FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

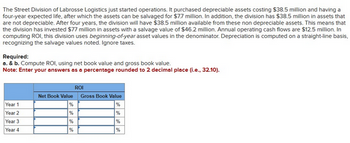

Transcribed Image Text:The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $38.5 million and having a

four-year expected life, after which the assets can be salvaged for $7.7 million. In addition, the division has $38.5 million in assets that

are not depreciable. After four years, the division will have $38.5 million available from these non depreciable assets. This means that

the division has invested $77 million in assets with a salvage value of $46.2 million. Annual operating cash flows are $12.5 million. In

computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis,

recognizing the salvage values noted. Ignore taxes.

Required:

a. & b. Compute ROI, using net book value and gross book value.

Note: Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10).

ROI

Net Book Value Gross Book Value

Year 1

%

%

Year 2

Year 3

%

%

%

%

Year 4

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company’s tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $127,450 $176,875 $247,455 $254,440 $271,125 Expenses $141,410 $128,488 $137,289 $145,112 $139,556 Crane will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return enter the Accounting rate of return in percentages rounded to 1 decimal place %arrow_forwardA division is considering the acquisition of a new asset that will cost $2,960,000 and have a cash flow of $790,000 per year for each of the four years of its life. Depreciation is computed on a straight-line basis with no salvage value. Ignore taxes. Required: a. & b. What is the ROI for each year of the asset's life if the division uses beginning-of-year asset balances and net book value for the computation? What is the residual income each year if the cost of capital is 8 percent? (Enter "ROI" answers as a percentage rounded to 1 decimal place (i.e., 32.1). Negative amounts should be indicated by a minus sign.) Year Investment Base ROI Residual Income 1 $2,960,000 % 2 % 3 % 4 %arrow_forwardHarbor Division has total assets (net of accumulated depreciation) of $542,000 at the beginning of year 1. Harbor also leases a machine for $23,000 annually. Expected divisional income in year 1 is $81,000 including $5,500 in income generated by the leased machine (after the lease payment). Harbor’s cost of capital is 10 percent. Harbor can cancel the lease on the machine without penalty at any time and is considering disposing of it today (the beginning of year 1). Required: a. Harbor computes ROI using beginning-of-the-year net assets. What will the divisional ROI be for year 1 assuming Harbor retains the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. What would divisional ROI be for year 1 assuming Harbor disposes of the leased machine? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) c. Harbor computes residual income using beginning-of-the-year net assets. What will the divisional residual income be for…arrow_forward

- The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $39.5 million and having a four-year expected life, after which the assets can be salvaged for $7.9 million. In addition, the division has $39.5 million in assets that are not depreciable. After four years, the division will have $39.5 million available from these non depreciable assets. This means that the division has invested $79 million in assets with a salvage value of $47.4 million. Annual operating cash flows are $12.7 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. Required: a. & b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (i.e., 32.10). Year 1 Year 2 Year 3 Year 4 Net Book Value % % % % ROI Gross Book Value % % % %arrow_forwardThe Street Division of Labrosse Logistics Just started operations. It purchased depreciable assets costing $39.5 million and having a four-year expected life, after which the assets can be salvaged for $7.9 million. In addition, the division has $39.5 million in assets that are not depreciable. After four years, the division will have $39.5 million available from these non depreciable assets. This means that the division has invested $79 million in assets with a salvage value of $47.4 million. Annual operating cash flows are $12.7 million. In computing ROI, this division uses beginning-of-year asset values in the denominator. Depreciation is computed on a straight-line basis. recognizing the salvage values noted. Ignore taxes. Required: a. & b. Compute ROI, using net book value and gross book value. Note: Enter your answers as a percentage rounded to 2 decimal place (Le., 32.10). Year 1 Year 2 Year 3 Year 4 Net Book Value % % ROI Gross Book Value %arrow_forwardThe Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $36.9 million and having a four-year expected life, after which the assets can be salvaged for $7.38 million. In addition, the division has $36.9 million in assets that are not depreciable. After four years, the division will have $36.9 million available from these nondepreciable assets. This means that the division has invested $73.8 million in assets with a salvage value of $44.28 million. Annual operating cash flows are $12.9 million. In computing ROI, this division uses end-of-year asset values in the denominator. Depreciation is computed on a straight-line basis, recognizing the salvage values noted. Ignore taxes. In computing ROI, this division uses end-of-year asset values. Assume that all cash flows increase 10 percent at the end of each year. This has the following effect on the assets’ replacement cost and annual cash flows: End of Year Replacement Cost Annual Cash…arrow_forward

- Hanshabenarrow_forwardThe Plastics Division of Minock Manufacturing currently earns $2.53 million and has divisional assets of $22 million. The division manager is considering the acquisition of a new asset that will add to profit. The investment has a cost of $5,514,000 and will have a yearly cash flow of $1,470,500. The asset will be depreciated using the straight-line method over a five-year life and is expected to have no salvage value. Divisional performance is measured using ROI with beginning-of-year net book values in the denominator. The company’s cost of capital is 7 percent. Ignore taxes. Required: What is the divisional ROI before acquisition of the new asset? What is the divisional ROI in the first year after acquisition of the new asset? Note: For all requirements, enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1).arrow_forwardHappyDay is planning to invest $20 million and acquire a new production line at the beginning of Year 3. Also, the company has intents to change the depreciation policy in order to manage the costs of production and income tax expenses better. Your new boss asks you to calculate depreciation expenses using straight-line, double-declining balance and units-of-production methods to determine which of the methods is better. The new asset is expected to have a 10-year useful life. The total production is estimated at 500,000 tons. With respect to the new asset, HappyDay is expecting to generate the following results in Years 3-5. Year 3 Year 4 Year 5 Expected amount of production, tons 45,000 65,000 60,000 Net Sales, thousand $ 85,000 120,000 110,000 Expenses (before depreciation and income tax), thousand $ 45,000 80,000 73,000 Income tax rate, % 30 30 30 Answer the following question 2. Compute HappyDay’s Total Expenses, Income…arrow_forward

- Need-Based Accounting Corp. has just purchased 10 photocopiers for a total cost of $500,000. The CCA rate for these photocopiers is 20%. The company plans to use these photocopiers for 10 years. By the end of the 10th year, the company expects to move into new imaging system that will no longer require the photocopiers, and the asset pool will then be closed. If the company can sell the photocopiers for $50,000 in 10 years’ time, what amount of terminal loss/CCA recapture can be claimed after the photocopiers have been sold? Assume that half-year rule applies. Please show all calculation steps:arrow_forwardRahularrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education