SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Do not use Ai

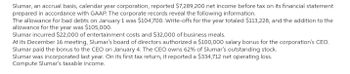

Transcribed Image Text:Slumar, an accrual basis, calendar year corporation, reported $7,289,200 net income before tax on its financial statement

prepared in accordance with GAAP. The corporate records reveal the following information.

The allowance for bad debts on January 1 was $104,700. Write-offs for the year totaled $113,228, and the addition to the

allowance for the year was $105,000.

Slumar incurred $22,000 of entertainment costs and $32,000 of business meals.

At its December 16 meeting, Slumar's board of directors authorized a $100,000 salary bonus for the corporation's CEO.

Slumar paid the bonus to the CEO on January 4. The CEO owns 62% of Slumar's outstanding stock.

Slumar was incorporated last year. On its first tax return, it reported a $334,712 net operating loss.

Compute Slumar's taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardEFG, an accrual basis calendar year corporation, reported $742,000 net income before tax on its financial statements prepared in accordance with GAAP. EFG’s records reveal the following information: The allowance for bad debts as of January 1 was $79,000. Write-offs for the year totaled $14,800, and the addition to the allowance for the year was $12,800. The allowance as of December 31 was $77,000. EFG paid a $25,970 fine to the state of Delaware for a violation of state pollution control laws. EFG was sued by a consumers' group for engaging in false advertising practices. Although EFG’s lawyers are convinced that the suit is frivolous, its independent auditors insisted on establishing a $74,200 allowance for contingent legal liability and reporting a $74,200 accrued expense on the income statement. EFG received a $244,860 advanced payment for 10,000 units of inventory on October 20. EFG reported the payment as revenue the following February when the units were shipped.arrow_forwardEFG, a calendar year, accrual basis corporation, reported $479,900 net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s financial records reveal the following information: EFG earned $10,700 on an investment in tax-exempt municipal bonds. EFG’s allowance for bad debts as of January 1 was $21,000. Write-offs for the year totaled $4,400, while the addition to the allowance was $3,700. The allowance as of December 31 was $20,300. On August 7, EFG paid a $6,000 fine to a municipal government for a violation of a local zoning ordinance. EFG’s depreciation expense per books was $44,200, and its MACRS depreciation deduction was $31,000. This is EFG’s second taxable year. In its first taxable year, it recognized an $8,800 net capital loss. This year, it recognized a $31,000 Section 1231 gain on the sale of equipment. This was EFG’s only disposition of noninventory assets. In its first taxable year, EFG capitalized $6,900 organizational costs…arrow_forward

- Gosling, Inc., a calendar year, accrual basis corporation, reported $756,000 net income after tax on its financial statements prepared in accordance with GAAP. The corporation's financial records reveal the following information: Gosling earned $3,500 on an investment in tax-exempt municipal bonds. Gosling received an advance payment of rent this year for $25,000. This amount was not included in book income. Gosling's depreciation expense per books was $72,000, and its MACRS depreciation deduction was $105,000. Gosling recorded $58,000 of business meals and $27,000 of entertainment expense for book purposes. Gosling's federal income tax expense per books was $220,000. a. Compute Gosling's taxable income and regular tax liability. b. Prepare a Schedule M-1, page 5, Form 1120, reconciling Gosling's book and taxable income.arrow_forwardLuong Corporation, a calendar year, accrual basis corporation, reported $1.65 million of net income after tax on its financial statements prepared in accordance with GAAP. The corporation's books and records reveal the following information: • Luong's federal income tax expense per books was $213,000. • Luong's book income included $23,000 of dividends received from a domestic corporation in which Luong owns a 25 percent stock interest, and $10,500 of dividends from a domestic corporation in which Luong owns a 5 percent stock interest. • Luong recognized $23,000 of capital losses this year and no capital gains. • Luong recorded $14,600 of book expense for meals not provided by a restaurant and $16,500 of book expense for entertainment costs. • Luong's depreciation expense for book purposes totaled $413,000. MACRS depreciation was $475,000. Required: a. Compute Luong's federal taxable income and regular tax liability. b. Prepare a Schedule M-1, page 6, Form 1120, reconciling Luong's…arrow_forwardsanarrow_forward

- Luong Corporation, a calendar year, accrual basis corporation, reported $1.15 million of net income after tax on its financial statements prepared in accordance with GAAP. The corporation's books and records reveal the following information: • Luong's federal income tax expense per books was $203,000. • Luong's book income included $13,000 of dividends received from a domestic corporation in which Luong owns a 25 percent stock interest, and $5,500 of dividends from a domestic corporation in which Luong owns a 5 percent stock interest. Luong recognized $13,000 of capital losses this year and no capital gains. • Luong recorded $9,600 of book expense for meals not provided by a restaurant and $11,500 of book expense for entertainment costs. • Luong's depreciation expense for book purposes totaled $403,000. MACRS depreciation was $475,000. Required: a. Compute Luong's federal taxable income and regular tax liability. b. Prepare a Schedule M-1, page 6, Form 1120, reconciling Luong's book…arrow_forwarduong Corporation, a calendar year, accrual basis corporation, reported $1 million of net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: Luong’s federal income tax expense per books was $200,000. Luong’s book income included $10,000 of dividends received from a domestic corporation in which Luong owns a 25 percent stock interest, and $4,000 of dividends from a domestic corporation in which Luong owns a 5 percent stock interest. Luong recognized $10,000 of capital losses this year and no capital gains. Luong recorded $8,000 of book expense for meals not provided by a restaurant and $10,000 of book expense for entertainment costs. Luong's depreciation expense for book purposes totaled $400,000. MACRS depreciation was $475,000. Required: Compute Luong's federal taxable income and regular tax liability.arrow_forwardBuster Corporation reported $150,000 in revenues in its Year 1 financial statements, of which $50,000 will not be included in the tax return until Year 2. The enacted tax rate is 34% for Year 1 and 25% for Year 2. What amount should Roger report for deferred income tax liability in its balance sheet at December 31, Year 1?arrow_forward

- Western Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: Western’s book income included $15,000 of dividends, received from a domestic corporation in which Western owns less than 1 percent of the outstanding stock. Western’s depreciation expense per books was $55,000, and its MACRS depreciation was $70,000. Western earned $5,000 of interest from municipal bonds and $6,000 of interest from corporate bonds. Western’s capital losses exceeded its capital gains by $2,000. Western’s federal income tax expense per books was $103,000. Compute Western’s federal taxable income and regular tax liability. My Solutions: federal taxable income = $585,500, regular tax liability = $122,955 (This is a past homework problem that I got wrong. Could you please explain how to do this, I do not understand what I did…arrow_forwardWestern Corporation, a calendar year, accrual basis corporation, reported $500,000 of net income after tax on its financial statements prepared in accordance with GAAP. The corporation’s books and records reveal the following information: Western’s book income included $15,000 of dividends, received from a domestic corporation in which Western owns less than 1 percent of the outstanding stock. Western’s depreciation expense per books was $55,000, and its MACRS depreciation was $70,000. Western earned $5,000 of interest from municipal bonds and $6,000 of interest from corporate bonds. Western’s capital losses exceeded its capital gains by $2,000. Western’s federal income tax expense per books was $103,000. Required: Compute Western’s federal taxable income and regular tax liability. Prepare a Schedule M-1, page 6, Form 1120, reconciling Western’s book and taxable income.arrow_forwardThe Loquat Corporation has book net income of $222,400 for the current year. Included in this figure are the following items, which are reported on the corporation's Schedule M-1, Reconciliation of Income (Loss) per Books with Income per Return. • Federal income tax expense $33,360 • Depreciation deducted on the books which is not deductible for tax purposes 44,480 • Deduction for 50 percent of meals expense which is not allowed for tax purposes 20,016 • Deduction for a tax penalty not allowed for tax purposes 8,896 • Tax-exempt interest income included in book income but not in tax income 13,344 Calculate Loquat Corporation's taxable income for the current year based on the information given.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning