FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Return to question

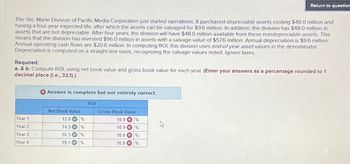

The Ste. Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing $48.0 million and

having a four-year expected life, after which the assets can be salvaged for $9.6 million. In addition, the division has $48.0 million in

assets that are not depreciable. After four years, the division will have $48.0 million available from these nondepreciable assets. This

means that the division has invested $96.0 million in assets with a salvage value of $57.6 million. Annual depreciation is $9.6 million.

Annual operating cash flows are $20.6 million. In computing ROI, this division uses end-of-year asset values in the denominator.

Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes.

Required:

a. & b. Compute ROI, using net book value and gross book value for each year. (Enter your answers as a percentage rounded to 1

decimal place (i.e., 32.1).)

Answer is complete but not entirely correct.

ROI

Year 1

Year 2

Year 3

Net Book Value

Gross Book Value

12.8%

10.9%

14.3 %

10.9%

16.3 %

10.9%

Year 4

19.1

%

10.9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Street Division of Labrosse Logistics Just started operations. It purchased depreciable assets costing $39.5 million and having a four-year expected life, after which the assets can be salvaged for $7.9 million. In addition, the division has $39.5 million in assets that are not depreciable. After four years, the division will have $39.5 million available from these non depreciable assets. This means that the division has invested $79 million in assets with a salvage value of $47.4 million. Annual operating cash flows are $12.7 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis. recognizing the salvage values noted. Ignore taxes. Required: a. & b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (Le., 32.10). Year 1 Year 2 Year 3 Year 4 Net Book Value % % ROI Gross Book Value %arrow_forwardAt the beginning of Year 1, Ithaca Incorporated purchased land for $1,500,000 from which it expects to extract 800,000 tons of minerals. The estimated residual value is $250,000. What is Ithaca's unit depletion rate? Round your answer to two decimal places.arrow_forwardHarbor Division has total assets (net of accumulated depreciation) of $630,000 at the beginning of year 1. Harbor also leases a machine for $18,000 annually. Expected divisional income in year 1 is $82,000 including $5,400 in income generated by the leased machine (after the lease payment). Harbor’s cost of capital is 9 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divisional ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forward

- Intella Manufacturing, Inc. has only one plant asset used in production. The asset had a cost of $535,000 and has been depreciated for 2 full years since the date of acquisition. This accounting resulted in a total accumulated depreciation of $220,000. The firm expects the asset to be productive for an additional 3 years and projects the asset's future cash flows to be $132,000 per year. Information about the company's products indicates that the asset might be impaired. Should the firm record an impairment loss for the current year? (Provide supporting computations.) First, calculate the carrying value of the asset using the table below. Less: Carrying value of asset Part 2 Next, conduct an impairment test for the asset using the table below. Step 1: Asset Impairment indicatedarrow_forwardThe Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $36.9 million and having a four-year expected life, after which the assets can be salvaged for $7.38 million. In addition, the division has $36.9 million in assets that are not depreciable. After four years, the division will have $36.9 million available from these nondepreciable assets. This means that the division has invested $73.8 million in assets with a salvage value of $44.28 million. Annual operating cash flows are $12.9 million. In computing ROI, this division uses end-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. In computing ROI, this division uses end-of-year asset values. Assume that all cash flows increase 10 percent at the end of each year. This has the following effect on the assets’ replacement cost and annual cash flows: End of Year Replacement Cost Annual Cash…arrow_forwardbot imag plase.arrow_forward

- Widget Industries erected a facility costing $1.56 million on land bought for $1 million. The firm used straight-line depreciation over a 39-year period; it installed $2.5 million worth of plant and office equipment (all classified as MACRS 7-year property). Gross income from the first year of operations (excluding capital expenditures) was $8.2 million, and $5.8 million was spent on labor and materials. How much did Widget pay in federal income taxes for the first year of operation? (a) $680,935 (b) $1,002,750 (c) $1,321,815 (d) $2,788,000arrow_forwardMost Company has an opportunity to invest in one of two new projects. Project Y requires a $320,000 investment for new machinery with a six-year life and no salvage value. Project Z requires a $320,000 investment for new machinery with a five-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. Project Y Project Z Sales $ 385,000 $ 308,000 Expenses Direct materials 53,900 38,500 Direct labor 77,000 46,200 Overhead including depreciation 138,600 138,600 Selling and administrative expenses 28,000 27,000 Total expenses 297,500 250,300 Pretax income 87,500 57,700 Income taxes (38%) 33,250 21,926 Net income $ 54,250 $ 35,774 Compute each project’s accounting rate of return.arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $144,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 90,000 Expenses Materials, labor, and overhead (except depreciation) 48,000 Depreciation—Equipment 12,000 Selling, general, and administrative expenses 9,000 Income $ 21,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment. I could not include an image for "C" please answer seperatelyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education