FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

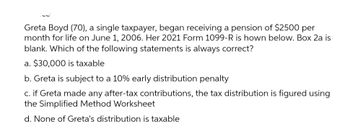

Transcribed Image Text:Greta Boyd (70), a single taxpayer, began receiving a pension of $2500 per

month for life on June 1, 2006. Her 2021 Form 1099-R is hown below. Box 2a is

blank. Which of the following statements is always correct?

a. $30,000 is taxable

b. Greta is subject to a 10% early distribution penalty

c. if Greta made any after-tax contributions, the tax distribution is figured using

the Simplified Method Worksheet

d. None of Greta's distribution is taxable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Louis files as a single taxpayer. In April of this year he received a $980 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) Problem 5-51 Part-b (Algo) b. Last year Louis had itemized deductions of $9,810 and he chose to claim the standard deduction. Louis’s itemized deductions included state income taxes paid of $2,335 and no other state or local taxes. Refund to be included in gross income- _______arrow_forwardMr. Coleman, an unmarried individual, has the following income items: Interest income Schedule C net profit $23,200 61,640 He has $10,300 itemized deductions and no dependents. Mr. Coleman's Schedule C income is qualified business income (non service). Required: Compute Mr. Coleman's income tax. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) AGI Taxable Income Income tax Amountarrow_forwardRequired information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) a. Last year Louis claimed itemized deductions of $12,650. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Refund to be included in gross incomearrow_forward

- Kyle Struck's filing status is single, and he has earned gross pay of $2,360. Each period he makes a 403(b) contribution of 8% of gross pay; and makes a contribution of 2% of gross pay to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $199,800.Social Security tax = $0.00Medicare tax = $ Please explain how the problem is solved?arrow_forwardSophie is a single taxpayer. For the first payroll period in July 2022, she is paid wages of $1,100 semimonthly. Sophie claims one allowance on her pre-2020 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2022 Allowance Amount Weekly $ 83 Biweekly 165 Semimonthly 179 Monthly 358 Quarterly 1,075 Semiannually 2,150 Annually 4,300 Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a semimonthly pay period. Sophie's withholding: $ 921 Xarrow_forwardLouis files as a single taxpayer. In April of this year he received a $980 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,400. (Leave no answer blank. Enter zero if applicable.) Problem 5-51 Part-c (Algo) c. Last year Louis claimed itemized deductions of $13,450. Louis’s itemized deductions included state income taxes paid of $3,870 and no other state or local taxes. Refund to be included in gross income - ________arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Louis files as a single taxpayer. In April of this year he received a $900 refund of state income taxes that he paid last year. How much of the refund, if any, must Louis include in gross income under the following independent scenarios? Assume the standard deduction last year was $12,950. Note: Leave no answer blank. Enter zero if applicable. b. Last year Louis had itemized deductions of $10,800 and he chose to claim the standard deduction. Louis's itemized deductions included state income taxes paid of $1,750 and no other state or local taxes. Refund to be included in gross incomearrow_forward2:Rachel Schillo earned gross pay of $1,900. She does not make any retirement plan contributions, and her current year taxable earnings for Social Security tax, to date, are $105,000.Total Social Security tax = $arrow_forwardDd.4.arrow_forward

- In 2022, Esther paid $20,000 in state income tax, and $20,000 in real estate taxes. Esther’s filing status is Single, and she claimed the above expenses as itemized deductions. In 2022, Esther’s deduction for state and local taxes is limited to which of the following amounts on her Federal Income Tax Return? Group of answer choices $10,000 $20,000 $40,000 $0arrow_forwardFarrah earns $180,000 this year (2023) from a small unincorporated business. What is her self- employment tax and additional Medicare tax liability (if any)? O $27,540 O $24,686 O $25,433 1.8 pts O None of these are correctarrow_forwardMaureen Smith is a single individual. She claims a standard deduction of $12,000. Her salary for the year was $134,750. What is her taxable income? a. $105,698 b. $120,620 c. $122,750 d. $121,863 e. $129,324arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education