Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

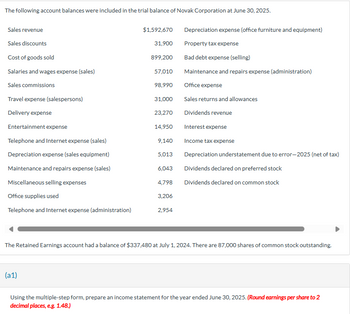

Transcribed Image Text:The following account balances were included in the trial balance of Novak Corporation at June 30, 2025.

Depreciation expense (office furniture and equipment)

Sales revenue

$1,592,670

Sales discounts

31,900

Property tax expense

Cost of goods sold

899,200

Bad debt expense (selling)

Salaries and wages expense (sales)

57,010

Maintenance and repairs expense (administration)

Sales commissions

98,990

Office expense

Travel expense (salespersons)

31,000

Sales returns and allowances

Delivery expense

23,270

Dividends revenue

Entertainment expense

14,950

Interest expense

Telephone and Internet expense (sales)

9,140

Income tax expense

Depreciation expense (sales equipment)

5,013

Depreciation understatement due to error-2025 (net of tax)

Maintenance and repairs expense (sales)

6,043

Dividends declared on preferred stock

Miscellaneous selling expenses

4,798

Dividends declared on common stock

Office supplies used

3,206

Telephone and Internet expense (administration)

2,954

The Retained Earnings account had a balance of $337,480 at July 1, 2024. There are 87,000 shares of common stock outstanding.

(a1)

Using the multiple-step form, prepare an income statement for the year ended June 30, 2025. (Round earnings per share to 2

decimal places, e.g. 1.48.)

Transcribed Image Text:$

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The following balances were taken from the books of Whispering Corp. on December 31, 2025. Interest revenue Cash Sales revenue Accounts receivable Prepaid insurance Sales returns and allowances Allowance for doubtful accounts Sales discounts Land Equipment Buildings Cost of goods sold $87,500 52,500 1,391,500 151,500 21,500 151,500 8,500 46,500 101,500 201,500 141,500 622,500 Assume the total effective tax rate on all items is 20%. Accumulated depreciation-equipment $41,500 Accumulated depreciation-buildings 29,500 Notes receivable Salling expenses Accounts payable Bonds payable Administrative and general expenses Accrued liabilities Interest expense Notes payable Loss from earthquake damage Common stock Retained earnings WHISPERING CORP. Income Statement 156,500 195,500 171,500 101,500 98,500 33,500 61,500 101,500 $ 151,500 Prepare a multiple-step income statement: 100,000 shares of common stock were outstanding during the year. (Round earnings per share to 2 decimal places, e.g.…arrow_forwardBramble Corp.'s adjusted trial balance at December 31, 2023, included the following: Debit Credit Sales Revenue $173000 Cost of Goods Sold $73000 Administrative Expenses 30400 Loss on Disposal of Equipment 10800 Sales Commission Expense 9600 Interest Income 6100 Loss from Flood Damage 14100 Loss from Discontinued Operations 25500 Credit Losses 7900 Totals $171300 $179100 Bramble uses the perpetual system, and their income tax rate is 30%. On Bramble's multiple-step income statement for 2023, income from continuing operations is ○ $50800. ○ $17885. ○ $23310. ○ $25550.arrow_forwardThe trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2021, included the following accounts: Account Title Debits CreditsSales revenue $2,300,000Cost of goods sold $1,400,000Selling and administrative expense 420,000Interest expense 40,000Gain on debt securities 80,000 The gain on debt securities is unrealized and classified as other comprehensive income. The trial balance does not include the accrual for income taxes. Lindor’s income tax rate is 25%. There were 1,000,000 shares of common stock outstanding throughout 2021.Required:Prepare a single, continuous multiple-step statement of…arrow_forward

- Shown below is an income statement for 2025 that was prepared by a poorly trained bookkeeper of Sheridan Corporation. Sheridan Corporation Sales revenue Investment revenue Cost of goods sold Selling expenses Administrative expenses Interest expense Income before special items INCOME STATEMENT December 31, 2025 $826,000 21,700 (405,000) (145,400) (192,400) (13,700) 91,200 Special items Loss on disposal of a component of the business (43,000) Net federal income tax liability Net income (9,640) $38,560 Prepare a multiple-step income statement for 2025 for Sheridan Corporation according to generally accepted accounting principles (including format and terminology). Sheridan Corporation has 50,000 shares of common stock outstanding and has a 20% federal income tax. (List Other revenues before Other expenses. Round per share values to 2 decimal places, eg. $2.50)arrow_forwardPlease help mearrow_forwardParis Company's trial balance of profit or loss accounts for the year ended December 31, 2021 included the following: DEBIT CREDIT Sales P2,500,000 Cost of Sales P1,600,000 Administrative Expenses 150,000 Loss on Sale of Equipment 90,000 Salesmen's Commission 100,000 Interest Revenue 50,000 Freight-out 30,000 Loss on Condemnation of Asset 100,000 Bad Debts Expense 30,000 P2,100,000 P2,550,000 Other Information: Finished goods inventory, Jan, 1 - P1,000,000; Finished Goods Inventory, Dec. 31 - P900,000 What was Paris Company's profit before tax?arrow_forward

- The following information was extracted from the records of Lodh Ltd for the year ended 30 June 2021. Lodh LTD Statement of financial position (extract) As at 30 June 2021 Assets Accounts Receivable $50,000 Allowance for doubtful debts (4,000) $46,000 Plant 200,000 Accumulated depreciation - Plant (50,000) 150,000 Liabilities Interest Payable 2,000 Provision for long service leave 10,000 Additional information · The accumulated tax depreciation for machines at 30 June 2021 was $66 667. · Long service leave has not been taken by any employee during the year. · The tax rate is 30%. Required Prepare a (partial) deferred tax worksheet to identify the TTD and DTD from the above information [You are required to input CA (Carrying Amount) and TB (tax Base) only in the response…arrow_forwardThe following account balances were taken from the 2021 adjusted trial balance of the Bowler Corporation: sales revenue, $325,000; cost of goods sold, $168,000; salaries expense, $45,000; rent expense, $20,000; depreciationexpense, $30,000; and miscellaneous expense, $12,000. Prepare an income statement for 2021.arrow_forwardPolis Corp.'s trial balance at December 31, 2023 is properly adjusted except for the income tax expense adjustment. Polis Corp. Trial Balance December 31, 2023 Cash$ 337,500 Accounts Receivable (net)1,447,500 Inventory1,192,500 Property, plant & equipment (net)4,183,000 Accounts payable & accrued liabilities $ 990,500Income taxes payable 342,500Future income tax liability 37,500Common shares 1,675,000Contributed surplus 1,340,000Retained earnings, Jan 1, 2023 2,325,000Net sales & other revenues 6,180,000Costs & expenses5,040,000 Income tax expenses689,500 Total$12,890,000$12,890,000 Other financial data for the year ended December 31, 2023: Included in accounts receivable is $360,000 due from a customer and payable in quarterly instalments of $45,000. The last payment is due December 29, 2025. The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $15,000 is classified as a current…arrow_forward

- Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $37,000 During 2024, credit sales were $1,785,000, cash collections from customers $1,865,000, and $42,000 in accounts receivable were written off. In addition, $3,700 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-90 days 91-120 days Over 120 days Percentage of Year- End Receivables in Group 60% 10 20 10 $ 467,000 Percent Uncollectible 38 5 25 45 Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. 2. Prepare the year-end adjusting entry for bad debts according to each of the…arrow_forwardRaintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $50,000 During 2024, credit sales were $1,850,000, cash collections from customers $1,930,000, and $59,000 in accounts receivable were written off. In addition, $5,000 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-90 days 91-120 days Over 120 days Percentage of Year- End Receivables in Group 65% 15 15 5 Percent Uncollectible 4% 10 30 50 $ 532,000 Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. 2. Prepare the year-end adjusting entry for bad debts according to each of the…arrow_forwardRaintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following Current asseter Receivables, set of allowance for uncollectible accounts of $32,000 During 2024, credit sales were $1760,000, cash collections from customers $1,840,000, and $37,000 in accounts receivable were written off. In addition, $3,200 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-30 days 91-120 days Over 120 days Percentage of Year- End Receivables in Group 458 10 20 Percent collectible 10 35 50 5442,000 Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off 2. Prepare the year-end adjusting entry for bad debts according to each of the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College