Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

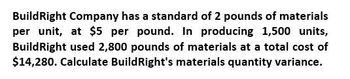

Calculate buildright material quantity variance

Transcribed Image Text:BuildRight Company has a standard of 2 pounds of materials

per unit, at $5 per pound. In producing 1,500 units,

Build Right used 2,800 pounds of materials at a total cost of

$14,280. Calculate BuildRight's materials quantity variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardEd Co. manufactures two types of O rings, large and small. Both rings use the same material but require different amounts. Standard materials for both are shown. At the beginning of the month, Edve Co. bought 25,000 feet of rubber for $6.875. The company made 3,000 large O rings and 4,000 small O rings. The company used 14,500 feet of rubber. A. What are the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance? B. If they bought 10,000 connectors costing $310, what would the direct materials price variance be for the connectors? C. If there was an unfavorable direct materials price variance of $125, how much did they pay per toot for the rubber?arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forward

- Jameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Given answer accounting questionsarrow_forwardPoonam has a standard of 1.5 pounds of materials per unit, at S6 per pound. In producing 2,000 units, Poonam used 3,100 pounds of materials at a total cost of $18,135. Poonam's material quantity variance is favorable or unfavorable? Answerarrow_forwardPoonam has a standard of 1.5 pounds of materials per unit, at S6 per pound. In producing 2,000 units, Poonam used 3,100 pounds of materials at a total cost of $18,135. Poonam's material quantity variance is favorable or unfavorable?arrow_forward

- ABC Company has set the following standards for one unit of product: Direct materials: 0.5 pounds a $1.00 per pound; Direct labor: 1 hour $10.00 per hour. The company produced 35,000 units and had the following actual costs: Direct materials: 18,000 pounds at a total cost of $17,280; Direct labor: 36,000 hours at a total cost of $374,400. Compute the direct labor rate variance. O $10,000 F O $10,000 U O $14,400 F O $14,400 Uarrow_forwardThe company set the standards for one unit of production: Direct Materials: 0.5 pounds @$1.00 per pound; Direct Labor: 1 hour @$10.00 per hour. The company produced 35,000 units and had the following costs: Direct Materials: 18,000 pounds at a total cost of $17,280, Direct Labor: 36.000 hours at a total cost of $374,400. Compute the Direct Material price variance.arrow_forwardThe Russell Company provides the following standard cost data per unit of product: Direct material (2 gallons @ $3 per gallon) Direct labor (1 hours @ $13 per hour) During the period, the company produced and sold 26,000 units, incurring the following costs: Direct material Direct labor 55,000 gallons @ $ 2.9 per gallon 26,500 hours @ $12.75 per hour $ 6 $13 The direct material price variance was:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning