ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

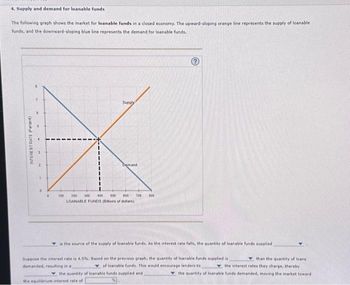

Transcribed Image Text:4. Supply and demand for loanable funds

The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable

funds, and the downward-sloping blue line represents the demand for loanable funds.

INTEREST RATE (Percent)

0

Supply

100 200 300 400 500 800

LOANABLE FUNDS (Dons of dollars)

700 800

is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied

than the quantity of loans

the interest rates they charge, thereby

the quantity of loanable funds demanded, moving the market toward

Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is

demanded, resulting in a

of loanable funds. This would encourage lenders to

the quantity of loanable funds supplied and

the equilibrium interest rate of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The graph below represents the market for loanable funds for an economy. Use the graph to answer the following questions. real interest rate 6% 51000 Loanable fund $ Assume there currently is a surplus in the market for loanable funds. The current real interest rate is I Select) the equilibrium real interest rate. As the market moves to the equilibrium real interest rate we expect I Select ] Demand for loanable funds comes from the activities of ISelect) 13arrow_forwardWhich of the following is one of the reasons that the demand curve for loanable funds is downward sloping? A lower real interest rate discourages domestic investors from purchasing foreign securities and encourages foreign investors to purchase domestic securities. A higher real interest rate encourages people to save. OA lower real interest rate discourages people from saving. OA higher real interest rate makes borrowing more expensive, Which of the following is one of the reasons that the supply curve for loanable funds is upward sloping? A higher real interest rate makes borrowing less expensive. OA lower interest rate makes borrowing less expensive. OA lower real interest rate encourages domestic consumers to purchase foreign securities and discourages foreigners from purchasing domestic securities. A lower real interest rate makes saving less appealing.arrow_forwardK Consider the graph to answer the following questions: a. The shift from S, to S₂ represents in the supply of loanable funds. b. With the shift in supply, the equilibrium quantity of loanable funds c. With the change in the equilibrium quantity of loanable funds, the quantity of saving and the quantity of investment ▼ A CI Real Interest Rate Market for Loanable Funds L₂ L1 Loanable Funds ($ per year) S₁ Qarrow_forward

- The following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. Supply 5 Demand 1 100 200 300 400 500 600 LOANABLE FUNDS (Billions of dollars) is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied Suppose the interest rate is 3.5%. Based on the previous graph, the quantity of loanable funds supplied is than the quantity of loans ▼ of loanable funds. This would encourage lenders to the interest rates they charge, thereby demanded, resulting in a the quantity of loanable funds supplied and the quantity of loanable funds demanded, moving the market toward 0% the equilibrium interest rate of INTEREST RATE (Percent)arrow_forward(Figure: The Market for Loanable Funds II) Use Figure: The Market for Loanable Funds II. An increase in private savings will shift the supply curve for loanable funds to the Interest rate causing the interest rate to r* = 6% E Supplyarrow_forwardThe following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. 10 Supply 8 Demand 100 200 300 400 500 600 700 800 900 1000 LOANABLE FUNDS (Billions of dollars) is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied increases v Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is v than the quantity of loans demanded, resulting in a v of loanable funds. This would encourage lenders to v the interest rates they charge, thereby v the quantity of loanable funds supplied and v the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of 5% . INTEREST RATE (Percent)arrow_forward

- Step 2 Determine the equilibrium real interest rate. The table below is broken down by Month, Real Interest Rate (%), Loanable Funds (trillions of $), Exogenous Change, Equilibria (increases, decreases, or no change. Use the data table to determine the equilibrium real interest rate after certain factors change: Equilibria (increases, decreases, or no change) Month Real Interest Loanable Funds Exogenous Rate (%) (trillions of $) Change 3 no change no change January 3% April 3% 4 increased fund ? supply decreased fund July 4% supply December 3% 3 increased fund ? demandarrow_forwardPLEASE ANSWER ALL QUESTIONS NOT JUST SOME PLEASE WRITE THE EXACT NUMBERS FOR THE GRAPH. PLEASE READ CAREFULLY, THIS MAY BE A SIMILAR QUESTION, BUT ALL QUESTIONS ARE DIFFERENTarrow_forward(Figure: Market for Loanable Funds 2) Based on the graph, if business taxes increase, the demand for loanable funds curve will shift from to and the new equilibrium will be at point holding supply constant at So. So Real Interest Rates (%) Do; D₁; c Do; D₁; b D₁; Do; a a b Loanable Funds ($) d S₁ Do D₁arrow_forward

- Mjarrow_forwardINTEREST RATE (Percent) Demand LOANABLE FUNDS (Billions of dollars) Supply Scenario 1: Suppose savers either buy bonds or make deposits in savings accounts at banks. Initially, the interest income earned on bonds or deposits is taxed at a rate of 20%. Now suppose there is an increase in the tax rate on interest income, from 20% to 25%. Demand Shift the appropriate curve on the graph to reflect this change. This change in the tax treatment of interest income from saving causes the equilibrium interest rate in the market for loanable funds to and the level of investment spending to Shift the appropriate curve on the graph to reflect this change. The implementation of the new tax credit causes the interest rate to Supply Scenario 2: An investment tax credit effectively lowers the tax bill of any firm that purchases new capital in the relevant time period. Suppose the government implements a new investment tax credit. This change in spending causes the government to run a budget Shift the…arrow_forwardUsing supply and demand diagrams representing the market for loanable funds, show and explain the effect on the equilibrium interest rate and quantity of loanable funds in the following events. Each event is treated independently: a) A reduction in government spending b) a change in tax laws that encouraged households to save morearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education