SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

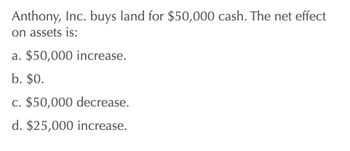

Transcribed Image Text:Anthony, Inc. buys land for $50,000 cash. The net effect

on assets is:

a. $50,000 increase.

b. $0.

c. $50,000 decrease.

d. $25,000 increase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 39.ABC sold land that cost $ 10,000 for $ 12,000. ABC will report: Select one: a. Net operating cash flow of $ 2,000. b. Net cash flow from financing of $ 2,000. c. Net cash flow from financing of $ 12,000. d. Net investment cash flow of $ 12,000.arrow_forwardGriffin's goat farm, Inc has sales of $666,000 costs of $328,000, depreciation expenses of $72,000 interest expense $46,000 and a tax rate of 24 percent. what is the taxable income? a. $167,200 b. 220,000 c. 266000 d. 52800 e. 292000arrow_forwardA property is purchased for $600,000 and sold for $900,000. Which of the following statements is most accurate? A.If the property is owned by an individual for 10 months the assessable capital gain is $150,000 B.If the property is owned by a superannuation fund for 15 months the assessable capital gain is $200,000 C.If the property is owned by a company for 10 months the assessable capital gain is $300,000 D.If the property is owned by an individual for 10 months the assessable capital gain is $300,000arrow_forward

- Gaarrow_forward7. The president of Dozier Corporation donated a building to Mandy Corporation. The building had an original cost of $200,000, a book value of $75,000, and a fair market value of $180,000. To record this donation, Mandy would a. make a memorandum entry b. debit Building for $75,000 and credit Gain for $75,000 c. debit Building for $200,000 and credit Gain for $200,000 d. debit Building for $180,000 and credit Gain for $180,000arrow_forwardThese expenditures were incurred by Blossom Company in purchasing land: cash price $55,000, assumed accrued property taxes $4,500, attorney's fees $2,100, real estate broker's commission $3,000, and clearing and grading $4,000. What is the cost of the land? The cost of the land 73900arrow_forward

- Rock Properties recently purchased a building that generates Gross Rental Income of $190,000 per year and Net Operating Income of $125,000 per year. Rock paid $250 per square foot for the 3,000 square foot building. What was the capitalization rate based on the purchase price? a. 25.3% b. 65.8% c. 16.7% d. 12.5% e. None of the above.arrow_forward1. What is the capitalized cost of each of Belvidere's land, land improvements, and building? SS attached thanksarrow_forwardSansoni Services exchanged an asset with cost of $20,000 (now 30% depreciated) for a similar asset worth $18,000. Sansoni received $2,000 boot. In the entry to record this exchange, Sansoni should record a. A $6,000 gain b. A $600 gain c. No gain or loss d. A $600 lossarrow_forward

- H1.arrow_forwardCompute the following. 1. Total gain. 2. Contract price. 3. Payments received in the year of sale. 4. Recognized gain in the year of sale and the character of such gain. а. (Hint: Think carefully about the manner in which the property taxes are han- dled before you begin your computations.) b. Same as parts (a)(2) and (3), except that Kay's basis in the property was $35,000.arrow_forwardThe ending net book value of Property, Plant & Equipment (PP&E) in year 1 and year 2 are $500,000 and $430,000 respectively on Company A's balance sheet. The company's depreciation expense in year 2 is $90,000. What is Company A's net capital expenditure? O a. %33 O b. %20. O c. %67. Od. %77. Nexto (? H 10:0 РОСОРНONЕ 11/3 SHOT ON POCOPHONE F1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you