FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

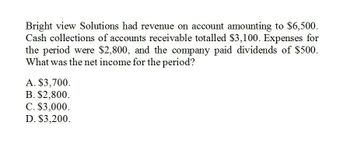

What was the net income for the period for this general accounting question?

Transcribed Image Text:Bright view Solutions had revenue on account amounting to $6,500.

Cash collections of accounts receivable totalled $3,100. Expenses for

the period were $2,800, and the company paid dividends of $500.

What was the net income for the period?

A. $3,700.

B. $2,800.

C. $3,000.

D. $3,200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Interest Revenue on the income statement is $3.900, beginning Interest Receivable is $360, ending Interest Receivable is $420, and Net Sales Revenue is $31,800. What is the cash receipt for interest? OA. $27,860 OB $3,100 OC. $3,140 OD. $3.860arrow_forwardHolloway Company earned $6,200 of service revenue on account during Year 1. The company collected $5,270 cash from accounts recievable during Year 1. a. the balance of the accounts recievable that would be reported on the Decmeber 31,Year1,balance sheet b. the amount of net income that would be reported on the Year 1 income statement. c. the amount of net cash flow from operating activites that would be reported on the Year 1 statement of cash flows d. the amount of retained earnings that would be reported on the Year 1 balance sheetarrow_forwardGregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forward

- Bleeker Street Bounty Work Sheet (partial) For the year ended December 31, 20-- Account Title Income Statement Balance Sheet 'Debit Credit Debit Credit Cash 12,300 Accounts Receivable 25,000 Merchandise Inventory 16,000 Store Supplies 1,100 Office Supplies 600 Prepaid Insurance 1,500 Store Equipment 66,000 Accumulated Depreciation-Store Equipment 38,000 Office Equipment 18,000 Accumulated Depreciation-Office Equipment 10,000 Accounts Payable 22,300 Salaries Payable 400 Long-Term Notes Payable 36,000 Carlo Perez, Capital 50,600 Carlo Perez, Drawing 32,000 Income Summary 17,000 16,000 Sales 61,500 Sales Returns and Allowances 500 Purchases 23,000 700 Purchases Returns and Allowancesarrow_forwardA company reports the following:Sales $1,500,000Average accounts receivable (net) 100,000Determine (a) the accounts receivable turnover and (b) the number of days’ sales in receivables. Round to one decimal place.arrow_forwardThe companys balance sheet showed an accounts receivble balance of $80,000 at the begininng of the year and $47,000 at the end of the year. The company reported $720,000 in credit sales for the year. What was the amount of cash collected on account receivables durig the yeararrow_forward

- The following account balances were extracted from the accounting records of A and D Corporation: Accounts Receivable $280,000 Uncollectible Account Expense $45,000 Allowance for Uncollectible Accounts $35,000 What is the net realizable value of the accounts receivable? $280,000 O $270,000 O $200,000 O $245,000 O $235,000arrow_forwardThe Liu Company had $600,000 of sales revenue. During the same accounting period the beginning and ending accounts receivable balances were $27,000 and $29,000, respectively. What amount of cash was collected from the customers during this period? A. $600,000 B. $602,000 C. $598,000 D. $2,000arrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $350,000; allowance for uncollectible accounts at the beginning of the year, $24,000 (credit balance); credit sales during the year, $1,200,000; accounts receivable written off during the year, $15,000; cash collections from customers, $1,100,000. Assuming the company estimates that future bad debts will equal 12% of the year-end balance in accounts receivable.1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward

- sanjuarrow_forwardWhat is the accounts receivable balance?arrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $300,000; allowance for uncollectible accounts at the beginning of the year, $25,000 (credit balance); credit sales during the year, $1,500,000; accounts receivable written off during the year, $16,000; cash collections from customers, $1,450,000. Assuming the company estimates that future bad debts will equal 10% of the year-end balance in accounts receivable. 1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education