FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

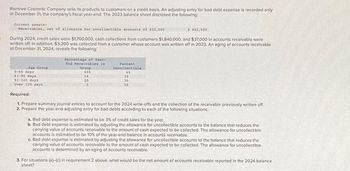

Transcribed Image Text:Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only

at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following

Current asseter

Receivables, set of allowance for uncollectible accounts of $32,000

During 2024, credit sales were $1760,000, cash collections from customers $1,840,000, and $37,000 in accounts receivable were

written off. In addition, $3,200 was collected from a customer whose account was written off in 2023. An aging of accounts receivable

at December 31, 2024, reveals the following:

Age Group

0-60 days

61-30 days

91-120 days

Over 120 days

Percentage of Year-

End Receivables in

Group

458

10

20

Percent

collectible

10

35

50

5442,000

Required:

1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off

2. Prepare the year-end adjusting entry for bad debts according to each of the following situations

a. Bad debt expense is estimated to be 3% of credit sales for the year.

b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the

carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible

accounts is estimated to be 10% of the year-end balance in accounts receivable.

c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the

carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible

accounts is determined by an aging of accounts receivable.

3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance

sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $36,000 $ 462,000 During 2024, credit sales were $1,780,000, cash collections from customers $1,860,000, and $41,000 in accounts receivable were written off. In addition, $3,600 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-90 days 91-120 days Percentage of Year- End Receivables in Group Percent Uncollectible 70% 20 5% 15 5 20 5 40 Over 120 days Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off. 2. Prepare the year-end adjusting entry for bad debts according to each of the…arrow_forwardThe Manda Panda Company uses the allowance method to account for bad debts. At the beginning of 2018, theallowance account had a credit balance of $75,000. Credit sales for 2018 totaled $2,400,000 and the year-endaccounts receivable balance was $490,000. During this year, $73,000 in receivables were determined to be uncollectible. Manda Panda anticipates that 3% of all credit sales will ultimately become uncollectible. The fiscal yearends on December 31.Required:1. Does this situation describe a loss contingency? Explain.2. What is the bad debt expense that Manda Panda should report in its 2018 income statement?3. Prepare the appropriate journal entry to record the contingency.4. What is the net accounts receivable value Manda Panda should report in its 2018 balance sheet?arrow_forwardProvide Correctarrow_forward

- johnson company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectable accounts had a credit balance of $12000 at the begining of 2024. no previously written off accounts recievable were reinstated during 2024. at 12/31/2024, gross accounts recievable totaled $200,100, and prior to recording the adjusting entry to recognize bad debt expenses for 2024, the allowance for uncollectable accounts had a debit balance of $22000. required 1. what was the balance in gross accounts recievable as of 12/31/2023? 2. what journal entry should johnson record to recognize bad debt expense for 2024? 3. assume johnson made no other adjustments of the allowance for uncollectable accounts during 2024. Determine the amount of accounts recievable written off during 2024. 4. if johnson instead used the direct write off method, what would bad debt expense be for 2024?arrow_forwardCarson's Bakery operates its business on a calendar year-end and uses 3% of Accounts Receivable to estimate bad debt expense. The company presents the following information at December 31, 2020 before any adjusting entries have been made. Account DR CR Accounts receivable 978,000 Allowance for doubtful accounts 23,750 667,500 Net credit sales What will the company record for bad debt expense? Debit choose your answer... type your answer... Credit choose your answer... type your answer...arrow_forwardConcord, Inc. had net sales in 2025 of $1,428,800. At December 31, 2025, before adjusting entries, the balances in selected accounts were Accounts Receivable $392,000 debit, and Allowance for Doubtful Accounts $4,240 credit. If Concord estimates that 9% of its receivables will prove to be uncollectible. Prepare the December 31, 2025, journal entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.)arrow_forward

- a) Prepare all journal entries to record the activity for the items above for 2020 b) Prepare any journal entries required at December 31, 2020 to record bad debt expense for the yeararrow_forwardRogan Company's total sales on account for the year amounted to $327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required: Journalize the following selected entries: 2017 Dec. 31 Record adjusting entry. 2018 Mar. 2 Write off the account of A.M. Billson as uncollectible, $584. June. 6 Write off the account of W.H. Gilders as uncollectible, $492.arrow_forwardHi, Please with question, thank you.arrow_forward

- Edsel Inc. has the following unadjusted year end trial balance information available for 2018: Credit sales Ending accounts receivable balance. Ending allowance for uncollectibles Estimated uncollectibles Multiple Choice If Edsel uses the gross accounts receivable approach for estimating the bad debt provision, the allowance for uncollectibles account, afte accounts are recorded, should show a balance of. O $2,600 O $3,600 $600,000 $180,000 $1,500 O $5,600 2%arrow_forwardSagararrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education