EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

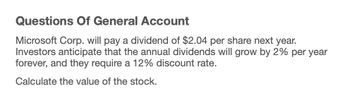

Transcribed Image Text:Questions Of General Account

Microsoft Corp. will pay a dividend of $2.04 per share next year.

Investors anticipate that the annual dividends will grow by 2% per year

forever, and they require a 12% discount rate.

Calculate the value of the stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?arrow_forwardBackyard Company is expected to pay a dividend of $L4 per share in the coming year. The required rate of return on the share is equal to 12% and dividends are expected to grow at the rate of 4% per year. Calculate the current value (price) of the stock. Note: Include two decimal points in your answer. Answer: Give your reasonsarrow_forwardCanPro Co. is expecting that its dividend for this coming year will be $1.2 a share and that all future dividends are expected to increase by 3 percent annually. What is the required return of this stock if the current market price of the stock is $17?arrow_forward

- MMC expects to pay its first dividend at the end of the year. The first dividend is expected to be $0.75 and the second $1.25. Then, dividends are expected to grow at 3.5% thereafter. Given a required return of 8.5%, what should the value of the stock be today?arrow_forwardConsider the stock of Davidson Company that will pay an annual dividendof $2 in the coming year. The dividend is expected to grow at a constantrate of 5 percent permanently. The market requires a 12-percent returnon the company. What is the current price of a share of the stock?arrow_forwardConsider the stock of Davidson Company that will pay an annual dividend of 2 in the coming year. The dividend is wxpected to grow at a constant rate of 5 percent permanently. The market requires a 12-percent return on the company. What is the current price of share of the stock?arrow_forward

- Whizcom Inc. is expected to pay a dividend of $1 next period. Dividends are expected to grow at 2% per year and the investors require a return of 12%. i) Compute the current stock price for Whizcom Inc.ii) What would be the likely stock price in year 5?iii) What would be per annum rate of return implied by a change in prices from time 0 to time 5?arrow_forwardThe common stock of Ert Co. is expected to pay a dividend of $2.50 per share next year. Thedividend is expected to grow at the rate of 3% per year forever. If the appropriate discount rate is10%, what should be the price of stock?arrow_forwardTresnan Brothers is expected to pay a $1.60 per share dividend at the end of the year (i.e., D1 = $1.60). The dividend is expected to grow at a constant rate of 9% a year. The required rate of return on the stock, rs, is 17%. What is the stock's current value per share? Round your answer to the nearest cent. $ ______ Travis Industries plans to issue perpetual preferred stock with an $11.00 dividend. The stock is currently selling for $106.00, but flotation costs will be 7% of the market price, so the net price will be $98.58 per share. What is the cost of the preferred stock, including flotation? Round your answer to two decimal places. ________ %arrow_forward

- Mclver's Meals, Inc. currently pays a OMR2 annual dividend. Investors believe that dividends will grow at 20% next year, 12% annually for the two years after that, and 6% annually thereafter. Assume the required return is 10%. What is the current market price of the stock? Select one: O a. OMR69.30 O b.OMR75.20 O c. OMR66.60 O d. OMR60.80 O e. OMR54.99arrow_forwardABC Company is expected to pay $2.80 per share dividend at the end of the year (D1 = $2.80). The dividend is expected to grow at a constant rate of 5% per year. The required rate of return on the stock, rs is 9%. What is the stock’s current value per share? 2. Use the information from question 2 to calculate the following. You will need to also calculate the current stock price for year 2 in order to calculate each of these items. (hint: Use PowerPoint slide 14 as a guide): Dividend yield Capital gains yield Total return 3. ABC Company also has perpetual preferred stock outstanding that sells for $25 a share and pays a dividend of $3.00 at the end of each year. What is the required rate of return?arrow_forwardNoRagrets, Inc is expected to pay a dividend in year 1 of $2 and a dividend in year 2 of $2.40. After year 2, dividends are expected to grow at the rate of 6% per year. An appropriate required return for the stock is 9%. The stock should be worth _______ today. Select one: a. $79.63 b. $73.21 c. $67.32 d. $73.37arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning