EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hi teacher please help me this question general accounting

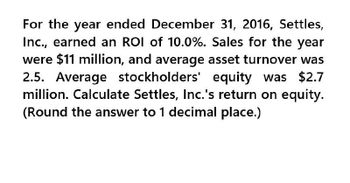

Transcribed Image Text:For the year ended December 31, 2016, Settles,

Inc., earned an ROI of 10.0%. Sales for the year

were $11 million, and average asset turnover was

2.5. Average stockholders' equity was $2.7

million. Calculate Settles, Inc.'s return on equity.

(Round the answer to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the year ended December 31, 2019, Settles Inc. earned an ROI of 9.6%. Sales for the year were $16 million, and average asset turnover was 2.4. Average stockholders' equity was $3.2 million.Required: Calculate Settles Inc.'s margin and net income. (Round "Margin" answer to 1 decimal place. Enter the net income answer in dollars, i.e., $5 million should be entered as 5,000,000.) Calculate Settles Inc.'s return on equity. (Round your answer to 1 decimal place.)arrow_forwardČardinal Industries had the following operating results for 2018: Sales = $34,621; Cost of goods sold Dividends paid = $2,023. At the beginning of the year, net fixed assets were $19,970, current assets were $7,075, and current liabilities were $4,01O. At the end of the year, net fixed assets were $24,529, current assets were $8,702, and current liabilities were $4,700. The tax rate for 2018 was 25 percent. $24,359; Depreciation expense = $6,027; Interest expense $2,725; %3D a. What is net income for 2018? (Do not round intermediate calculations.) b. What is the operating cash flow for 2018? (Do not round intermediate calculations.) c. What is the cash flow from assets for 2018? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) d- If no new debt was issued during the year, what is the cash flow to creditors? (Do not 1. round intermediate calculations.) d- If no new debt was issued during the year, what is the cash flow to stockholders? (Do…arrow_forwardIn 2016, the Allen corporation had sales of $67 million, total assets of $42 million, and total liabilities of $19 million. The interest rate on the company’s debt is 6.3 percent, and it’s tax rate is 35 percent. The operating profit margin is 14 percent A. Compute the firm’s 2016 net operating income and net income The firm’s 2016 net operating income is Round to two decimal places B. Calculate the firms operating return on assets and return on equity.arrow_forward

- In 2016, the Allen corporation had sales of $63 million, total assets of $44 million, and total liabilities of $15 million. The interest rate on the company’s debt is 5.7 percent, and it’s tax rate is 35 percent. The operating profit margin is 14 percent. A. Compute the firm’s 2016 net operating income and net income The firm’s 2016 net operating income is Round to two decimal places.arrow_forwardThe average days of account payable?arrow_forwardThe comparative financial statements of Bettancort Inc. are as follows. The market price of Bettancort Inc. common stock was $71.25 on December 31, 2014. InstructionsDetermine the following measures for 2014, rounding to one decimal place:1. a.Working capital b. Current ratio c. Quick ratiod. Accounts receivable turnovere. Number of days' sales in receivablesf. Inventory turnoverg. Number of days' sales in inventoryh. Ratio of fixed assets to long-term liabilitiesi. Ratio of liabilities to stockholders’ equityj. Number of times interest charges are earnedk. Number of times preferred dividends are earned2. a. Ratio of net sales to assetsb. Rate earned on total assetsc. Rate earned on stockholders' equityd. Rate earned on common stockholders' equitye. Earnings per share on common stockf. Price-earnings ratiog. Dividends per share of common stockh. Dividend yieldarrow_forward

- James Furnishings generated $2 million in sales during 2016, and its year-end total assets were $1.5 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.75 for every $1.00 increase in sales. James' profit margin is 3%, and its retention ratio is 35%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardAt year-end 2016, total assets for Arrington Inc. were $1.4 million and accounts payable were $410,000. Sales, which in 2016 were $2.8 million, are expected to increase by 20% in 2017. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to $440,000 in 2016, and retained earnings were $305,000. Arrington plans to sell new common stock in the amount of $60,000. The firm's profit margin on sales is 3%; 50% of earnings will be retained. a. What were Arrington's total liabilities in 2016? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. b. How much new long-term debt financing will be needed in 2017? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round your…arrow_forwardCardinal Industries had the following operating results for 2018: Sales = $34,318; Cost of goods sold = $24,212; Depreciation expense = $5,997; Interest expense = $2,710; Dividends paid = $1,996. At the beginning of the year, net fixed assets were $19,940, current assets were $7,054, and current liabilities were $3,992. At the end of the year, net fixed assets were $24,502, current assets were $8,684, and current liabilities were $4,673. The tax rate for 2018 was 22 percent. a. What is net income for 2018? (Do not round intermediate calculations.) b. What is the operating cash flow for 2018? (Do not round intermediate calculations.) c. What is the cash flow from assets for 2018? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) d-1. If no new debt was issued during the year, what is the cash flow to creditors? (Do not round intermediate calculations.) d-2. If no new debt was issued during the year, what is the cash flow…arrow_forward

- Paladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were $3.2 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.80 for every $1.00 increase in sales. Paladin's profit margin is 5%, and its retention ratio is 40%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardIn 2018, Jake's Jamming Music, Inc. announced an ROA of 8.46 percent, ROE of 13.50 percent, and profit margin of 8.5 percent. The firm had total assets of $8.5 million at year-end 2018. Calculate the 2018 value of net income available to common stockholders for Jake’s Jamming Music, Inc. (Enter your answer in dollars. Round your answer to the nearest whole dollar.) Calculate the 2018 value of common stockholders’ equity for Jake’s Jamming Music, Inc. (Enter your answer in dollars not in millions and round to the nearest whole dollar.)arrow_forwardCalculate the P/R for (WMT) as of November 14, 2017, when the company's stock price closed at $91.09.2 The company's profit for the fiscal year ending January 31, 2017, was US$13.64 billion, and its number of shares outstanding was 3.1 billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT