FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't use ai given answer accounting questions

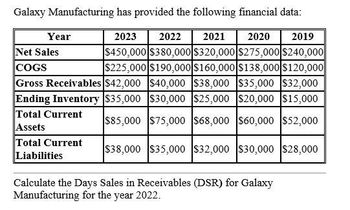

Transcribed Image Text:Galaxy Manufacturing has provided the following financial data:

Year

Net Sales

2021

2023 2022

$450,000 $380,000 $320,000 $275,000 $240,000

$225,000 $190,000 $160,000 $138,000 $120,000

2020 2019

COGS

Gross Receivables $42,000 $40,000 $38,000 $35,000 $32,000

Ending Inventory $35,000 $30,000 $25,000 $20,000 $15,000

Total Current

Assets

Total Current

Liabilities

$85,000 $75,000 $68,000 $60,000 $52,000

$38,000 $35,000 $32,000 $30,000 $28,000

Calculate the Days Sales in Receivables (DSR) for Galaxy

Manufacturing for the year 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information provided below:Rubialac PaintsSelected Income Statement Items, 2020Cash Sales $2,500,000Credit Sales $9,500,000Total Sales $12,000,000COGS 7,000,000 Rubialac PaintsSelected Balance Sheet Accounts12/31/2020 12/31/19 ChangeAccounts Receivable $550,000 $400,000 $150,000Inventory $275,000 $250,000 $25,000Accounts Payable $150,000 $110,000 $40,000 What is the inventory turnover for Rubialac Paints? What is the average production cycle for the firm? What is the average collection cycle? What could Eagle Paints do to reduce the average collection cycle?arrow_forwardBlue Company reported the following information in its financial statements. Blue Company (FIFO) $millions Sales COGS Inventories 2021 $60,000 $45,000 $15,000 2020 52,000 36,000 13,000 The LIFO reserve for Blue Company is $2,760 at the end of 2020 and $2,500 at the end of 2021.What is the 2021 gross profit for Blue Company, assuming Blue Company had used LIFO? Select one: a. $14,740 b. $15,740 c. $14,260 d. $15,000 e. $15,260arrow_forwardThe following condensed information is reported by Beany Baby Collectibles. 2024 2023 Income Statement Information Sales revenue $13,020,000 $9,000,000 Cost of goods sold 8,436,960 6,500,000 Net income 394,320 308,000 Balance Sheet Information Current assets $1,660,000 $1,560,000 Long-term assets 2,260,000 1,960,000 Total assets $3,920,000 $3,520,000 Current liabilities $1,260,000 $960,000 Long-term liabilities 1,440,000 1,440,000 Common stock 860,000 860,000 Retained earnings 360,000 260,000 Total liabilities and stockholders' equity $3,920,000 $3,520,000arrow_forward

- Indigo Corporation Indigo Corporation Balance Sheets December 31 Income Statements For the Years Ended December 31 2020 2019 2020 2019 2018 Sales revenue $ 21,000 $606,000 $ 31,000 $ 19,000 $746,000 Cash Less: Sales returns and allowances 41,000 31,000 Accounts receivable (net) 49,000 51,000 46,000 Other current assets 96,000 Net sales 101,000 70,000 705,000 575,000 76,000 51,000 431,000 Investments 61,000 Cost of goods sold 356,000 500,000 370,000 358,000 Gross profit Plant and equipment (net) 274,000 219,000 $739,000 $614,000 $547,000 Operating expenses (including income taxes) 181,000 151,000 $ 68,000 $ 93,000 $ 86,000 $ 81,000 $ 71,000 Current liabilities Net income Long-term debt 151,000 91,000 56,000 Additional information: Common stock, $10 par 306,000 326,000 316,000 126,000 Retained earnings 176,000 114,000 The market price of Indigo's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 1. You must compute dividends paid. All dividends were paid in…arrow_forwardConsider the following information for Handley Stores for 2020 and 2021: 2020 2021 Total assets $72,590,000 $68,832,000 Noninterest-bearing current liabilities 5,368,000 6,039,000 Net income 4,453,000 6,039,000 Interest expense 2,944,000 3,640,000 Sales 55,572,000 117,425,000 Tax rate 35% 35% X Your answer is incorrect. Compute ROI for both years. (Round answers to 2 decimal places, e.g. 15.32%.) 2020 2021 ROI 6.13 % 8.77 % * Your answer is incorrect. Break ROI down into profit margin and investment turnover. (Round answers to 4 decimal places, eg. 15.3215.) 2020 2021 Profit margin 8.01 5.14 Investment turnover 0.78 1.72arrow_forwardExcerpts from the annual report of XYZ Corporation follow: 2019 $675,138 $241,154 $64,150 $93,650 $25,100 2020 Cost of goods sold Inventory Net income $754,661 $219,686 $31,185 $68,685 $26,900 Retained earnings LIFO reserve Tax rate 20% 20% If XYZ used FIFO, its net income for fiscal 2020 would be O a. $34,165 O b. $30,375 O c. $32,625 d. $36,545arrow_forward

- Mahoney, Inc. reports the following information in its annual report: January 1, 2024 December 31, 2024 Inventory value at LIFO $1,500,000 $1,600,000 LIFO reserve 40,000 50,000 Inventory value at FIFO $ 1,540,000 $1,650,000 Sales for 2024 totaled $10,000,000. Cost of goods sold under LIFO totaled $ 6,700,000. What is Mahoney's 2024 inventory balance, cost of goods sold and gross profit if it uses the FIFO method?arrow_forwardCALCULATE ROIarrow_forwardThe following condensed information is reported by Sporting Collectibles. 2021 2020 Income Statement Information Sales revenue $ 7,224,000 $ 7,600,000 Cost of goods sold 4,782,288 5,100,000 Net income 316,480 168,000 Balance Sheet Information Current assets $ 1,520,000 $ 1,420,000 Long-term assets 2,120,000 1,820,000 Total assets $ 3,640,000 $ 3,240,000 Current liabilities $ 1,120,000 $ 820,000 Long-term liabilities 1,580,000 1,580,000 Common stock 720,000 720,000 Retained earnings 220,000 120,000 Total liabilities and stockholders' equity $ 3,640,000 $ 3,240,000 Required:1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) 2. Determine the amount of dividends paid to shareholders in 2021.arrow_forward

- Consider the following financial statement information for Hi-Tech Instruments: 2020 (Thousands of Dollars, except Earnings per Share) Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,300 Dividends 2,600 Earnings per share 4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Dec. 31, 2020 Dec. 31, 2019 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total Current Assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total Assets $172,000 $167,000 Liabilities and Stockholders’ Equity Notes payable—banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total Current Liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total Liabilities 85,000 85,700 Common stock* 50,000 50,000 Retained earnings 37,000 31,300 Total Stockholders’ Equity 87,000 81,300 Total Liabilities and…arrow_forwardConsider the following financial statement information for Hi-Tech Instruments: 2020 (Thousands of Dollars, except Earnings per Share) Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,300 Dividends 2,600 Earnings per share 4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Dec. 31, 2020 Dec. 31, 2019 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total Current Assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total Assets $172,000 $167,000 Liabilities and Stockholders’ Equity Notes payable—banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total Current Liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total Liabilities 85,000 85,700 Common stock* 50,000 50,000 Retained earnings 37,000 31,300 Total Stockholders’ Equity 87,000 81,300 Total Liabilities and…arrow_forwardConsider the following financial statement information for Hi-Tech Instruments: 2020 (Thousands of Dollars, except Earnings per Share) Sales revenue $210,000 Cost of goods sold 125,000 Net income 8,300 Dividends 2,600 Earnings per share 4.15 HI-TECH INSTRUMENTS, INC. Balance Sheets (Thousands of Dollars) Dec. 31, 2020 Dec. 31, 2019 Assets Cash $18,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total Current Assets 103,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total Assets $172,000 $167,000 Liabilities and Stockholders’ Equity Notes payable—banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total Current Liabilities 45,000 45,700 9% Bonds payable 40,000 40,000 Total Liabilities 85,000 85,700 Common stock* 50,000 50,000 Retained earnings 37,000 31,300 Total Stockholders’ Equity 87,000 81,300 Total Liabilities and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education