Concept explainers

Harbor Division has total assets (net of

Required:

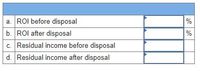

a. Harbor computes

b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).)

c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for year 1 assuming Harbor retains the leased machine?

d. What would divisional residual income be for year 1 assuming Harbor disposes of the leased machine?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Tullis Construction enters into a long-term fixed price contract to build an office tower for $10,600,000. In the first year of the contract Tullis incurs $3,000,000 of cost and the engineers determined that the remaining costs to complete the project are $5,000,000. Tullis billed $5,000,000 in year 1 and collected $3,100,000 by the end of the end of the year. How should Tullis report Construction in Progress and Billings on Construction in Progress at the end of year 1 on the balance sheet assuming the use of the completed - contract method? O A. asset of $2,000,000 O B. liability of $1,900,000 O C. asset of $1,900,000 O D. liability of $2,000,000arrow_forwardFive Star is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $149,600 of 5% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of equipment Life of equipment Estimated residual value of equipment Yearly costs to operate the warehouse, excluding depreciation of equipment Yearly expected revenues-years 1-8 Yearly expected revenues-years 9-16 Required: Differential revenue from alternatives: Revenue from operating warehouse Revenue from investment in bonds Differential revenue from operating warehouse 1. Prepare a differential analysis report of the proposed operation of the warehouse for the 16 years as compared with present conditions. Five Star Proposal to Operate Warehouse. Differential cost of alternatives: Costs to operate warehouse ✓ $149,600 16 years $27,500 Cost of equipment less residual…arrow_forwardCrane SA manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is R$594,813, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be R$18,000. The hospital will pay rents of R$72,000 at the beginning of each year. Crane incurred R$410,000 in manufacturing cost and R$14,200 in legal fees directly related to the signing of the lease. Crane has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Click here to view factor tables. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to O decimal places, e.g. 5,275.) (1) (2) (3) Lease receivable at commencement of the…arrow_forward

- Harbor Division has total assets (net of accumulated depreciation) of $645,000 at the beginning of year 1. Harbor also leases a machine for $22,000 annually. Expected divisional income in year 1 is $84,000 including $5,400 in income generated by the leased machine (after the lease payment). Harbor's cost of capital is 11 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divislonal ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forwardKingbird Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $304,659, and its unguaranteed residual value at the end of the lease term is estimated to be $19.400. National will pay annual payments of $40,800 at the beginning of each year. Kingbird incurred costs of $164,100 in manufacturing the equipment and $3,900 in sales commissions in closing the lease. Kingbird has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 8%. Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessor. This is a sales-type lease Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to O decimal places, eg. 5.275) (1) Lease receivable S (2) Sales price S (3) Cost of sales $arrow_forwardCarr Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,900. The freight and installation costs for the equipment are $515. If purchased, annual repairs and maintenance are estimated to be $410 per year over the four-year useful life of the equipment. Alternatively, Carr can lease the equipment from a domestic supplier for $1,750 per year for four years, with no additional costs. Required: A. Prepare a differential analysis dated August 4 to determine whether Carr should lease (Alternative 1) or purchase (Alternative 2) the equipment. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required. (Hint: This is a “lease or buy” decision, which must be analyzed from the…arrow_forward

- 6. Cheyenne Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $276,779, and its unguaranteed residual value at the end of the lease term is estimated to be $18,400. National will pay annual payments of $39,900 at the beginning of each year. Cheyenne incurred costs of $189,300 in manufacturing the equipment and $3,700 in sales commissions in closing the lease. Cheyenne has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 10%.Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessor.This is a .Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places, e.g.…arrow_forwardHarbor Division has total assets (net of accumulated depreciation) of $542,000 at the beginning of year 1. Harbor also leases a machine for $23,000 annually. Expected divisional income in year 1 is $81,000 including $5,500 in income generated by the leased machine (after the lease payment). Harbor’s cost of capital is 10 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divisional ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forwardWinett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year municipal contract. The equipment costs $291,000 and would have no salvage value when the contract expires at the end of four years. Estimated annual operating results of the project are as follows. Revenue from contract sales Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from contract work $211,000 72,750 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Winett's proposal to undertake this contract. a. Payback period b. Return on average investment c. Net present value $308,000 283,750 $ 24,250 a. Payback period. b. Return on average investment. (Round your percentage answer to 1 decimal place (i.e., 0.123 to be entered as 12.3).) c. Net present value of the proposal to undertake contract work,…arrow_forward

- Vaughn Company is considering a capital investment of $378,400 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $18,920 and $86,000, respectively. Vaughn has an 7% cost of capital rate, which is the required rate of return on the investment. (a1) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 2.25.) Your answer is correct. Cash payback period (a2) eTextbook and Media (b) Your answer is correct. Annual rate of return Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 2.25%.) eTextbook and Media 4.4 years Net present value $ 10 Attempts: 1 of 5 used % Attempts: 1 of 5 used Using the discounted cash flow technique, compute the net present value. (Round present value factor calculations to 5…arrow_forwardWildhorse Company manufactures a check-in kiosk with an estimated economic life of 10 years and leases it to Sheffield Chicken for a period of 9 years. The normal selling price of the equipment is $172,124, and its unguaranteed residual value at the end of the lease term is estimated to be $26,200. Sheffield will pay annual payments of $20,800 at the beginning of each year. Wildhorse incurred costs of $141,100 in manufacturing the equipment and $2,400 in sales commissions in closing the lease. Wildhorse has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sheffield Chicken has an incremental borrowing rate of 5%. The lessor's implicit rate is unknown to the lessee.arrow_forwardStowe Construction Company is considering selling excess machinery with a book value of $281,500 (original cost of $400,300 less accumulated depreciation of $118,800) for $274,900, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $285,500 for 5 years, after which it is expected to have no residual value. During the period of the lease, Stowe Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $24,900. Question Content Area a. Prepare a differential analysis dated March 21 to determine whether Stowe Construction Company should lease (Alternative 1) or sell (Alternative 2) the machinery. If required, use a minus sign to indicate a loss. Differential AnalysisLease (Alt. 1) or Sell (Alt. 2) MachineryMarch 21 Line Item Description LeaseMachinery(Alternative 1) SellMachinery(Alternative 2) DifferentialEffects(Alternative 2) Revenues $Revenues $Revenues $Revenues Costs Costs Costs Costs…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education