Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

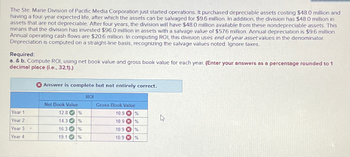

Transcribed Image Text:The Ste. Marie Division of Pacific Media Corporation just started operations. It purchased depreciable assets costing $48.0 million and

having a four-year expected life, after which the assets can be salvaged for $9.6 million. In addition, the division has $48.0 million in

assets that are not depreciable. After four years, the division will have $48.0 million available from these nondepreciable assets. This

means that the division has invested $96.0 million in assets with a salvage value of $57.6 million. Annual depreciation is $9.6 million.

Annual operating cash flows are $20.6 million. In computing ROI, this division uses end-of-year asset values in the denominator.

Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes.

Required:

a. & b. Compute ROI, using net book value and gross book value for each year. (Enter your answers as a percentage rounded to 1

decimal place (i.e., 32.1).)

Answer is complete but not entirely correct.

ROI

Year 11

Year 2

Net Book Value

Gross Book Value

12.8 %

10.9

%

14.3 %

10.9

%

Year 3

4

16.3 %

10.9%

Year 4

19.1%

10.9 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Harbor Division has total assets (net of accumulated depreciation) of $542,000 at the beginning of year 1. Harbor also leases a machine for $23,000 annually. Expected divisional income in year 1 is $81,000 including $5,500 in income generated by the leased machine (after the lease payment). Harbor’s cost of capital is 10 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divisional ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forwardThe Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $39.5 million and having a four-year expected life, after which the assets can be salvaged for $7.9 million. In addition, the division has $39.5 million in assets that are not depreciable. After four years, the division will have $39.5 million available from these non depreciable assets. This means that the division has invested $79 million in assets with a salvage value of $47.4 million. Annual operating cash flows are $12.7 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Required: a. & b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10). Year 1 Year 2 Year 3 Year 4 Net Book Value % % % % ROI Gross Book Value % % % %arrow_forwardThe Street Division of Labrosse Logistics Just started operations. It purchased depreciable assets costing $39.5 million and having a four-year expected life, after which the assets can be salvaged for $7.9 million. In addition, the division has $39.5 million in assets that are not depreciable. After four years, the division will have $39.5 million available from these non depreciable assets. This means that the division has invested $79 million in assets with a salvage value of $47.4 million. Annual operating cash flows are $12.7 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis. recognizing the salvage values noted. Ignore taxes. Required: a. & b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (Le., 32.10). Year 1 Year 2 Year 3 Year 4 Net Book Value % % ROI Gross Book Value %arrow_forward

- i need the answer quicklyarrow_forwardThe Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $36.9 million and having a four-year expected life, after which the assets can be salvaged for $7.38 million. In addition, the division has $36.9 million in assets that are not depreciable. After four years, the division will have $36.9 million available from these nondepreciable assets. This means that the division has invested $73.8 million in assets with a salvage value of $44.28 million. Annual operating cash flows are $12.9 million. In computing ROI, this division uses end-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. In computing ROI, this division uses end-of-year asset values. Assume that all cash flows increase 10 percent at the end of each year. This has the following effect on the assets’ replacement cost and annual cash flows: End of Year Replacement Cost Annual Cash…arrow_forwardThe Plastics Division of Minock Manufacturing currently earns $2.53 million and has divisional assets of $22 million. The division manager is considering the acquisition of a new asset that will add to profit. The investment has a cost of $5,514,000 and will have a yearly cash flow of $1,470,500. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company’s cost of capital is 7 percent. Ignore taxes. Required: What is the divisional ROI before acquisition of the new asset? What is the divisional ROI in the first year after acquisition of the new asset? Note: For all requirements, enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).arrow_forward

- The Plastics Division of Minock Manufacturing currently earns $3.54 million and has divisional assets of $25 million. The division manager is considering the acquisition of a new asset that will add to profit. The investment has a cost of $5,466,000 and will have a yearly cash flow of $1,458,500. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company's cost of capital is 7 percent. Ignore taxes. The division manager learns that there is an option to lease the asset on a year-to-year lease for $1,162,000 per year. All depreciation and other tax benefits would accrue to the lessor. Required: a. What is the division's residual income before considering the project? b. What is the division's residual income if the asset is purchased? c. What is the division's residual income if the asset is leased? Note:…arrow_forwardHappyDay is planning to invest $20 million and acquire a new production line at the beginning of Year 3. Also, the company has intents to change the depreciation policy in order to manage the costs of production and income tax expenses better. Your new boss asks you to calculate depreciation expenses using straight-line, double-declining balance and units-of-production methods to determine which of the methods is better. The new asset is expected to have a 10-year useful life. The total production is estimated at 500,000 tons. With respect to the new asset, HappyDay is expecting to generate the following results in Years 3-5. Year 3 Year 4 Year 5 Expected amount of production, tons 45,000 65,000 60,000 Net Sales, thousand $ 85,000 120,000 110,000 Expenses (before depreciation and income tax), thousand $ 45,000 80,000 73,000 Income tax rate, % 30 30 30 Answer the following question 2. Compute HappyDay’s Total Expenses, Income…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education