Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you please give me correct answer the accounting question?

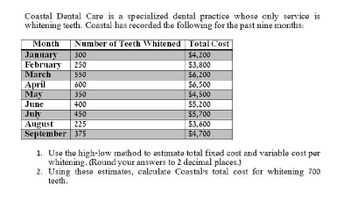

Transcribed Image Text:Coastal Dental Care is a specialized dental practice whose only service is

whitening teeth. Coastal has recorded the following for the past nine months:

Month Number of Teeth Whitened Total Cost

January

300

February

250

March

550

April

600

May

350

June

400

July

450

August

225

September 375

$4,200

$3,800

$6,200

$6,500

$4,500

$5,200

$5,700

$3,600

$4,700

1. Use the high-low method to estimate total fixed cost and variable cost per

whitening. (Round your answers to 2 decimal places.)

2. Using these estimates, calculate Coastal's total cost for whitening 700

teeth.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months: Month Number of Cavities Filled Total Cost January 575 $6,400 February 475 5,350 March 675 6,050 April 550 6,250 May 300 5,150 June 500 6,050 July 325 5,300 August 400 5,050 September 425 5,900 Required: 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. 2. Using these estimates, calculate Mountain’s total cost for filling 350 cavities.arrow_forwardDon't Use Aiarrow_forwardYour Answerarrow_forward

- If you give me wrong answer, I will give you unhelpful ratearrow_forwardMountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months: Month Number of Cavities Filled Total Cost January 625 $5,600 February 700 6,000 March 500 4,500 April 425 4,100 May 450 4,500 June 300 3,200 July 375 3,500 August 550 4,900 September 575 5,400 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. 2. Using these estimates, calculate Mountain’s total cost for filling 500 cavities.arrow_forwardMountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months: Month Number of Cavities Filled Total Cost January 300 $5,000 February 600 6,150 March 575 6,350 April 450 5,400 May 525 6,150 June 550 6,050 July 625 6,300 August 325 5,200 September 400 5,200 Required: 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. (Round your Variable cost per unit to 2 decimal places.) Fixed Cost Variable Cost per cavity filled 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. 2. Using these estimates, calculate Mountain’s total cost for filling 425 cavities.arrow_forward

- Provide Answer pleasearrow_forwardProvide fast answer ASAP PLEASEarrow_forwardABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and aftercare (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning