FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

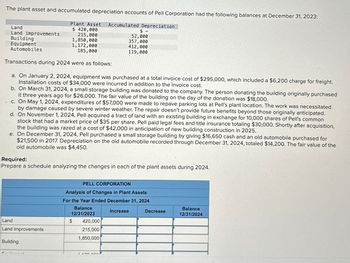

Transcribed Image Text:The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023:

Land

Land improvements

Building

Plant Asset

$ 420,000

215,000

1,850,000

1,172,000

Accumulated Depreciation

$ -

52,000

357,000

Equipment

Automobiles

185,000

412,000

119,000

Transactions during 2024 were as follows:

a. On January 2, 2024, equipment was purchased at a total invoice cost of $295,000, which included a $6,200 charge for freight.

Installation costs of $34,000 were incurred in addition to the invoice cost.

b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased

it three years ago for $26,000. The fair value of the building on the day of the donation was $18,000.

c. On May 1, 2024, expenditures of $57,000 were made to repave parking lots at Pell's plant location. The work was necessitated

by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated.

d. On November 1, 2024, Pell acquired a tract of land with an existing building in exchange for 10,000 shares of Pell's common

stock that had a market price of $35 per share. Pell paid legal fees and title insurance totaling $30,000. Shortly after acquisition,

the building was razed at a cost of $42,000 in anticipation of new building construction in 2025.

e. On December 31, 2024, Pell purchased a small storage building by giving $16,650 cash and an old automobile purchased for

$21,500 in 2017. Depreciation on the old automobile recorded through December 31, 2024, totaled $14,200. The fair value of the

old automobile was $4,450.

Required:

Prepare a schedule analyzing the changes in each of the plant assets during 2024.

PELL CORPORATION

Analysis of Changes in Plant Assets

For the Year Ended December 31, 2024

Balance

12/31/2023

Increase

Land

$

420,000

Land improvements

215,000

1,850,000

Building

Decrease

Balance

12/31/2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Land Land improvements Building Plant Asset $ 460,000 235,000 2,050,000 1,180,000 Accumulated Depreciation $ - 56,000 361,000 Equipment Automobiles 205,000 416,000 123,000 Transactions during 2024 were as follows: a. On January 2, 2024, equipment was purchased at a total invoice cost of $315,000, which included a $6,600 charge for freight. Installation costs of $38,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $30,000. The fair value of the building on the day of the donation was $20,000. c. On May 1, 2024, expenditures of $61,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those…arrow_forwardThe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Plant Asset Accumulated Depreciation $ 480,000 245,000 2,150,000 1,184,000 215,000 Land Land improvements Building Equipment Automobiles Transactions during 2024 were as follows: a. On January 2, 2024, equipment was purchased at a total invoice cost of $325,000, which included a $6,800 charge for freight Installation costs of $40,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $32,000. The fair value of the building on the day of the donation was $21,000. c. On May 1, 2024, expenditures of $63,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forwardAt December 31, 2023, Cord Company's plant asset and accumulated depreciation and amortization accounts had balances as follows: Category Plant Asset Accumulated Depreciation and Amortization Land $ 185,000 $ — Land improvements — — Buildings 2,000,000 438,502 Equipment 1,625,000 327,500 Automobiles and trucks 182,000 110,325 Leasehold improvements 236,000 118,000 Depreciation methods and useful lives: Buildings—150% declining balance; 25 years. Equipment—Straight line; 10 years. Automobiles and trucks—200% declining balance; 5 years, all acquired after 2020. Leasehold improvements—Straight line. Land improvements—Straight line. Depreciation is computed to the nearest month and residual values are immaterial. Transactions during 2024 and other information: On January 6, 2024, a plant facility consisting of land and building was acquired from King Corporation in exchange for 35,000 shares of Cord's common stock. On this date, Cord's stock had a fair value of $60 a…arrow_forward

- Prepare partial balance sheetarrow_forwardPresented below is information related to plant assets, natural resources, and intangibles at year end on December 31, 2021, for Pronghorn Company: Buildings $1,255,000 Goodwill 700,000 Patents 500,000 Coal Mine 510,000 Accumulated Depreciation—Bldg. 646,000 Accumulated Depletion 294,000 1 .Prepare a partial balance sheet for Pronghorn Company that shows how the above listed items would be presented. (List Property, Plant and Equipment in order of Buildings and Coal Mine.)arrow_forwardvnt.okarrow_forward

- Information related to plant assets, natural resources, and intangible assets at the end of 2022 for Windsor, Inc. is as follows: buildings $1,060,000, accumulated depreciation-buildings $648,000, goodwill $409,000, coal mine $501,000, and accumulated depletion-coal mine $103,000. Prepare a partial balance sheet of Windsor, Inc. for these items. (List Property, Plant and Equipment in order of Coal Mine and Buildings.) Windsor, Inc. Balance Sheet (partial) $ $ $arrow_forwardThe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Accumulated Depreciation 0 Land Land improvements Building Equipment Automobiles Plant Asset $ 395,000 193,500 1,590,000 1,248,000 159,000 Transactions during 2021 were as follows: $ 54,000 395,000 450,000 116,500 a. On January 2, 2021, equipment were purchased at a total invoice cost of $305,000, which included a $6,400 charge for freight. Installation costs of $36,000 were incurred. b. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $34,000. The fair value of the building on the day of the donation was $21,400. c. On May 1, 2021, expenditures of $59,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forwardhe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Plant Asset Accumulated Depreciation Land $510,000 - Land Improvements 260,000 61,000 Building 2,300,000 366,000 Equipment 1,190,000 421,000 Automobiles 230,000 128,000 Transactions during 2021 were as follows: On January 2, 2021, equipment were purchased at a total invoice cost of $340,000, which included a $7,100 charge for freight. Installation costs of $43,000 were incurred. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $35,000. The fair value of the building on the day of the donation was $22,500. On May 1, 2021, expenditures of $66,000 were made to repave parking lots at Pell’s plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn’t provide future benefits beyond those originally…arrow_forward

- The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Plant Asset AccumulatedDepreciation Land $ 400,000 $ — Land improvements 205,000 50,000 Building 1,750,000 355,000 Equipment 1,168,000 410,000 Automobiles 175,000 117,000 Transactions during 2021 were as follows: On January 2, 2021, equipment were purchased at a total invoice cost of $285,000, which included a $6,000 charge for freight. Installation costs of $32,000 were incurred. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $24,000. The fair value of the building on the day of the donation was $17,000. On May 1, 2021, expenditures of $55,000 were made to repave parking lots at Pell’s plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn’t provide future…arrow_forwardPresented below is information related to plant assets, natural resources, and intangibles at year end on December 31, 2021, for Hanley Company: Buildings Goodwill $1,280,000 650,000 Patents 480,000 Coal Mine 440,000 Accumulated Depreciation-Bldg. 670,000 Accumulated Depletion 275,000 Prepare a partial balance sheet for Hanley Company that shows how the above listed items would be presented. (List Property, plant and equipment with buildings first.) HANLEY COMPANY Balance Sheet (Partial) +A $ $arrow_forwardDomesticarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education