SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

I need this question answer general accounting

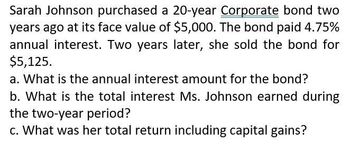

Transcribed Image Text:Sarah Johnson purchased a 20-year Corporate bond two

years ago at its face value of $5,000. The bond paid 4.75%

annual interest. Two years later, she sold the bond for

$5,125.

a. What is the annual interest amount for the bond?

b. What is the total interest Ms. Johnson earned during

the two-year period?

c. What was her total return including capital gains?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jean Miller purchased a $1,000 corporate bond for $888. The bond paid 3.8 percent annual interest. Three years later, she sold the bond for $968. Calculate the total return for Ms. Miller’s bond investment.arrow_forwardOne year ago, Irlene purchased some bonds at a value of $2,876 and received two semi- annual interest payments of $76.60 each. Today the bonds are valued at $2,784.50. What is Irlene's income yield? What is Irlene's capital gain yield? What is Irlene's investment total rate of return?arrow_forwardJames purchased a bond for $3380 that had a rate compounded annually, 2 years later he sold it for $3700. What interest rate, compounded annually, did James earn on this investment? 4.32% 4.73% 4.63% 0.96%arrow_forward

- Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate ofreturn that she is earning. For example, three years ago she paid $13,000 for 200 shares of Malti Company’s common stock. She received a $420 cash dividend on the stock at the end of each year for three years.At the end of three years, she sold the stock for $16,000. Kathy would like to earn a return of at least 14%on all of her investments. She is not sure whether the Malti Company stock provided a 14% return andwould like some help with the necessary computations.Required:(Ignore income taxes.) Using the net present value method, determine whether or not the Malti Companystock provided a 14% return. Use the general format illustrated in Exhibit 12–2 and round all computationsto the nearest whole dollar.arrow_forwardKathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return she is earning. For example, three years ago she paid $19,000 for 930 shares of Malti Company's common stock. She received a cash dividend of $735 on the stock at the end of each year for three years. At the end of three years, she sold the stock for $22,000. Kathy would like to earn a return of at least 17% on all of her investments. She is not sure whether the Malti Company stock provides a 17% return and would like some help with the necessary computations. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 17% return? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the net present value Kathy earned on her investment in Malti…arrow_forwardKathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $27,000 for 1,010 shares of Malti Company's common stock. She received a $879 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $25,000. Kathy would like to earn a return of at least 7% on all of her investments. She is not sure whether the Malti Company stock provide a 7% return and would like some help with the necessary computations. Required: Compute the net present value that Kathy earned on her investment in Malti Company stock. Did the Malti Company stock provide a 7% return?arrow_forward

- A retired couple invested $12000 in bonds at a simple interest rate of 8%. At the end of one year, how much interest did they receive on their investment?arrow_forwardKathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $23,500 for 1,030 shares of Malti Company's common stock. She received a $917 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $21,000. Kathy would like to earn a return of at least 8% on all of her investments. She is not sure whether the Malti Company stock provided a 8% return and would like some help with the necessary computations. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value that Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 8% return? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the net present value that Kathy earned on her investment in…arrow_forwardKathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $25,000 for 1,200 shares of Malti Company’s common stock. She received a $1,032 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $24,000. Kathy would like to earn a return of at least 13% on all of her investments. She is not sure whether the Malti Company stock provided a 13% return and would like some help with the necessary computations. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value that Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 13% return?arrow_forward

- Bonnie paid $9,200 for corporate bonds that have a par value of $10,000 and a coupon rate of 8.6 percent, payable quarterly. Bonnie received her first interest payment after holding the bonds for three months and then sold the bonds for $9,421. Part 2 If Bonnie is in a 33 percent marginal tax bracket for federal income tax purposes, what are the tax consequences of her ownership and sale of the bonds?arrow_forwardKathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $23,000 for 500 shares of Malti Company's common stock. She received a $460 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $30,000. Kathy would like to earn a return of at least 13% on all of her investments. She is not sure whether the Malti Company stock provide a 13% return and would like some help with the necessary computations. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value that Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 13% return? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the net present value that Kathy earned on her investment…arrow_forwardAn Investor buys common stock in a firm for $1000, At the end of the first year and overy year thereafter, she receives a' dividend of $100; which she imtmediately invests in a savings and loan institution that pays 5 percent interest compounded annually, At the end of the tenth year, just after recoiving her dividend , she sells the stock for $1200. What is the rate of interest (on an annual compounding basis) yielded by this investment program?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT