Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide answer this accounting question not use chatgpt

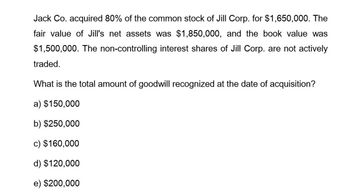

Transcribed Image Text:Jack Co. acquired 80% of the common stock of Jill Corp. for $1,650,000. The

fair value of Jill's net assets was $1,850,000, and the book value was

$1,500,000. The non-controlling interest shares of Jill Corp. are not actively

traded.

What is the total amount of goodwill recognized at the date of acquisition?

a) $150,000

b) $250,000

c) $160,000

d) $120,000

e) $200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the total amount of goodwill recognized at the date of acquisition?arrow_forwardAssume that ayisiyiniwiwinak Corp. paid $19 million to purchase 10-Trees Inc. Below is a summary of the balance sheet of 10-Trees Inc. at the time of the ayisiyiniwiwinak Corp. acquisition (amounts are given in million $). The fair value of 10-Tree Inc.'s non-current assets was higher than the book value and amounted to $24 at that time. Assets Current assets Non-current assets Total assets 6 18 24 Liabilities Current liabilities Non-current liabilities Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 8 10 18 2 4 6 24 Requirement 1: Based on the information provided above, fill Blanks 1 and 2. Blank #1: What is the goodwill resulting from this transaction? Enter your response as a plain number (no $-signs or decimals).arrow_forwardX company acquired 90% of the voting stock of company Y by paying $75,000 in cash and stock. The fair value of the noncontrolling interest is $20,000. The book value of Y company is $56,000. Calculate the percentage of total goodwill that is allocated to the controlling interest according to U.S. GAAP? (Assume that no revaluations of acquired identifiable net assets is required.) A) 63% B) 67% C) 75% D) 90%arrow_forward

- On January 1, 2021 Major acquired 60% of Minor for a cash payment of $600,000. At date of acquisition, the fair value of Minor's net assets were $300,000. Assuming there is no control premium, how much Goodwill is recorded in the consolidated financial statements $420,000 $300,000 $700,000 $60,000arrow_forwardsarrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, for $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Assets Cash Professor Scholar Corporation Corporation $50,300 Accounts receivable Inventory Land Buildings and equipment Less: Accumulated depreciation Investment in Scholar Corporation Total Assets Liabilities & Equity Accounts payable Mortgage payable Common stock Retained earnings NCI in Net assets of Scholar Corporation Total Liabilities & Equity 90,000 130,000 60,000 410,000 (150,000) 102,200 $ 692,500 $152,500 250,000…arrow_forward

- On January 1, 2022, Paulson Corporation purchased 65% of the outstanding common stock of Sun Company, which became a subsidiary of Paulson. No goodwill was reported on this acquisition. Differences between book value and fair value of the net identifiable assets of Sun Company on January 1, 2022, were limited to the following: Book value $ 19,000 Inventories (FIFO) Building (net) [remaining life: 5 years; straight-line depreciation; no salvage value] | 45,000 40,000 Sun's cost of goods sold was $38,000 in 2022. Sun reported an income of 20,000 in 2023. The noncontrolling interest in net income for the year ended December 31, 2023 (second year after business combination) was a. $7,350 b. $7,175 C. $6,825 d. $6,650 Fair value $ 18,500arrow_forwardPolypipe Company acquired 80% of Svedex Company’s voting stock for $95,000 in cash. The noncontrolling interest had an estimated fair value of $20,000. Some of Svedex’s identifiable assets and liabilities at the date of acquisition had fair values that were different from reported values, as follows: Book Value Fair Value Property, net $ 6,000 $ 4,000 Licensing agreements 1,000 25,000 Svedex’s total shareholders’ equity at the date of acquisition was as follows: Capital stock $5,000 Retained deficit (400) Treasury stock (50) Total $ 4,550 On a date-of-acquisition consolidation working paper, eliminating entry (R) credits the noncontrolling interest in Svedex in the amount of Select one: a. $15,450 b. $18,600 c. $19,090 d. $20,000arrow_forwardAcquirer Limited purchased 75 per cent of Subby Limited for $45 000. The fair value of identifiable assets was $95 000, and the fair value of liabilities and contingent liabilities amounted to $47 000. According to AASB 10, what would be the amount of 'goodwill allocated to non-controlling interests of Subby Limited'?arrow_forward

- On January 1, 2022, Pacer Corporation (Pacer) acquired 80% of Sprint Ltd. (Sprint) Corp. for $500,000. Please uses the cost method to account for its investment. On January 1, 2022, Sprint's retained earnings and common shares were $350,000 and $110,000, respectively. Sprint's book values did not differ materially from its fair values on the date of acquisition with the following exceptions: • Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2022. • A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years. The financial statements of Pacer and Sprint for the year ended December 31, 2023 are shown below: Income Statements Pacer Corporation Sprint Ltd. Sales $500,000 $300,000 Other revenues 300,000 120,000 Less: expenses Cost of goods sold 400,000 240,000 Depreciation/amortization…arrow_forwardBartholomew Corporation acquired 80 percent of the outstanding shares of Samson Company in Year 1 by paying $5,500,000 in cash. The fair value of Samson’s identifiable net assets is $5,000,000. Bartholomew uses the proportionate share of the acquired firm’s net assets approach to measure noncontrolling interest. Samson is a separate cash-generating unit. Good will recorded by the company at date of acquisition: Select one:a. 500,000b. 1500,000c. 600,000d. 1875000arrow_forwardProfessor Corporation acquired 70 percent of Scholar Corporation's common stock on December 31, 20X4, fr $102,200. The fair value of the noncontrolling interest at that date was determined to be $43,800. Data from the balance sheets of the two companies Included the following amounts as of the date of acquisition: Item Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation. Investment in Scholar Corporation Total Assets Accounts Payable Mortgage Payable Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Professor Corporation $ 50,300 90,000 Scholar Corporation $21,000 44,000 130,000 75,000 60,000 30,000 410,000 250,000 (150,000) (80,000) 102,200 $ 692,500 $340,000 $ 152,500 $ 35,000 250,000 180,000 80,000 40,000 210,000 85,000 $ 692,500 $340,000 At the date of the business combination, the book values of Scholar's assets and liabilities approximated fair value except for Inventory, which had a fair value of $81,000, and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning