Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

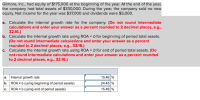

Transcribed Image Text:Gilmore, Inc., had equity of $175,000 at the beginning of the year. At the end of the year,

the company had total assets of $330,000. During the year, the company sold no new

equity. Net income for the year was $37,000 and dividends were $5,000.

a. Calculate the internal growth rate for the company. (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

b. Calculate the internal growth rate using ROA × b for beginning of period total assets.

(Do not round intermediate calculations and enter your answer as a percent

rounded to 2 decimal places, e.g., 32.16.)

c. Calculate the internal growth rate using ROA × b for end of period total assets. (Do

not round intermediate calculations and enter your answer as a percent rounded

to 2 decimal places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Columbus Corp. had $380,000 additions to retained earnings for the year. The firm paid out $210,000 in cash dividends, and it has ending total equity of $6.7 million. The company currently has 200,000 shares of common stock outstanding and the stock currently sells for $90 per share. What is the PE ratio? Round it to two decimal places.arrow_forwardA company's calendar-year financial data are shown below. The company had total assets of $339,000 and total equity of $144,400 for the prior year. No additional shares were issued during the year. The December 31 market price per share is $49.50. Cash dividends of $19,500 were paid during the year. Calculate the following ratios for the company: (a) Profit margin ratio. (b) Retum on total assets. (c) Return on ordinary shareholders' equity. (d) Basic earnings per share. (e) Price earnings ratio. (f) Dividend yield. Net sales Cost of goods sold..... Gross profit..... Operating expenses Operating income Interest expense Income before taxes Income taxes. Net profit www***** Accounts receivable (net). Inventory..... Property, plant and equipment (net) . Total assets Current liabilities. Long-term notes payable .…..... Share Capital: $5 par value Retained earnings...... Total liabilities and equity. $650,000 422,500 $227,500 140,500 $ 87,000 9,100 $77,900 23,400 $ 54,500 Ending Balances $…arrow_forwardBerman & Jaccor Corporation's current sales and partial balance sheet are shown below. This year Sales $ 1,000 Balance Sheet: Assets Cash $ 150 Short-term investments $ 110 Accounts receivable $ 250 Inventories $ 250 Total current assets $ 760 Net fixed assets $ 400 Total assets $ 1,160 Sales are expected to grow by 8% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forward

- Swiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $160,000 in assets. By the end of the year, assets had grown to $210,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 14% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: 1 1 Denominator: = Return on assetsarrow_forwardAt the beginning of its current fiscal year, Willie Corporation's balance sheet showed assets of $12,400 and liabilities of $6,400. During the year, liabilities decreased by $1,400. Net income for the year was $3,050, and net assets at the end of the year were $6,650. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Stockholders' Equity Assets Liabilities + PIC RE Beginning: Changes: $ 12,400 = $ (750) = 6,400 + (1,400) + $ 0+ $ 6,000 0+ Changes: Ending: $ 11,650 = $ 5,000 + 0+ EA $ 3,050 +Net income (2,400) Dividends 6,650arrow_forward2 For the most recent year, Camargo, Inc., had sales of $562,000, cost of goods sold of $248,050, depreciation expense of $63,900, and additions of retained earnings of $76,300. The firm currently has 23,500 shares of common stock outstanding and the previous year's dividends per share were $1.45. Assuming a 22% income tax rate, what was the times interest earned ratio? (DO NOT round intermediate calculations and round your answer 10 2 decimal places, e.g., 32016 Times interest earned: ? timesarrow_forward

- Last year, Atlantic Richfield had sales of $325,000 and a net income of $28,700. The firm finances using only debt and common equity, and total assets equal total invested capital. Year-end assets were $250,000, and the firm's debt ratio (total-debt-to-total-capital ratio) was 15%. What was their ROE? Your answer should be between 7.12 and 15.40, rounded to 2 decimal places, with no special characters.arrow_forwardSmashed Pumpkins Company paid $176 in dividends and $603 in interest over the past year. The company increased retained earnings by $504 and had accounts payable of $654. Sales for the year were $16,440 and depreciation was $740. The tax rate was 21 percent. What was the company's EBIT?arrow_forwardIn its most recent financial statements, Nessler Inc. reported $55 million of net income and $605 million of retained earnings. The previous retained earnings were $563 million. How much in dividends were paid to shareholders during the year? Assume that all dividends declared were actually paid. Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest dollar, if necessary.arrow_forward

- For the most recent year, Camargo, Incorporated, had sales of $574,000, cost of goods sold of $250,780, depreciation expense of $65,400, and additions to retained earnings of $77,800. The firm currently has 25,000 shares of common stock outstanding and the previous year's dividends per share were $1.54. Assuming a 25 percent Income tax rate, what was the times Interest earned ratlo? Note: Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Times interest earned timesarrow_forwardThe newspaper reported last week that Bennington Enterprises earned $34.09 million this year. The report also stated that the firm's return on equity is 18 percent. The firm retains 70 percent of its earnings. What is the firm's earnings growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) What will next year's earnings be? (Do not round intermediate calculations and enter your answer in dollars, 'not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Earnings growth rate Next year's earnings %arrow_forwardIn the past year, TVG had revenues of $2.93 million, cost of goods sold of $2.43 million, and depreciation expense of $102,200. The firm has a single issue of debt outstanding with book value of $1.17 million on which it pays an interest rate of 10%. What is the firm’s times interest earned ratio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education