Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please solve this question general accounting

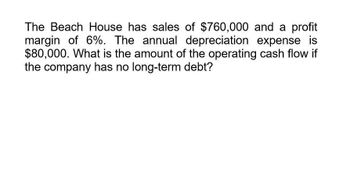

Transcribed Image Text:The Beach House has sales of $760,000 and a profit

margin of 6%. The annual depreciation expense is

$80,000. What is the amount of the operating cash flow if

the company has no long-term debt?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the operating cash flow?arrow_forwardSo Long, Inc, has sales of $334,000, costs of $145,400, depreciation expense of $63,200 and interest expense of $22,300. If the tax rate is 35%, (a) What is the operating cash flow or OCF? (b) Explain why interest paid is not a component of operating cash flow.arrow_forwardABC, Inc., is considering purchase of a new equipment. The expected sales are expected to be $5,556,982. The annual cash operating expenses are expected to be $2,957,536. The annual depreciation is estimated to be $456,926 and the interest expense is estimated to be $206,975. If the tax rate is 33%, what is the operating cash flow?arrow_forward

- Now suppose a firm has the following information: $7 million insales, $4 million of costs of goods sold excluding depreciation andamortization, and $500,000 of other operating expenses. What isits EBITDA? ($2.5 million)arrow_forwardWhat is the operating cash flow? General accountingarrow_forwardBronze, Inc has sales of $58,200, costs of $25,300, depreciation expense of $3,100, and interest expense of $4,400. If the tax rate is 21 percent, what is the operating cash flow?arrow_forward

- What is the operating cash flow. General accountingarrow_forwardDaniel's Market has sales of $36,000, costs of $28,000, depreciation expense of $3,000, and interest expense of $1,500. If the tax rate is 30 percent, what is the operating cash flow, OCF?arrow_forwardIn the Wall Bricks, Inc.’s balance sheet lists net fixed asset as $12 million. The fixed assets could currently be sold for $10 million. Wall Bricks’ current balance sheet shows current assets of $6 million and current liabilities of $3 million. If all the current accounts were liquidated today, the company would receive $4 million cash after paying the $1 million in liabilities. What is the book value of Wall Bricks’ assets today? What is the market value of these assets?arrow_forward

- Consider a company with EBIT of $450,000, tax rate of 25%, depreciation and amortization expenses of $60,000, capital expenditures of $120,000, acquisition expenses of $80,000 and change in working capital of negative $30,000. How much is its free cash flow during that period? Round to the nearest whole dollar.arrow_forwardhas total sales of $1,500,000 and costs of $993,500. Depreciation is $60,000 and the tax rate is 21 percent. The firm does not have any interest expense. What is the operating cash flow?arrow_forwardGraff, Incorporated, has sales of $55,000, costs of $25,000, depreciation expense of $2,750, and interest expense of $2,500. If the tax rate is 23 percent, what is the operating cash flow, or OCF? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Operating cash flowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning