CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Don't use ai i will report you answer solve it as soon as possible with proper explanation

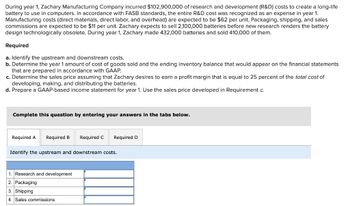

Transcribed Image Text:During year 1, Zachary Manufacturing Company incurred $102,900,000 of research and development (R&D) costs to create a long-life

battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1.

Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $62 per unit. Packaging, shipping, and sales

commissions are expected to be $11 per unit. Zachary expects to sell 2,100,000 batteries before new research renders the battery

design technologically obsolete. During year 1, Zachary made 432,000 batteries and sold 410,000 of them.

Required

a. Identify the upstream and downstream costs.

b. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements

that are prepared in accordance with GAAP.

c. Determine the sales price assuming that Zachary desires to earn a profit margin that is equal to 25 percent of the total cost of

developing, making, and distributing the batteries.

d. Prepare a GAAP-based income statement for year 1. Use the sales price developed in Requirement c.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Required D

Identify the upstream and downstream costs.

1. Research and development

2. Packaging

3. Shipping

4. Sales commissions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During year 1, Baird Manufacturing Company Incurred $65,800,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $78 per unit. Packaging, shipping, and sales commissions are expected to be $7 per unit. Baird expects to sell 1,400,000 batteries before new research renders the battery design technologically obsolete. During year 1, Baird made 432,000 batteries and sold 405,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the year 1 amount of cost of goods sold and the ending Inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c. Determine the sales price assuming that Baird desires to earn a profit margin that is equal to 30 percent of the total cost of developing, making, and…arrow_forwardDuring year 1, Finch Manufacturing Company incurred $115,000,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $50 per unit. Packaging, shipping, and sales commissions are expected to be $18 per unit. Finch expects to sell 2,500,000 batteries before new research renders the battery design technologically obsolete. During year 1, Finch made 438,000 batteries and sold 392,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c. Determine the sales price assuming that Finch desires to earn a profit margin that is equal to 30 percent of the total cost of developing, making, and…arrow_forwardDuring year 1, Perez Manufacturing Company incurred $117,500,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $64 per unit. Packaging, shipping, and sales commissions are expected to be $11 per unit. Perez expects to sell 2,500,000 batteries before new research renders the battery design technologically obsolete. During year 1, Perez made 434,000 batteries and sold 395,000 of them. Fill in the GAAP-based income statement for year 1. Use the sales price = 93.75 PEREZ MANUFACTURING COMPANY Income Statement Sales revenue Cost of goods sold Gross margin Depreciation expense Inventory holding expense Research & development expense Net income (loss) 0 $0 Farrow_forward

- During Year 2, Baird Manufacturing Company incurred $112,500,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in Year 2. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $74 per unit. Packaging, shipping, and sales commissions are expected to be $14 per unit. Baird expects to sell 2,500,000 batteries before new research renders the battery design technologically obsolete. During Year 2, Baird made 448,000 batteries and sold 400,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the Year 2 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c. Determine the sales price assuming that Baird desires to earn a profit margin that is equal to 25 percent of the total cost of developing, making, and…arrow_forwardDuring Year 2, Fanning Manufacturing Company incurred $147,000,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in Year 2. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $52 per unit. Packaging, shipping, and sales commissions are expected to be $16 per unit. Fanning expects to sell 3,000,000 batteries before new research renders the battery design technologically obsolete. During Year 2, Fanning made 446,000 batteries and sold 400,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the Year 2 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c. Determine the sales price assuming that Fanning desires to earn a profit margin that is equal to 30 percent of the total cost of developing, making,…arrow_forwardParesarrow_forward

- all I need is cost of goods sold, it's not 36,704,000arrow_forwardDuring the current year, Pitt Company incurred costs to develop and produce a routine, low-risk computer software product. 1,300,000 Completion of detailed program design Costs incurred for coding and testing to establish technological feasibility Other coding costs after establishment of technological feasibility Other testing costs after establishment of technological feasibility Costs of producing product masters for training materials Duplication of computer software and training materials from product masters (1,000 units) Packaging product (500 units) 3. In the year-end statement of financial position, what amount should be capitalized as software cost? 1,000,000 2,400,000 2,000,000 1,500,000 2,500,000 900,000 a. 5,400,000 b. 5,700,000 c. 5,900,000 d. 6,900,000arrow_forwardSpacely Sprockets, Inc. invested $4,995,000 for new manufacturing equipment for its plant in Jetson, NY. The equipment was anticipated to have a useful life of 11 years, or 29,800 machine hours and a residual value of $507,000. In its first year in operation the equipment was used for 2,180 hours and an additional 2,700 hours in its second year of usage.The Income Statement for years 1 and 2 of Spacely Sprockets, Inc. are shown below.All items rounded to nearest whole dollar. Spacely Sprockets, Inc. Year 1 Year 2 Net Sales $35,590,000 $36,164,000 COGS $23,120,000 $22,978,000 Gross Profit $12,470,000 $13,186,000 Operating Expenses(before adding in Depreciation) $7,650,000 $8,152,000 Income from Operations $4,820,000 $5,034,000 Income Tax Expense (at 30%) $1,446,000 $1,510,200 Net Income $3,374,000 $3,523,800 Round all items to the nearest whole dollar and use rounded values for all future calculations.1. Calculate the depreciation expense for year 1 and 2 using…arrow_forward

- Demmert Manufacturing incurred the following expenditures during the current fiscal year: annual maintenance on its machinery, $5,400; remodeling of offices, $22,000; rearrangement of the shipping and receiving area resulting in an increase in productivity, $35,000; addition of a security system to the manufacturing facility, $25,000. How should Demmert account for each of these expenditures?arrow_forwardOn March 17, Advanced Technologies developed a patent related to laser surgery techniques. They spent $1,200,000 to develop the patent internally, consisting of personnel ($800,000), equipment ($300,000), and materials ($100,000). The company also had the following additional costs: $20,000 in legal fees associated with the purchase and filing of the patent, $35,000 to advertise its new laser surgery techniques, and $45,000 to train employees. What is the recorded cost of the patent?arrow_forwardSpacely Sprockets, Inc. invested $4,996,000 for new manufacturing equipment for its plant in Jetson, NY. The equipment was anticipated to have a useful life of 11 years, or 31,800 machine hours and a residual value of $496,000. In its first year in operation the equipment was used for 2,130 hours and an additional 2,990 hours in its second year of usage.The Income Statement for years 1 and 2 of Spacely Sprockets, Inc. are shown below.All items rounded to nearest whole dollar. Spacely Sprockets, Inc. Year 1 Year 2 Net Sales $34,491,000 $36,106,000 COGS $22,202,000 $22,388,000 Gross Profit $12,289,000 $13,718,000 Operating Expenses(before adding in Depreciation) $7,663,000 $8,113,000 Income from Operations $4,626,000 $5,605,000 Income Tax Expense (at 30%) $1,387,800 $1,681,500 Net Income $3,238,200 $3,923,500 Round all items to the nearest whole dollar and use rounded values for all future calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College