Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

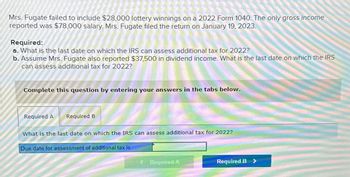

Transcribed Image Text:Mrs. Fugate failed to include $28,000 lottery winnings on a 2022 Form 1040. The only gross income

reported was $78,000 salary. Mrs. Fugate filed the return on January 19, 2023.

Required:

a. What is the last date on which the IRS can assess additional tax for 2022?

b. Assume Mrs. Fugate also reported $37,500 in dividend income. What is the last date on which the IRS

can assess additional tax for 2022?

Complete this question by entering your answers in the tabs below.

Required A Required B

What is the last date on which the IRS can assess additional tax for 2022?

Due date for assessment of additional tax is

Required A

5220

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Heron Corporation, a calendar year, accrual basis taxpayer, provides the following information for this year and asks you to prepare Schedule M-1. Net income per books (after-tax) $239,700 Taxable income 195,000 Federal income tax liability 59,300 Interest income from tax-exempt bonds 5,000 Interest paid on loan incurred to purchase tax- 2,000 exempt bonds Life insurance proceeds received as a result of 100,000 death of Heron's president Premiums paid on policy on life of Heron's 4,500 president Excess of capital losses over capital gains 2,000 Retained earnings at beginning of year 375,000 Cash dividends paid 90,000 Tax depreciation in excess of book 7,500 depreciationarrow_forwardFive years ago, as the result of an examination of your client, Pachenko, the IRS assessed a $5000 tax liability, which remains unpaid. Which section and subsection of the internal revenue code defines the length of the period after assessment during which the IRD has to begin court proceedings to collect taxes? Enter your response in the answer field below IRS$arrow_forwardA calendar-year taxpayer had net Code Sec. 1231 losses of $8,000 in 2018. He had net Code Sec. 1231 gains of $5,250 and $4,600 in 2019 and 2020, respectively. There were no net Code Sec. 1231 losses in 2015, 2016, and 2017. What portion of the net Code Sec. 1231 gain is reported as ordinary income, and what portion is considered long-term capital gain in 2020? $5,250 is reported as ordinary income; no portion is treated as long-term gain. No long-term capital gain is reported and $3,400 is reported as ordinary income. $2,750 is reported as ordinary income and $1,850 is reported as long-term capital gain. $2,150 is reported as long-term capital gain and $2,400 is reported as ordinary income.arrow_forward

- Nonearrow_forwardBob Brain files a single tax return and decides to itemize his deductions. Bob's income for the year consists of $75,300 of salary, $2,850 long-term capital gain, and $1,650 interest income. Bob's expenses for the year consist of $770 in investment advice fees and $235 in tax return preparation fees. What is Bob's investment expense deduction? Multiple Choice $0 $770 $235 $1,005 None of the choices are correct.arrow_forward11.A taxpayer is claiming tax preparation expense as a legal and professional fee. They paid $430 at your office last year. The forms breakdown by cost is as follows: Form 1040- $100 Form Sch. C- $125 Form SE- $55 Form 8867- $75 Form 8863- $75 What is the correct amount that can be deducted on their Schedule C for the current year? Choose one answer. a. $280 b. $180 c. $355 d. $430arrow_forward

- Sally and Tom were married and properly filed a joint return for the year 20x4 on March 30, 20 x5. The return reported $200,000 of gross income and a tax liability of $40,000. A total of $ 37,500 in taxes had been withheld from their salaries during the year. The IRS mailed a Notice of Deficiency to Sally and Tom on April 15, 20x8. What would be the last date on which the IRS could assess tax if- (a) Sally and Tom did not file a petition in the Tax Court? (b) The Tax Court issued its opinion on April 1, 20x9 and entered its decision on June 30, 20x9? (c) Would your answer to (b) be different if the Notice of Deficiency had been mailed on April 10, 20x8 ?arrow_forwardPaulina Morales, a single taxpayer, had wage income of $68,950 in 2019. Her only other income was ordinary dividend income reported to her on Form 1099-DIV. She is required to file Schedule B, Interest and Ordinary Dividends, if her dividend income exceeds a threshold amount of: $350 $1,200 $1,500 $2,500arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education