FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

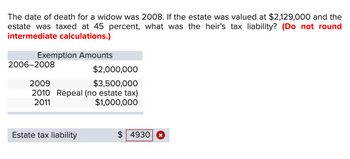

Transcribed Image Text:The date of death for a widow was 2008. If the estate was valued at $2,129,000 and the

estate was taxed at 45 percent, what was the heir's tax liability? (Do not round

intermediate calculations.)

Exemption Amounts

2006-2008

$2,000,000

2009

$3,500,000

2010 Repeal (no estate tax)

2011

$1,000,000

Estate tax liability

$4930

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates that his tax liability will be $12,250. Last year, his total tax liability was $16,500. He estimates that his tax withholding from his employer will be $9,225. Problem 8-77 Part b (Algo) b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Dates April 15th June 15th September 15th January 15th Total Actual Withholding Required Withholding Over (Under) Withheld Penalty Per Quarter $ 0.00arrow_forwardArams taxable income before considering capital gains and losses is $81,000. Determine arams taxable income and how much of the income will be taxed at ordinary rates.arrow_forwardMs. Beal recognized a $42,400 net long-term capital gain and a $33,000 net short-term capital loss this year. What is her current net income tax cost from her capital transactions if her marginal rate on ordinary income is 37%? Multiple Choice $6,360 $4,240 $1,880 $8,480arrow_forward

- All tax calculations should be based on the 2020 Tax Rate Schedules. Figures should be rounded to the nearest dollar. Percentages should be rounded to the nearest whole percentage (e.g., 32% instead of 32.2%) Depreciation. For her dry-cleaning business, Janet made a single asset purchase four years ago: she paid $49,000 for a dry-cleaning machine (a type of equipment) that she placed in service on April 3 of that year. On July 5 of this year, the fourth year she has used the machine, she sold it. How much depreciation should she claim for the machine this year?arrow_forwardHenry, a single taxpayer with a marginal tax rate of 35 percent(taxable income is $319,000 before considering any of the items below), sold the following assets during the year: Asset Sale Price Tax Basis Gain/Loss Holding Period ABC Stock $ 53,800 $ 26,900 $ 26,900 More than One Year XYZ Stock $ 15,800 $ 11,850 $ 3,950 Less than One Year Stamp Collection $ 13,800 $ 6,900 $ 6,900 More than One Year RST Stock $ 16,800 $ 22,800 $ (6,000) Less than One Year Rental Home $ 103,800 $ 51,900* $ 51,900 More than One Year *$25,950 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.What tax rate(s) will apply to Henry's capital gains or losses?arrow_forwardIn the current tax year, a taxpayer sells a painting for $12,000. She purchased the painting two years ago for $8,000. The short-term capital gains rate is 25%. The long-term capital gains rate is 15%. What is the taxpayer's gain for the current tax year? O $600 short-term capital gain. O $600 long-term capital gain. O $1,000 long-term capital gain. O$1,000 short-term capital gain An individual with a taxable income of $50,000 sells 300 shares of stock at a market price of $100 per share. At the individual's present level of income, there is a marginal ordinary income tax rate of 25% and a long-term capital gains rate of 15%. 200 shares of the stock were acquired 13 months earlier at a price of $80 per share, and 100 shares were acquired two years earlier at a price of $60 per share. What is this individual's tax liability after this transaction? O $2,000 O $1,800 O $8,000 O $1,200arrow_forward

- Required information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) a. Last year Louis claimed itemized deductions of $12,650. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Refund to be included in gross incomearrow_forwardDineshbhaiarrow_forwardRequired information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $530,000. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. b. His $530,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $570,000. Answer is complete but not entirely correct. Income tax Net investment income tax Total tax liability Amount 159,251.75 x 2,000.00 x 161,251.75arrow_forward

- Clayton received a $140,000 distribution from his 401(k) account this year. Assuming Clayton's marginal tax rate is 25 percent, what is the total amount of tax and penalty Shauna will be required to pay if she receives the distribution on her 62nd birthday and she has not yet retired? Group of answer choices $0 $14,000 $35,000 $49,000 None of the choices is correct.arrow_forwardRequired information [The following information applies to the questions displayed below] Jesse Brimhall is single. In 2021, his itemized deductions were $9,000 before considering any real property taxes he paid during the year. Jesse's adjusted gross income was $70,000 (also before considering any property tax deductions). In 2021, he paid real property taxes of $3,000 on property 1 and $1,200 of real property taxes on property 2. He did not pay any other deductible taxes during the year. b. If property 1 is Jesse's business building (he owns the property) and property 2 is his primary residence, what is his taxable income after taking property taxes into account (ignore the deduction for qualified business income)? Taxable incomearrow_forwardDinesh bhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education