SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Quick answer of this accounting questions

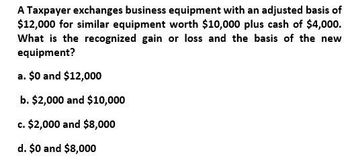

Transcribed Image Text:A Taxpayer exchanges business equipment with an adjusted basis of

$12,000 for similar equipment worth $10,000 plus cash of $4,000.

What is the recognized gain or loss and the basis of the new

equipment?

a. $0 and $12,000

b. $2,000 and $10,000

c. $2,000 and $8,000

d. $0 and $8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- account answer wantedarrow_forward17arrow_forward1. The following relates to taxpayer500,000 Interest expense200,000 interest income-promissory notesCompute the deductible expense 2. A taxpayer with net sales of P2,000,000 and cost of sales of P1,000,000 incurred P12,000 EAR expenses. Compute the allowable deduction for EAR expenses 3. The personal car of the taxpayer had the following data:5,000,000 Fair market value4,000,000 purchase price10 years estimated useful lifeWhat is the deductible annual depreciation expense?arrow_forward

- Taxpayer has assets = $10,000 and liabilities = $15,000, determine if taxpayer is insolvent and to which extent B D insolvent by $5,000 insolvent by $10,000 insolvent by $15,000 totally insolvent; it doesn't matter how much ←arrow_forwardGRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The Tax shall be Plus of Excess Over 250,000 250,000 400,000 20% 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000arrow_forwardIf a taxpayer has interest income of $5,500 and investment interest expenses of $6,000 in itemized deductions, what amount can the taxpayer deduct in investment interest expenses? *If zero, enter "0". 5500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT