FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The

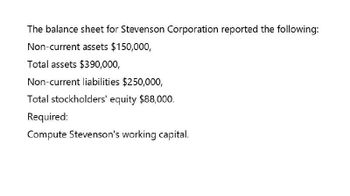

Transcribed Image Text:The balance sheet for Stevenson Corporation reported the following:

Non-current assets $150,000,

Total assets $390,000,

Non-current liabilities $250,000,

Total stockholders' equity $88,000.

Required:

Compute Stevenson's working capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The balance sheet for Yakima Corporation reported the following: noncurrent assets, $230,000; total assets, $470,000; noncurrent liabilities, $210,000; total stockholders’ equity, $83,000. Compute Stevenson’s working capital.arrow_forwardThe balance sheet for simmons corporation reported the followingarrow_forwardProvide balance sheet data ?arrow_forward

- Balance Sheet You are evaluating the balance sheet for Cypress Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $670,000, Accounts receivable = $870,000, Inventory = $570,000, Accrued wages and taxes = $111,000, Accounts payable = $207,000, and Notes payable = $1,070,000. What is Cypress's net working capital? Multiple Choice $1,388,000 O $2,110,000 $722,000 O $3,498,000arrow_forwardBalance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forwardThe balance sheet for the Capella Corporation is as follows: Assets Liabilities and Shareholders' Equity Current assets $ 300 Current liabilities $ 110 Net fixed assets 1, 200 Long-term debt 500 Shareholders' equity 890 Total assets $ 1,500 Total liabilities and shareholders' equity $ 1, 500 What is the Net Working Capital for Capella Corporation?arrow_forward

- Jones Corp. reported current assets of $191,000 and current liabilities of $136,000 on its most recent balance sheet. The working capital is:arrow_forwardScare Train, Inc. has the following balance sheet statement items: current liabilities of $779,470; net fixed and other assets of $1,329,896; total assets of $3,237,746; and long-term debt of $621,991. What is the amount of the firm's net working capital?arrow_forwardCoastal's balance sheet for a recent year revealed the following information Current assets Noncurrent assets Noncurrent liabilities $ 820,000 550,000 320,000 480,000 Stockholders' equity Required: Determine the amount of working capital reported in the balance sheet. Working capitalarrow_forward

- Question: Calculate the weights of capital components based on the book value balance sheet. (answer in excel format and show input for spreadsheets)arrow_forwardABC Corporation has the following balance sheet. How much net operating working capital does the firm have? Cash Short-term investments Accounts receivable Inventory Current assets Net fixed assets Total assets O a. $285.00 O b. $15.00 O c. $68.00 O d. $82.00 Oe. $232.00 $10 Accounts payable Accruals 84 Notes payable 56 Current liabilities $150 Long-term debt 100 Common equity Retained earnings Total liab. & equity $250 $22 60 53 $135 30 30 55 $250arrow_forwardWu Systems has the following balance sheet. Assume that all current assets are used in operations. How much net operating working capital does the firm have?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education