CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

None

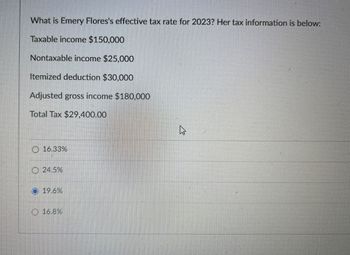

Transcribed Image Text:What is Emery Flores's effective tax rate for 2023? Her tax information is below:

Taxable income $150,000

Nontaxable income $25,000

Itemized deduction $30,000

Adjusted gross income $180,000

Total Tax $29,400.00

16.33%

24.5%

19.6%

16.8%

<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute the 2019 tax liability and the marginal and average tax rates for the following taxpayers (use the 2019 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single taxpayer, has taxable income of 94,800. b. Lazare, who files as a head of household, has taxable income of 57,050.arrow_forwardCalculating marginal tax rates. Lacey Hansen is single and received the items and amounts of income shown below during 2018, as shown below. Determine the marginal tax rate applicable to each item. Note that if the item is not taxable, the marginal rate is 0.arrow_forwardIn 2019, what is the top tax rate for individual long-term capital gains and the top tax rate for long-term capital gains of collectible items assuming that the Medicare tax does not apply. 10; 20 20; 28 15; 25 25; 28arrow_forward

- Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2019:arrow_forwardWhat is the amount of the tax liability for a single person having taxable income of $59,200? Use the appropriate Tax Tables and Tax Rate Schedules 2022 Note: All answers should be rounded to the nearest dollar. Multiple Choice $7,326. $7,147. $8,647. $6,696.arrow_forwardIf you have a taxable income of $372,570.00, what is your total tax bill? $ average tax rate? %arrow_forward

- Based on the following data, will Ann Wilton receive a federal tax refund or owe additional taxes in 2019? Taxable Income Tax Rate 0–$47,630 15% $47,630–$95,259 20.5% $95,259–$147,667 26% $147,667–$210,371 29% Net income(line 23600) $ 50,650 Deductions to determine net income $ 11,840 Federal income tax withheld $ 6,964 Total non-refundable tax credit amounts,excluding medical expenses $ 10,319 Medical expenses $ 2,700arrow_forwardHelp pleasearrow_forwardGodaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed...

Finance

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning