Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

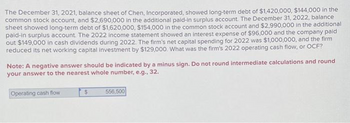

Transcribed Image Text:The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,420,000, $144,000 in the

common stock account, and $2,690,000 in the additional paid-in surplus account. The December 31, 2022, balance

sheet showed long-term debt of $1,620,000, $154,000 in the common stock account and $2,990,000 in the additional

paid-in surplus account. The 2022 income statement showed an interest expense of $96,000 and the company paid

out $149,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,000,000, and the firm

reduced its net working capital investment by $129,000. What was the firm's 2022 operating cash flow, or OCF?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round

your answer to the nearest whole number, e.g., 32.

Operating cash flow

$

556,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- The December 31, 2013, balance sheet of Schism, Inc., showed long-term debt of $1,400,000, $140,000 in the common stock account and $2,650,000 in the additional paid-in surplus account. The December 31, 2014, balance sheet showed long-term debt of $1,580,000, $150,000 in the common stock account and $2,950,000 in the additional paid-in surplus account. The 2014 income statement showed an interest expense of $94,000 and the company paid out $145,000 in cash dividends during 2014. The firm's net capital spending for 2014 was $960,000, and the firm reduced its net working capital investment by $125,000. What was the firm's operating cash flow during 2014?arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,425,000, $145,000 in the common stock account, and $2,700,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,630,000, $155,000 in the common stock account and $3,000,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,500 and the company paid out $150,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,010,000, and the firm reduced its net working capital investment by $130,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardPlease answer in good accounting form. Thankyou What is the retained earnings balance ending December 31, 2021?arrow_forward

- Detroit Inc reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,500 Common stock 3,400 Paid-in capital—share repurchase 1,900 Treasury stock (at cost) 220 Paid-in capital—excess of par 30,300 During 2022 ($ in thousands), net income was $9,100; 25% of the treasury stock was resold for $510; cash dividends declared were $700; cash dividends paid were $450. What ($ in thousands) was shareholders' equity as of December 31, 2022?arrow_forwardvvk.3arrow_forwardSunland Rental Corporation had the following balances in its shareholders' equity accounts at January 1, 2021: Accumulated other comprehensive income (loss) Contributed surplus-reacquisition of common shares Retained earnings Common shares (25,000 shares) Feb. 2 Sunland had the following transactions and events during 2021: Apr. 17 Oct. 29 $ (26,000) Dec. 31 559,000 1,600,000 625.000 Repurchased 1.200 shares for $57,600. Declared and paid cash dividends of $71,000. Issued 1,900 shares for $106,000 cash. Reported comprehensive income of $415,000, which included other comprehensive income of $31.000.arrow_forward

- Fall Corporation's capital structure consists of 500,000 authorized shares of common stock, of which 100,000 have been issued and are still outstanding. At December 31, 2022, an analysis of the accounts and discussions with company officials revealed the following information: Accounts payable...... Accounts receivable (trade accounts). Accumulated depreciation..... Accumulated other comprehensive income. Allowance for uncollectible accounts. Amortization expense.. Cash....... Common stock ($1 par value) Cost of goods sold Deferred revenue.. Depreciation expense. Dividend revenue.. Fair value adjustment (trading securities - debit balance). Gain on investments (Unrealized, NI).... General and administrative expenses. Interest expense... Interest payable..... Inventory, December 31, 2022. Investments in trading securities (cost)... Land held for future plant site.... 4% Notes payable (maturity 7/1/26 - $40,000 due July 1, 2023)... Paid in capital in excess of par.. Patents...... Pension…arrow_forwardIn 2019, Chirac Enterprises issued, at par, 60 $1,000, 8% bonds, each convertible into 100 shares of common stock. Chirac had revenues of $17,500 and expenses other than interest and taxes of $8,400 for 2020. (Assume that the tax rate is 20%.) Throughout 2020, 2,000 shares of common stock were outstanding; none of the bonds was converted or redeemed. Instructions a. Compute diluted earnings per share for 2020. b. Assume the same facts as those assumed for part (a), except that the 60 bonds were issued on September 1, 2020 (rather than in 2019), and none have been converted or redeemed. Compute diluted earnings per share for 2020. c. Assume the same facts as assumed for part (a), except that 20 of the 60 bonds were actually converted on July 1, 2020. Compute diluted earnings per share for 2020.arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,460,000, $152,000 in the common stock account, and $2,770,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,700,000, $162,000 in the common stock account and $3,070,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $100,000 and the company paid out $157,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,080,000, and the firm reduced its net working capital investment by $137,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow Prev 9 of 10 ▬▬▬ ‒‒‒ Next >arrow_forward

- Pluto Company began operations on January 1, 2019 with an authorized capital of 500,000 preference shares of P5 par value of which 30% of which was issued for P7 and 950,000 ordinary shares of P10 par value of which half were issued on January 1, 2019 at P15 per share. During the year, the company had a net income of P1,250,000 and declared dividends of P250,000. The following were the transactions in 2020: a. Issued 100,000 ordinary shares for P17 b. Issued 150,000 preference shares for P8 per share. c. Authorized the purchase of a custom made machine to be delivered in January 2021. Pluto Company appropriated P300,000 of accumulated profits for the purchase of the machine. d. Issued additional 50,000 preference shares for P9 per share, e. Net income for the year, P1,200,000. Dividends of P600,000 were declared for 2020 to shareholders of record on January 15, 2021 to be paid on March 15, 2021 per share. What is the total contributed capital as of December 31, 20207arrow_forwardRancho Cucamonga, Inc. presents the following excerpts from its December 31, 2020 balance sheet: Long-Term Liabilities: Note payable, 8% $200,000 Bonds payable, 10% 1,000,000 Shareholders’ Equity Common stock, par 50,000 Additional paid-in-capital, common stock 350,000 Total contributed capital 400,000 Retained earnings 250,000 Total shareholders’ equity 650,000 The accounting department also conveys the following information: Risk-free rate of return - 3% Risk premium - 4.05% Tax rate – 30% Requirement: Compute Rancho Cucamonga’s weighted average cost of capital.arrow_forwardC. Reither Co. reports the following information for 2025: sales revenue $700,000 cost of goodssold $500,000, operating expenses $80,000, and an unreliazed holding loss on available-for-sale debt securities of 2025 of $60,000. It declared and paid a cash dividend of $10,000 in 2025. C. Reither Co. has Janaury 1, 2025, balances in common stock $350,000; accumulated other comprehensive income $80,000; and retained earnings $90,000. It issued no stock during 2025. Prepare a statement of stockholders' equity. (Ignore income taxes).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education