Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accounting

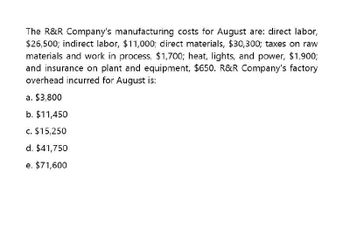

Transcribed Image Text:The R&R Company's manufacturing costs for August are: direct labor,

$26,500; indirect labor, $11,000; direct materials, $30,300; taxes on raw

materials and work in process, $1,700; heat, lights, and power, $1,900;

and insurance on plant and equipment, $650. R&R Company's factory

overhead incurred for August is:

a. $3,800

b. $11,450

c. $15,250

d. $41,750

e. $71,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- York Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forwardJohansen company has the following estimated..accounting questionsarrow_forwardCosts would bearrow_forward

- A company estimated the manufacturing overhead costs for the coming year at $420,000. The total estimated direct labor hours are 15,000 hours, and the estimated machine hours to be worked are 6,000 hours. The company allocates its manufacturing overhead costs based on the direct labor hours. What is the pre-determined overhead allocation rate? a. $20 per direct labor hour b. $70 per machine hour c. $28 per machine hour d. $28 per direct labor hourarrow_forwardAaron Company estimates direct labor costs and manufacturing overhead costs for the coming year to $900,000 and $700,000, respectively. Aaron allocates overhead costs based on labor hours. the estimated total labor hours and machine hours for the coming year are 16,000 hours and 10,000 hours, respectively., What's the predetermined overhead allocation rate?arrow_forwardThe accounting records of Nelson Manufacturing revealed the following selected costs: Sales commissions, $96,000; plant insurance, $80,000; and administrative expenses, $150,000. What is Nelson Manufacturing's period costs total?arrow_forward

- Walter company uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. The company's estimated costs for the next year are: Direct materials $3,000 Direct labor $20,000 Depreciation on factory equipment $6,000 Rent on factory $12,000 Sales salaries $29,000 Factory utilities $15,000 Indirect labor $5,000 It is estimated that 5,000 direct labor hours will be worked during the year. The predetermined overhead rate will be: $3.90 $5.90 $7.80 $7.60 None of the above Please show the work.arrow_forwardThe accounting records of Dixon Company revealed the following costs: direct materials used, $250,000; direct labor, $425,000; manufacturing overhead, $375,000; and selling and administrative expenses, $220,000. Dixon's product costs total:arrow_forwardWarner Company purchases $ 50,000 of raw materials on account, and it incurs $ 60,000 of factory labor costs. Supporting records show that (a) the Assembly Department used $ 24,000 of the raw materials and $ 35,000 of the factory labor, and (b) the Finishing Department used the remainder. Manufacturing overhead is assigned to departments on the basis of 160% of labor costs.Journalize the assignment of overhead to the Assembly and Finishing Departments. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles Debit Credit Mar.31 enter an account title for the journal entry on March 31 enter a debit amount enter a credit amount enter an account title for the journal entry on March 31 enter a debit amount enter a credit amount enter an account title for the journal entry on March 31 enter a debit amount enter a credit amountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub