Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Which of the following statements is TRUE?

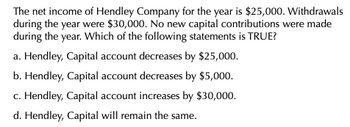

Transcribed Image Text:The net income of Hendley Company for the year is $25,000. Withdrawals

during the year were $30,000. No new capital contributions were made

during the year. Which of the following statements is TRUE?

a. Hendley, Capital account decreases by $25,000.

b. Hendley, Capital account decreases by $5,000.

c. Hendley, Capital account increases by $30,000.

d. Hendley, Capital will remain the same.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Branch Corp.'s total assets at the end of last year were $310,000 and its net income after taxes was $22,750. What was its return on total assets? Select the correct answer. a. 8.34% b. 7.34% c. 6.84% d. 7.84% e. 6.34%arrow_forwardWhipporwill, Incorporated's, net income for the most recent year was $16,802. The tax rate was 21 percent. The firm paid $3,706 in total interest expense and deducted $4,491 in depreciation expense. What was the cash coverage ratio for the year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Cash coverage ratio timesarrow_forward24. Following are a company's income statement at the end of the last year (year 0) and coming year (year 1). Each year, the company's accounts receivable need to be main- tained at 5% of sales. The company's inventory and accounts payable do not change. Capital expenditure in year 1 is $10,000. Year Sales Depreciation EBIT Taxes (a) What is the free cash flow in year 17 1 85,000 92,000 20,000 22,000 17,000 19,500 3,500 3,700 0 (b) The company's business is mature, so it is expected to generate the same amount of free cash flow every year forever. The firm-specific discount rate is 7%, and the risk-free rate is 2%. What is the enterprise value of the company? (c) The company has $150,000 in cash and $50,000 in debt. In addition, it has 7000 shares outstanding. What is the company's stock price per share?arrow_forward

- Whipporwill, Incorporated’s, net income for the most recent year was $24,020. The tax rate was 24 percent. The firm paid $4,156 in total interest expense and deducted $6,291 in depreciation expense. What was the cash coverage ratio for the yeararrow_forwardFVA Inc.'s net income for the most recent year was $41,445. The tax rate was 25 percent. The firm paid $10,440 in total interest expense and deducted $10,630 in depreciation expense. What was the cash coverage ratio for the year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Cash coverage ratio timesarrow_forwardA company had sales of $600 and costs of $300. Depreciation was an additional $150, and interest paid was $30. Taxes were 40% of pretax income. Dividends were $30. Beginning net fixed assets were $500 and ending net fixed assets were $750. The company started the year with a net working capital of $510 and ended with $550. No shares of stock were issued that year A. Calculate net income (nearest dollar without dollar sign ($) or comma, e.g. 15000. Negative cash flow is -15000 B. Calculate operating cash flow (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000arrow_forward

- am. 115.arrow_forwardThe Bookbinder Company had $550,000 cumulative operating losses prior to the beginning of last year. It had $110,000 in pre-tax earnings last year before using the past operating losses and has $330,000 in the current year before using any past operating losses. It projects $360,000 pre-tax earnings next year. Enter your answers as positive values. If an amount is zero, enter "0". Round your answers to the nearest dollar. How much taxable income was there last year? $ How much, if any, cumulative losses remained at the end of the last year? $ What is the taxable income in the current year? $ How much, if any, cumulative losses remain at the end of the current year? $ What is the projected taxable income for next year? $ How much, if any, cumulative losses are projected to remain at the end of next year?arrow_forwardGilmore, Inc., had equity of $175,000 at the beginning of the year. At the end of the year, the company had total assets of $330,000. During the year, the company sold no new equity. Net income for the year was $37,000 and dividends were $5,000. a. Calculate the internal growth rate for the company. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the internal growth rate using ROA × b for beginning of period total assets. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Calculate the internal growth rate using ROA × b for end of period total assets. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- A firm had after-tax Income last year of $1.0 million. Its depreciation expenses were $0.2 million, and its total cash flow was $1.0 million. What happened to net working capital during the year? Note: Enter your answer in millions rounded to 1 decimal place. Net working capital millionarrow_forwardSolve this problemarrow_forwardKk.374.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning