EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

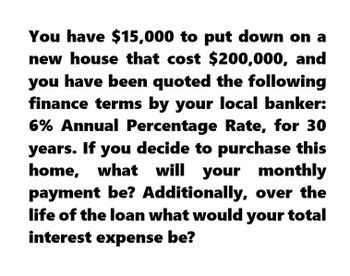

Transcribed Image Text:You have $15,000 to put down on a

new house that cost $200,000, and

you have been quoted the following

finance terms by your local banker:

6% Annual Percentage Rate, for 30

years. If you decide to purchase this

home, what will your monthly

payment be? Additionally, over the

life of the loan what would your total

interest expense be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardYou are buying a house and have saved a down payment of $15,000. You can afford a monthly payment of $1200, and the house can be financed at 2.5% for 30 years. Compute the maximum loan amount (MLA), rounding to the nearest cent: What is the maximum purchase price (MPP), rounded to the nearest cent?arrow_forwardYou lend a friend $10,000, which your friend will repay in 5 equal annual end-of-year payments of $3,000, with the first payment to be received 1 year from now. What rate of return does your loan receive? I need to be able to use excel and manually calculate as well.arrow_forward

- You'd like to purchase a house. You're monthly take home pay is $4560. You'd like to use one fourth of your take home pay for a house payment. You have $18500 for a down payment. You can get an APR of 4.35% compounded monthly. What is the total cost of a house you can afford with a 15 year mortgage?arrow_forwardSuppose you purchase a house using a 30-year fixed rate mortgage. The APR on the loan is 3.2% and you will be required to make monthly payments of $3,700 what is the price you paid for your home?arrow_forwardYou need $12,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires an 8% annual return. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answers to the nearest cent. Interest: $ Principal repayment: $arrow_forward

- You want to purchase a house valued at $200,000. After a downpayment, you can finance the house with a 20 year mortgage at 4.2% APR, compounded monthly. What percentage of the house will you need to finance in order to have monthly payments of $1,000? Round to two decimal places. What is the downpayment?arrow_forwardUse the following information to answer the questions. Price of home to purchase- $300,000 Rate- 2.8% (15 year) 3.2% (30 year) Down Payment- $65,000 What would be your monthly payment on a 15 year loan, assuming $2,400 property taxes and $2,400 home insurance?arrow_forwardYou need $15,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires a 8% annual return. What will be your annual loan payments? Round your answer to the nearest cent. Do not round intermediate calculations.arrow_forward

- Need helparrow_forwardYou need $19,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 5 years, with the first payment to be made one year from today. He requires a 5% annual return. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardYou need a 30-year, fixed-rate mortgage to buy a new home for $400,000. Your mortgage bank will lend you the money at a 6 percent APR for a 360 month loan. You can only afford a monthly payment of $1000. How much downpayment should you put at the time of purchase? Please show your work using excel formulas.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT