVER CORPORATIONPartial Statement of Comprehensive Income Select a comprehensive income item DividendsExpensesNet Income / (Loss)Retained EarningsRevenueTotal ExpensesTotal RevenuesIncome Tax ExpenseOther Comprehensive IncomeUnrealized Holding Gain on Available-for-Sale SecuritiesIncome Before Income TaxesComprehensive Income $Enter a dollar amount Select a comprehensive income item DividendsExpensesNet Income / (Loss)Retained EarningsRevenueTotal ExpensesTotal RevenuesIncome…arrow_forwardI just need number 2, thanks!arrow_forwardSkysong Inc., a greeting card company, had the following statements prepared as of December 31, 2020. SKYSONG INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $6.900 Accounts receivable 61.900 50,500 Short-term debt investments (available-for-sale) 34,800 18,200 Inventory 39,900 59,800 Prepaid rent 4,900 4.000 Equipment 155,500 131,200 Accumulated depreciation-equipment (34,800 ) (25,300 ) Copyrights 45,700 50.200 Total assets $314,000 $295,500 Accounts payable $46,200 $39,700 Income taxes payable 4,000 6,100 Salaries and wages payable 7,900 4,000 Short-term loans payable 7,900 10,000 Long-term loans payable 59.800 68,600 Common stock, $10 par 100,000 100,000 Contributed capital, common stock 30,000 30,000 Retained earnings 58,200 37,100 Total liabilities & stockholders' equity $314,000 $295,500arrow_forward

- Income tax expense has not yet been recorded. The income tax rate is 40%. Determine the following: (a) operating income (loss), (b) income (loss) before income taxes, and (c) net income (loss).arrow_forwardhe following information is from Atlanta Corp. for the 12 months ended December 31. Sales revenue $800,000 Cost of goods sold 500,000 Selling and administrative expenses 150,000 Interest expense 5,000 Gain on sale of short-term investments 8,800 Prepare a multiple - step income statement (excluding the earnings per share disclosures) assuming a tax rate of 25 %. Report income tax expense in its own separate section.arrow_forward1. If a company has a pre - tax accounting income of $1, 000, with interest revenue from municipal bonds totaling S500, and operates under a 20% tax rate, how would you record the journal entry?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education