Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Account Subject

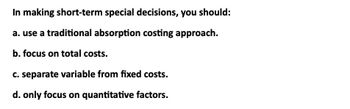

Transcribed Image Text:In making short-term special decisions, you should:

a. use a traditional absorption costing approach.

b. focus on total costs.

c. separate variable from fixed costs.

d. only focus on quantitative factors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Explain how the high-low method is used for cost estimation. What, if any, are the limitations of this approach to cost estimation?arrow_forwardWhich statement is correct? A. Activity-based cost systems are less costly than traditional cost systems. B. Activity-based cost systems are easier to implement than traditional cost systems. C. Activity-based cost systems are more accurate than traditional cost systems. D. Activity-based cost systems provide the same data as traditional cost systems.arrow_forwardGEt General Account Solution asap no Ai please.arrow_forward

- Absorption costing is:A. a good way to value inventories for the balance sheet.B. used for external reporting purposes.C. less useful than variable costing for management decision making. D. A and B is correct E. A, B and C is correctarrow_forwardIn making a short-term special decision, which of the following is MOST important? a. Use a conventional absorption costing method b. Focus on the total cost c. Separate variable and fixed costs d. Discount cash flow to their present valuesarrow_forwardIn a decision analysis situation, which one of the following costs is generally not relevant to the decision?A. Differential cost.B. Avoidable cost.C. Incremental cost.D. Historical cost.arrow_forward

- When using the general methods to estimate cost behavior, A. It is a good idea to use multiple methods so results can be compared B. Managers often apply their own best judgement as a first step in the estimation process C. Results are likely to differ from method to method D. Large differences in methods suggest that the cost cannot be estimated.arrow_forwardWhich of the following statements regarding marginal costing is incorrect? Select one: O A. It is useful long-term planning technique OB. It assumes that fixed costs remain fixed over relevant activity ranges O C. It assumes that variable costs vary in proportion to activity O D. It assumes that costs can be classified as variable or fixedarrow_forwardDecisions where relevant cost analysis might be used effective is Keep or replace decision. Explain IN YOUR OWN WORDS what "Keep or replace decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forward

- True or 2. Reasons for using standard costing include: A) Comparing projected costs against actual costs B) Planning and budgeting purposes C) Setting prices in advance D) Identifying specific areas for process improvement E) All of the abovearrow_forwardManagement may be tempted to overproducea. when using variable costing, in order to increase net income.b. when using variable costing, in order to decrease net income.c. when using absorption costing, in order to increase net income.d. when using absorption costing, in order to decrease net income.arrow_forwardHow important is it to trace costs appropriately? Explain. As you are beginning to think about the importance of tracing costs appropriately, please consider the differences between variable costing and absorption costing. What implications does each of these have on such things as financial reporting of profit and pricing your products for the marketplace?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College