EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Assets turnover??

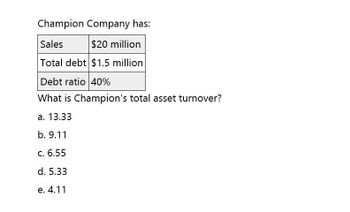

Transcribed Image Text:Champion Company has:

Sales

$20 million

Total debt $1.5 million

Debt ratio 40%

What is Champion's total asset turnover?

a. 13.33

b. 9.11

c. 6.55

d. 5.33

e. 4.11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A4arrow_forwardThe following information is available on Company A: Sales Operating Income $900,000 $36,000 Shareholders' Equity Average Operating Assets $100,000 $180,000 Minimum Required Rate of Return 15% What is the fixed asset turnover for Company A? ○ 25 ○ 5 O 9 O2arrow_forwardFollowing data is given for XYZ company: Sales $114,000 Operating income Total assets $39,900 $71,250 Return on investment for XYZ company is: a. 21.875% b. 56% с. 100% d. 10%arrow_forward

- If Epic, Inc. has an ROE of 25%, an equity multiplier of 4, and a profit margin of 12%, what is the total asset turnover ratio? a. 0.0833 b. 0.192 c. 0.5208 d. 0.75arrow_forwardNeed help with this accounting questionarrow_forwardAmir Company’s net income and net sales are $18,000 and $1,100,000, respectively,and average total assets are $100,000. What is Amir’s return on assets?a. 20.0%b. 18.0%c. 3.7%d. 7.0%arrow_forward

- Calculate the sales margin, asset turnover, and ROA for the companies below: Average Capital Assets Company A B Net Income Sales 350,000 5,500,000 12,000,000 .06 845,000 9,350,000 13,500,000 Sales Margin 1 Asset Turnover 2.9 1.44 Note: Please write the sales Margin and ROI as a percentage or as a decimal rounded to two places behind the decimal point. ROI 6,500,000 4,150,000arrow_forwardSE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Left-Aid Corporation DPS $2.45 Total Asset Turnover 3.80 Net Profit Margin 6.50% EPS $3.50 Total Assets/Equity 1.60 Refer to Exhibit 9.17. What is Left-Aid Corporation's expected sustainable growth rate? a. 22.1% b. 18.7% c. 11.9% d. 27.7% e. 30.0%arrow_forward16. Quick assets P208,000 Acid test ratio 2.6 to 1 Current ratio 3.5 to 1 Net sales for the year P1,800,000 Cost of sales for the year P990,000 Average total assets P1,200,000 The company’s inventory balances at December 31 is? The company’s asset turnover ratio for the year is?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT