FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help

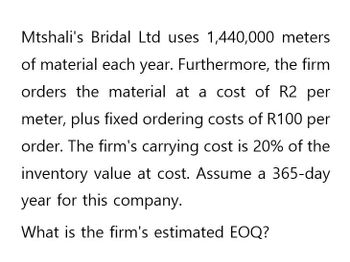

Transcribed Image Text:Mtshali's Bridal Ltd uses 1,440,000 meters

of material each year. Furthermore, the firm

orders the material at a cost of R2 per

meter, plus fixed ordering costs of R100 per

order. The firm's carrying cost is 20% of the

inventory value at cost. Assume a 365-day

year for this company.

What is the firm's estimated EOQ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company sells its product at P18 per unit. Variable costs are P12 per unit and fixed costs are 150,000 per annum. The company wants to realize a profit of P60,000 during the year. What should be the sales revenue?arrow_forwardABC Corporation sells its product for $12 per unit. Next year, fixed expenses are expected to be $400,000 and variable expenses are expected to be $8 per unit. How many units must the company sell to generate a target profit (net operating income) of $80,000?arrow_forwardThe fixed cost at Harley motors are $1M annually. The main product has a revenue of $9.90 per unit and $4.50 variable cost What is the annual profit (or loss) if 150,000 units are sold?arrow_forward

- Jasmine Inc. makes a single product that it sells for $25 each. Variable costs are $13 per unit and annual fixed costs total $30,000 per year. The company would like to realize operating income next year of $60,000. What level of sales in dollars must the company achieve to reach its target profit?arrow_forwardOn the average, a company has a work-in-process lead time of 10 weeks and annualcost of goods sold of $30 million. Assuming that the company works 50 weeks a year:a. What is the dollar value of the work-in-process?b. If the work-in-process could be reduced to 5 weeks and the annual cost of carryinginventory was 20% of the WIP inventory value, what would be the annual savings?arrow_forwardEOQ for manufacturer. Sk8 Company produces skateboards and purchases 20,000 units of a wheel bearing each year at a cost of $1 per unit. Sk8 requires a 15% annual rate of return on investment. In addition, the relevant carrying cost (for insurance, materials handling, breakage, etc.) is $0.17 per unit per year. The relevant ordering cost per purchase order is $38.40.arrow_forward

- A product sells for $50 with variable costs of $36 per unit and annual fixed costs of $1,200,000. If the company wants to earn an operating income equal to 20% of sales, how many units must be sold (Assume all units produced are sold)?arrow_forwardA machine manufacturer sells each machine for $6,900. The fixed costs are $287,450 per annum, variable costs are $2,050 per machine, and the production capacity is 74 machines in a year. a. What is the break-even volume? Round up to the next whole number b. What is the break-even revenue? Round to the nearest cent c. What is break-even as a percent of capacity per annum? % Round to two decimal places d. What is the profit or loss made if 68 machines are sold in a year?arrow_forwardA company expects to sell 20,000 units of a product next year. Variable production cost is ₱15 and variable selling costs is 15% of the selling price. Fixed expenses are ₱250,000 per year. The firm set a target profit of ₱100,000 (ignoring tax). Based on the information, the unit selling price should be? a. ₱17.50 b. ₱17.65 c. ₱32.50 d. ₱38.24 e. ₱216.67arrow_forward

- Hirt Corporation sells its product for $12 per unit. Next year, fixed expenses are expected to be $290,000 and variable expenses are expected to be $10 per unit. How many units must the company sell to generate net operating income of $69,000?(Financial Account)arrow_forwardThe Monde Company makes a juice cooler with a capacity of 24 bottles. Each juice cooler sells for 245 USD. The monthly fixed costs incurred by the company are 385000 USD, and the variable cost of producing each juice cooler is 205 USD. Determine the firm’s break-even level. Find the amount of sales needed to ensure that the company will realize a profit equal to 5% of the total cost (round the result if needed).arrow_forwardThe sales price per unit would be?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education