FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:S

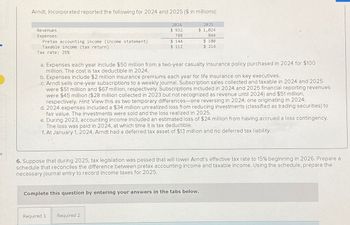

Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions):

2024

$932

788

$ 144

$ 112

Revenues

Expenses

Pretax accounting income (income statement)

Taxable income (tax return)

Tax rate: 25%

2025

$ 1,024

844

$ 180

$ 214

a. Expenses each year include $50 million from a two-year casualty insurance policy purchased in 2024 for $100

million. The cost is tax deductible in 2024.

b. Expenses include $2 million insurance premiums each year for life insurance on key executives.

c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025

were $51 million and $67 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues

were $45 million ($28 million collected in 2023 but not recognized as revenue until 2024) and $51 million,

respectively. Hint. View this as two temporary differences-one reversing in 2024; one originating in 2024.

d. 2024 expenses included a $34 million unrealized loss from reducing investments (classified as trading securities) to

fair value. The investments were sold and the loss realized in 2025.

e. During 2023, accounting income included an estimated loss of $24 million from having accrued a loss contingency.

The loss was paid in 2024, at which time it is tax deductible.

f. At January 1, 2024, Arndt had a deferred tax asset of $13 million and no deferred tax liability.

6. Suppose that during 2025, tax legislation was passed that will lower Arndt's effective tax rate to 15% beginning in 2026. Prepare a

schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, prepare the

necessary journal entry to record income taxes for 2025.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In early 2012, Cho-Sun's gross pay increased from $71,000 per year to $83,000 per year. Answer parts (a) and (b). Taxable Income (Income tax brackets) Tax Rates $44,701 or less 15% of taxable income less than or equal to $44,701; plus Over $44,701 up to $89,401 22% of taxable income greater than $44,701 and less than or equal to $89,401; plus Over $89,401 up to $138,586 26% of taxable income greater than $89,401 and less than or equal to $138,586; plus Over $138,586 29% of taxable income greater than $138,586 (a) What was the annual percent increase in Cho-Sun's pay before federal income taxes? nothing% (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) (b) What was the annual percent increase in Cho-Sun's pay after federal income taxes were deducted? nothing% (Round the final answer to two decimal places as needed.…arrow_forwardPlease answer it in good accounting form. Thankyouarrow_forwardNow assume that Syer does account for its NOL under the CARES Act. Prepare the appropriate journal entry to record Syer’s 2020 income taxes, and indicate Syer’s 2020 net income(loss). Syer Company reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in millions): 2016 2017 2018 2019 2020 $ 330) $ 130 $ 0 $0 $ (660) Syer’s 2020 NOL is driven by an unfortunate obsolescence of its primary product. Given great uncertainty in Syer’s future profitability, Syer’s management does not believe it is more likely than not that it will be able to realize deferred tax assets in future years. Syer’s federal tax rate decreased from 35% to 21% starting in 2018.arrow_forward

- Use the following information for Ingersoll, Incorporated. Assume the tax rate is 23 percent. Sales Depreciation 2020 2021 $15,073 $15,036 1,731 1,806 Cost of goods sold 4,329 4,777 Other expenses 981 859 Interest 830 961 Cash 6,172 6,676 Accounts receivable 8,110 9,637 Short-term notes payable 1,240 1,217 Long-term debt 20,530 24,811 Net fixed assets 51,042 54,483 Accounts payable 4,496 4,854 Inventory 14,402 15,358 1,300 1,688 Dividends Prepare a balance sheet for this company for 2020 and 2021. (Do not round intermediate calculations.) INGERSOLL, INCORPORATED Balance Sheet as of December 31 Current assets Assets 2020 2021arrow_forwardPlease show each step of calculation. Thanks in advance.arrow_forwardUse the following information to calculate the federal average tax rate (ignore tax credits) for a taxpayer who earned $115,000 from employment, and where bonds were sold for $20,000 during the year that originally cost $10,000: Taxable income Up to $47,630 On the next $47,629 On the next $52,408 On the next $62,704 Over $210,371 Select one: Tax Rate 15% 20.5% Based on the above, the average tax rate (ATR) is closest to: a. 19.15% b. 19,45% c. 20.5% d. 26.0% 26% 29% 33%arrow_forward

- Greenville Industries uses the accrual basis to account for all sales transactions. Sales for 2022 total $500,000. Included in this amount is $70,000 in receivables from sales on installment. Installment sales are considered revenue for book purposes, but not for tax purposes. Operating expenses total $170,000 and are treated the same for book and tax purposes. Assuming a 40% tax rate, what is the amount of Greenville's deferred tax asset or liability? OA. $14,000 deferred tax liability B. $28,000 deferred tax liability OC. $28,000 deferred tax asset OD. $14,000 deferred tax assetarrow_forwardUse the following information for Ingersoll, Inc., (assume the tax rate is 23 percent): 2019 2020 Sales $ 15,073 $15,036 Depreciation 1,731 1,806 Cost of goods sold 4,329 4,777 Other expenses 981 859 Interest 830 961 Cash 6,172 6,676 Accounts receivable 8,110 9,637 Long-term debt 20,530 24,811 Net fixed assets 51,042 54,483 Accounts payable 5,736 6,071 Inventory 14,402 15,358 Dividends 1,300 1,688 Prepare a balance sheet for this company for 2019 and 2020. (Do not round intermediate calculations. Be sure to list the accounts in order of their liquidity.) INGERSOLL, INC. Assets Cash Accounts receivable Net fixed assets Inventory Current assets Balance Sheet as of Dec. 31 2019 2020 $ 6,172 $ 6,676 8,110 9,637 51,042 54,483 14,402 15,358 Total assets $ 86,654 $ 89,154 Liabilities Accounts payable $ 5,736 $ 6,071 Long-term debt 20,530 24,811arrow_forwardDhapaarrow_forward

- Robin Corp. had the following in 2020: Taxable Income: $330,000 Federal income tax: $69,300 Interest on state gov’t (muni) bond: $5,000 Interest on corporate bond: $10,000 Meals expense (total): $3,000 Key person life insurance premiums: $3,500 Key person life insurance proceeds: $130,000 Ordinary & necessary business expenses $250,000 Dividends (from a less-than-20%-owned US corp.): $35,000 What is Robin Corp.’s current E&P? Assume that there is no cash surrender value on the life insurance policy?arrow_forwardBlossom Ltd. reported the following income for each of the years indicated. For each year, accounting income and income for tax purposes were the same. All tax rates indicated were enacted by the beginning of 2023. Blossom's policy is to carry back any tax losses first before carrying forward any remaining losses to future years. Year Income/(Loss) Tax Rate 2023 55,000 25% 2024 65,600 28% 2025 14,600 30% 2026 (145,700) 33% 2027 (73,800) 27% 2028 93,400 27% Prepare the journal entries for the years 2023 to 2028 to record income taxes. Assume that, at the end of each year, the loss carryforward benefits are judged more likely than not to be realized in the future. Blossom Ltd. follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and List all debit dit atrios)arrow_forwardUse the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. 2020 2021 Sales $ 21,049 $ 19,038 Depreciation 2,466 2,574 Cost of goods sold 6,140 6,821 Other expenses 1,406 1,223 Interest 1,155 1,370 Cash 8,721 9,517 Accounts receivable 11,578 13,752 Short-term notes payable 1,764 1,731 Long-term debt 29,330 35,454 Net fixed assets 72,976 77,880 Accounts payable 6,323 6,910 Inventory 20,577 21,952 Dividends 2,429 2,404 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education