Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN: 9781305506756

Author: James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

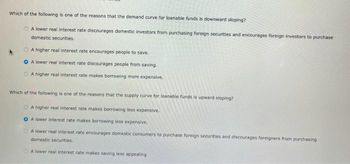

Transcribed Image Text:Which of the following is one of the reasons that the demand curve for loanable funds is downward sloping?

A lower real interest rate discourages domestic investors from purchasing foreign securities and encourages foreign investors to purchase

domestic securities.

A higher real interest rate encourages people to save.

OA lower real interest rate discourages people from saving.

OA higher real interest rate makes borrowing more expensive,

Which of the following is one of the reasons that the supply curve for loanable funds is upward sloping?

A higher real interest rate makes borrowing less expensive.

OA lower interest rate makes borrowing less expensive.

OA lower real interest rate encourages domestic consumers to purchase foreign securities and discourages foreigners from purchasing

domestic securities.

A lower real interest rate makes saving less appealing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- During the financial crisis it was proposed that firms be provided with a tax credit for investment projects. Such a tax credit would shift: a. the demand for loanable funds left and shift the supply of dollars in the market for foreign-currency exchange right. b. both the demand for loanable funds and the supply of dollars in the market for foreign-currency exchange right. c. both the demand for loanable funds and the supply of dollars in the market for foreign-currency exchange left. d. the demand for loanable funds right and shift the supply of dollars in the market for foreign-currency exchange left.arrow_forwardIndicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift? Interest rate 24% 22 20 ' 18 16 14 12 10 a 6 4 2 Y S ° $200 $400 600 D 800 1,000 1,200 Quantity of leanable funds (billions of dollars) Indicate the Quantity demanded and Quantity supplied of loanable funds if the Interest rates increases by 2% (from the equilibrium rate). would changed in interest rate cause a movement along the curve or shift?arrow_forwardIf foreign income and wealth decrease, this would most likely a. not affect the market for loanable funds. b. cause the supply of loanable funds to increase. c. cause the supply of loanable funds to decrease. d. cause the demand for loanable funds to increase in order for foreigners to maintain consumption. e. cause the demand for loanable funds to decrease.arrow_forward

- Find a quote below and illustrate the effect of these phenomena on the world market for loanable funds. Make sure to explain the change of the equilibrium price and quantity of loanable funds. “Many Economists worry that the aging populations of industrial countries are going to start running down their savings just when the investment appetite of emerging economies, mostly in East Asia, is growing”.arrow_forwardWhere does the demand for loanable funds come from in a closed economy? How does a government adopting a policy of taxing investment from the private sector impact the demand for loanable funds? What happens to the equilibrium interest rate following this policy? Illustrate using the supply and demand in the market for loanable funds.arrow_forwardOnly typed answerarrow_forward

- Graph Interest Rate Figure 2 Saving Incentives Increase the Supply of Loanable Funds A change in the tax laws to encourage Americans to save more would shift the supply of loanable funds to the right from S₁ to S₂. As a result, the equilibrium interest rate would fall, and the lower interest rate would stimulate investment. Here the equilibrium interest rate falls from 5 percent to 4 percent, and the equilibrium quantity of loanable funds saved and invested rises from $1,200 billion to $1, 600 billion. 5% 4% 2.... which reduces the equilibrium interest rate... See graph built step by step 0 $1,200 Supply, S₁ $1,600 3.... and raises the equilibrium quantity of loanable funds. 5₂ 1. Tax incentives for saving increase the supply of loanable funds... Demand Build graph yourself Loanable Funds (in billions of dollars)arrow_forwardConsider the supply and the demand in the market for loanable fund. If Mari purchased construction company’s stocks, to which is it added: Supply or Demand? If Mari borrowed to build her new house, which is it added to: Supply or Demand? Stock: House:arrow_forwardAssume that initially a country has a loanable funds supply curve of S₁. Now, imagine that interest rates across the country increase by 3%. Click on the curve that best represents the loanable funds supply after this increase. Interest rate 6% 5%- 4% 3% Click or tap the appropriate place in the image. S₂ 200 250 300 S₁ 350 5₂ 400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning