Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer this general accounting problem

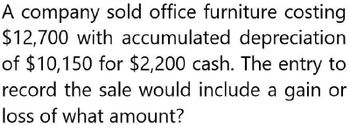

Transcribed Image Text:A company sold office furniture costing

$12,700 with accumulated depreciation

of $10,150 for $2,200 cash. The entry to

record the sale would include a gain or

loss of what amount?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company sold office furniture costing $16,500 with accumulated depreciation of $14,000 for $1,800 cash. The entry to record the sale would include a gain or loss of what amount?arrow_forwardAnswer full question.arrow_forwardUn Company sold office equipment with a cost of $39,000 and accumulated depreciation of $34,976 for $6,200 Required a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? c. How would the sale affect net income (increase, decrease, no effect) and by how much? d. How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect) and by how much? e. How would the event affect the statement of cash flows (inflow, outflow, no effect) and in what section? a b C d C Book value Gain (loss) on sale Net income would Total assets would Effect Section by byarrow_forward

- Un Company sold office equipment with a cost of $42,880 and accumulated depreciation of $39,583 for $5,010. Required What is the book value of the asset at the time of sale? What is the amount of gain or loss on the disposal? How would the sale affect net income (increase, decrease, no effect) and by how much? How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect) and by how much? How would the event affect the statement of cash flows (inflow, outflow, no effect) and in what section?arrow_forwardUn Company sold office equipment with a cost of $42,960 and accumulated depreciation of $39,803 for $5,640. a. what is the book value of the asset at the time of sale b, what is the amount of gain/loss on the disposal c. how would the sale affect net income and by how much d. how would the sale affect the amount of total assets shown on the balance sheet e. how would the event affect the statements of cash flowsarrow_forwardKindly help me with accounting questionsarrow_forward

- I want to correct answer general accountingarrow_forwardSir please help me sir urgently pleasearrow_forwardBasco Company sold office furniture for $40,000 cash. Th furniture cost $58,000 and had accumulated depreciation through the date of sale totaling $37,000. The company will recgonize. A. a loss of $19,000. B. a gain of $19,000. C. a gain of $21,000. D. a loss of $21,000. thanks for appreciated aittae ijteiyjearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College