FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

provide answer general accounting question

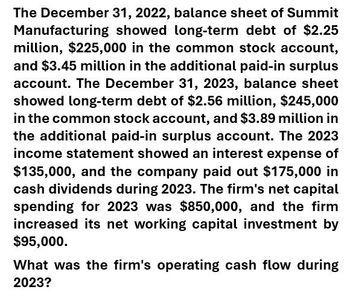

Transcribed Image Text:The December 31, 2022, balance sheet of Summit

Manufacturing showed long-term debt of $2.25

million, $225,000 in the common stock account,

and $3.45 million in the additional paid-in surplus

account. The December 31, 2023, balance sheet

showed long-term debt of $2.56 million, $245,000

in the common stock account, and $3.89 million in

the additional paid-in surplus account. The 2023

income statement showed an interest expense of

$135,000, and the company paid out $175,000 in

cash dividends during 2023. The firm's net capital

spending for 2023 was $850,000, and the firm

increased its net working capital investment by

$95,000.

What was the firm's operating cash flow during

2023?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,385,000, $137,000 in the common stock account, and $2,620,000 in the additional paid-in surplus account. The December 31, 2019. balance sheet showed long-term debt of $1,550,000, $147,000 in the common stock account and $2.920.000 in the additional paid-in surplus account. The 2019 income statement showed an interest expense of $92,500 and the company paid out $142,000 in cash dividends during 2019. The firm's net capital spending for 2019 was $930,000, and the firm reduced its net working capital investment by $122,000. What was the firm's 2019 operating cash flow, or OCF? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Operating cash flowarrow_forwardThe December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2019, balance sheet showed long-term debt of $1,620,000, $154,0000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2019 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2019. The firm's net capital spending for 2019 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2019 operating cash flow, OCF?arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,470,000, $154,000 in the common stock account, and $2,790,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,720,000, $164,000 in the common stock account and $3,090,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $101,000 and the company paid out $159,000 in cash dividends during 2022. The firm’s net capital spending for 2022 was $1,100,000, and the firm reduced its net working capital investment by $139,000. What was the firm's 2022 operating cash flow, or OCF?arrow_forward

- The December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,380,000, $136,000 in the common stock account, and $2,610,000 in the additional paid-in surplus account. The December 31, 2019, balance sheet showed long-term debt of $1,540,000, $146,000 in the common stock account and $2,910,000 in the additional paid-in surplus account. The 2019 income statement showed an interest expense of $92,000 and the company paid out $141,000 in cash dividends during 2019. The firm’s net capital spending for 2019 was $920,000, and the firm reduced its net working capital investment by $121,000. What was the firm's 2019 operating cash flow, or OCF? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.)arrow_forwardThe December 31, 2018, balance sheet of Whelan, Inc., showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2019, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2019 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2019. The firm’s net capital spending for 2019 was $1,000,000, and the firm reduced its net working capital investment by $129,000arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid out $149,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,000,000, and the firm reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow $ 556,500arrow_forward

- The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,460,000, $152,000 in the common stock account, and $2,770,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,700,000, $162,000 in the common stock account and $3,070,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $100,000 and the company paid out $157,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,080,000, and the firm reduced its net working capital investment by $137,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow Prev 9 of 10 ▬▬▬ ‒‒‒ Next >arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,405,000, $141,000 in the common stock account, and $2,660,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,590,000, $151,000 in the common stock account and $2,960,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $94,500 and the company paid out $146,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $970,000, and the firm reduced its net working capital investment by $126,000. What was the firm's 2022 operating cash flow, or OCF? Operating cash flow=arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,400,000, $140,000 in the common stock account, and $2,650,000 in the additional paid - in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,580, 000, $150,000 in the common stock account and $ 2,950,000 in the additional paid - in surplus account. The 2022 income statement showed an interest expense of $94, 000 and the company paid out $145,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $ 960,000, and the firm reduced its net working capital investment by $125,000. What was the firm's 2022 operating cash flow, or OCF?arrow_forward

- Nikularrow_forward6arrow_forwardPhelps, Incorporated had assets of $67,646, llabilities of $15,466, and 10,718 shares of outstanding common stock at December 31, 2020. Net income for 2020 was $7,829. The company had assets of $79,571, liabilities of $18,551, 10,771 shares of outstanding common stock, and its stock was trading at a price of $10 per share at December 31, 2021. Net income for 2021 was $9,993. Required: a. Calculate EPS for 2021. b. Calculate ROE for 2021. c. Calculate the Price/Earnings Ratio for 2021. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate EPS for 2021. (Do not round intermediate calculations. Round your final answer to 2 decimal place EPSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education