FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:aces

s

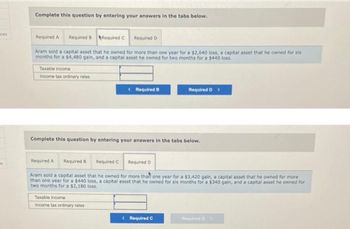

Complete this question by entering your answers in the tabs below.

Required C

Aram sold a capital asset that he owned for more than one year for a $2,640 loss, a capital asset that he owned for six

months for a $4,480 gain, and a capital asset he owned for two months for a $440 loss.

Required A Required B

Taxable income

Income tax ordinary rates

Required A

Required B

Complete this question by entering your answers in the tabs below.

Required D

Required C

Taxable income

Income tax ordinary rates

< Required B

Required D

Required D >

Aram sold a capital asset that he owned for more than one year for a $3,420 gain, a capital asset that he owned for more

than one year for a $440 loss, a capital asset that he owned for six months for a $340 gain, and a capital asset he owned for

two months for a $2,180 loss.

< Required C

Required D

Transcribed Image Text:ces

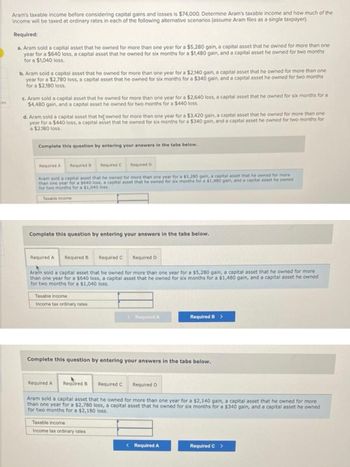

Aram's taxable income before considering capital gains and losses is $74,000. Determine Aram's taxable income and how much of the

income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer).

Required:

a. Aram sold a capital asset that he owned for more than one year for a $5,280 gain, a capital asset that he owned for more than one

year for a $640 loss, a capital asset that he owned for six months for a $1,480 gain, and a capital asset he owned for two months

for a $1,040 loss.

b. Aram sold a capital asset that he owned for more than one year for a $2,140 gain, a capital asset that he owned for more than one

year for a $2,780 loss, a capital asset that he owned for six months for a $340 gain, and a capital asset he owned for two months

for a $2,180 loss.

c. Aram sold a capital asset that he owned for more than one year for a $2,640 loss, a capital asset that he owned for six months for a

$4,480 gain, and a capital asset he owned for two months for a $440 loss.

d. Aram sold a capital asset that he owned for more than one year for a $3,420 gain, a capital asset that he owned for more than one

year for a $440 loss, a capital asset that he owned for six months for a $340 gain, and a capital asset he owned for two months for

a $2,180 loss.

Complete this question by entering your answers in the tabs below.

Required 5

Required A

Required C Required D

Aram sold a capital asset that he owned for more than one year for a $5,280 gain, a capital asset that he owned for more

than one year for a $640 loss, a capital asset that he owned for six months for a $1,480 gain, and a capital asset he owned

for two months for a $1,040 loss.

Taxable income

Complete this question by entering your answers in the tabs below.

Required A

Required B

Taxable income

Income tax ordinary rates

Aram sold a capital asset that he owned for more than one year for a $5,280 gain, a capital asset that he owned for more

than one year for a $640 loss, a capital asset that he owned for six months for a $1,480 gain, and a capital asset he owned

for two months for a $1,040 loss.

Required C

Required A Required B

Required D

Taxable income

Income tax ordinary rates

Complete this question by entering your answers in the tabs below.

Required C

Required A

Required D

Required B >

Aram sold a capital asset that he owned for more than one year for a $2,140 gain, a capital asset that he owned for more

than one year for a $2,780 loss, a capital asset that he owned for six months for a $340 gain, and a capital asset he owned

for two months for a $2,180 loss.

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image)arrow_forwardSir plzarrow_forwardRequired information [The following information applies to the questions displayed below] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) Capital Asset Lock X stock N stock 0 stock Antiques Rental home Holding Period >1 year Market Value $ 50, 300 28, 300 $ 41,400 39,300 >1 ума 30,300 22,400 1 year 300,800+ 90.400 > 1 year *$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. ⚫. Given that Ron and Anne have taxable income of only $19.600 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2023 assuming they file a joint return? Gross tax liabilityarrow_forward

- help me with the steps and answersarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] BCS Corporation is a calendar-year, accrual-method taxpayer. BCS was formed and started its business activities on January 1 of this year. It reported the following information for the year. Indicate BCS's deductible amount for this year in each of the following alternative scenarios. (Leave no answers blank. Enter zero if applicable.) e. On December 1 of this year, BCS acquired equipment from Equip Company. As part of the purchase, BCS signed a separate contract that provided that Equip would warranty the equipment for two years (starting in December 1 of this year). The extra cost of the warranty was $12,000, which BCS finally paid to Equip in January of next year.arrow_forwardDuring 2016, an estate generated income of $57,500: Rental income $21,500 18,500 7,500ב Interest income Dividend income The interest income is conveyed immediately to the beneficiary stated in the decedent's will. The dividends are given to the decedent's church. What is the taxable income of the estate? Taxable incomearrow_forward

- Return to question Given the following tax structure: Salary $ 40,500 Taxpayer Total Tax $ 2,349 Pedro 000 ES $ a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? X Answer is complete but not entirely correct. $3,074 b. This would result in what type of tax rate structure? Answer is complete and correct. Tax rate structure Regressive 5:03 AM x> ツ 10/26/2021 61°F to search N4arrow_forwardsviarrow_forwardQuestion 3: Property tax Aamir owns property with an assessed value of $500,000. Khaled’s property has an assessed value of $1.5 million. Property tax has the following tax brackets:2% for value less than $1million and 1% for value in excess of $1 million. Calculate the amount of Property Tax payable to the government by Aamir and Khaled? Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?arrow_forward

- mgarrow_forwardRequired information Problem 4-30 (LO 4-1) (Algo) [The following information applies to the questions displayed below.] Aram's taxable income before considering capital gains and losses is $83,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Problem 4-30 Part d (Algo) d. Aram sold a capital asset that he owned for more than one year for a $3,690 gain, a capital asset that he owned for more than one year for a $530 loss, a capital asset that he owned for six months for a $430 gain, and a capital asset he owned for two months for a $2,360 loss. > Answer is complete but not entirely correct. $ 84,230✔ $ 81,070 Taxable inco Income taxed at ordinary ratesarrow_forward*Adjusted Gross income is $18,000* Determine the tax liability if you are filing single using the standard deduction of $12,000 and have no adjustments, itemized deductions, or tax credits.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education