Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

The cost of goods sold? General accounting

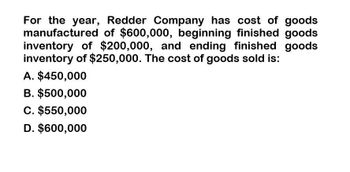

Transcribed Image Text:For the year, Redder Company has cost of goods

manufactured of $600,000, beginning finished goods

inventory of $200,000, and ending finished goods

inventory of $250,000. The cost of goods sold is:

A. $450,000

B. $500,000

C. $550,000

D. $600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cost of goods sold Pine Creek Company completed 200,000 units during the year at a cost of 3,000,000. The beginning finished goods inventory was 25,000 units at 310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow.arrow_forwardA production department within a company received materials of $7,000 and conversion costs of $5,000 from the prior department. It added material of $78400 and conversion costs of $47000. The equivalent units are 5,000 for material and 4,000 for conversion. What is the unit cost for materials and conversion?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Orinder Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 275,800, direct labor cost was 153,000, and overhead cost was 267,300. There were 25,000 units produced. Unit manufacturing cost (rounded to the nearest cent) is a. 28.40 b. 27.98 c. 34.95 d. 27.55arrow_forwardCost of goods soldPine Creek Company completed 200,000 units during the year at a cost of$3,000,000. The beginning finished goods inventory was 25,000 units at $310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow.arrow_forwardABC Corporation has the following estimated cost information for the upcoming year: a. Direct materials $100,000. b. Indirect Materials: $20,000. c. Direct labor: $150,000. d. Indirect labor: $70,000. e. Other MOH: $50,000. f. Sales commissions: $25,000. g. Advertising expense: $51,000. h. Rent on factory building: $35,000. i. Rent on office building: $40,000. The company estimated that 10,500 machine hours and 20,000 direct labor hours will be worked during the upcoming year. The company uses direct labor hours as the allocation base. What is the POHR rate for the company?arrow_forward

- Cavy Company completed 10,510 units during the year at a cost of $746,210. The beginning finished goods inventory was 2,310 units valued at $152,460. Assuming a FIFO cost flow, determine the cost of goods sold for 9,490 units. $4arrow_forwardMaterials used, P326,000. Total manufacturing costs charged to production during the year (including direct materials, direct labor, and factory overhead applied at the rate of 60% of direct labor cost), P686,000. Cost of goods available for sale, P826,000. Selling and general expenses, P25,000. 1.What is the amount of direct materials purchased during the year? 2.What is the total conversion cost? 3.What is the direct labor costs charged to production during the year? 4.How much is the total prime cost? 5.The following selected information pertains to Top Gun Manufacturing Inc.: Direct materials of P625,000, indirect materials of P125,000, direct labor of P750,000, indirect labor of P112,500, and factory overhead (not including indirect materials and indirect labor) of P375,000. How much is the conversion cost.arrow_forwardCavy Company completed 10,020 units during the year at a cost of $771,540. The beginning finished goods inventory was 2,200 units valued at $158,400. Determine the cost of goods sold for 9,040 units, assuming a FIFO cost flow.arrow_forward

- Worth Company reported the following year-end information- beginning work in process inventory, $180,000; cost of goods manufactured, $866,000; beginning finished goods inventory, $252,000; ending work in process inventory, $220,000; and ending finished goods inventory, $264,000. Worth Company's cost of goods sold for the year is? requirement: with solutionarrow_forwardHernando Manufacturing, Inc. reported the following information for the year: Number of Units Produced $152,000 Number of Units Sold 62,000 Cost of Goods Manufactured 268,000 Cost of Goods Sold 52,900 Sales Revenue 130,000 Gross Profit 72,940 Operating Expense 727,000 What was the unit product cost? (Round your answer to the nearest cent.) A. $1.76 B. $0.85 C. $0.86 D. $4.32arrow_forwardThe following cost incurred by Lucky corporation for October 2019 were as follows: Direct Materials used, P20,000 Indirect materials used, P1,000 Direct labor, P9,000 Indirect labor, P5,000 Other factory cost, P5,000 Selling expenses,P10,000 Administrative expenses, P12,000 Question: How much is the total product cost? a. P62,000 b. P50,000 c. P29,000 d. P40,000 Plz answer fast without plagiarism and don't copy answer plzarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College