Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

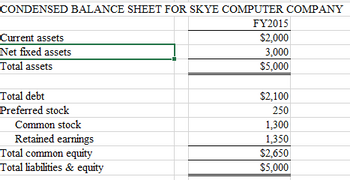

Question: Calculate the weights of capital components based on the book value

Transcribed Image Text:CONDENSED BALANCE SHEET FOR SKYE COMPUTER COMPANY

FY2015

$2,000

3,000

$5,000

Current assets

Net fixed assets

Total assets

Total debt

Preferred stock

Common stock

Retained earnings

Total common equity

Total liabilities & equity

$2,100

250

1,300

1,350

$2,650

$5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How to calculate working capital, current assests, current liabilities, quick assets, quick ratio and current ratio.arrow_forwardanalyze the use of the assets of Facebook please. Please include two ratios, Asset Turnover and Return on Assets. These ratios need to incorporate all assets on the balance sheet.arrow_forwardThe income statement section of the worksheet includes ________arrow_forward

- Identifying Financial Statement Line Items and Accounts Several line items and account titles are listed below. For each, indicate in which of the following financial statement(s) we would likely find the item or account: income statement (IS), balance sheet (BS), statement of stockholders' equity (SE), or statement of cash flows (SCF). (Select all that apply.) Account (a) Cash asset (b) Expenses (c) Noncash assets (d) Contributed capital (e) Cash outflow for capital expenditures (f) Retained earnings (g) Cash inflow for stock issued (h) Cash outflow for dividends (i) Revenue Financial Statement(s) ◆ + + ♦ ♦ + ◆arrow_forwardIdentify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Transaction 1. Owner invests $900 cash in business in exchange for stock 2. Receives $700 cash for services provided 3. Pays $500 cash for employee wages 4. Buys $100 of equipment on credit 5. Purchases $200 of…arrow_forwardplease do the balance sheet and sshow work the first partarrow_forward

- 1) Where is the Standard Balance Sheet located in QuickBooks? 2) What is the purpose of a comparative balance sheet? 3) How is a balance sheet modified?arrow_forwardProject X has an initial cost of $46,919, and its expected net cash inflows are $11,500 per year for 6 years. The firm has a WACC of 8 percent, and Project X's risk would be similar to that of the firm's existing assets. Calculate the discounted payback period of Project X. 5.14 years |arrow_forwardThe traditional way of preparing a balance sheet is to list all assets in the order of their: A) Market value B) Risk C) Liquidity D) Costarrow_forward

- A financial statement that reveals the change in capital. The ending fi gure for capital is thenplaced on the balance sheet is called:arrow_forwardThe following lettered items represent a classification scheme for a balance sheet, and the numbered items represent data found on balance sheets. In the blank next to each account, write the letter indicating to which category it belongs. А. Current assets В. Investments C. Property, plant, and equipment D. Intangible assets Е. Current liabilities F. Long-term liabilities G. Stockholders' equity Н. Not on the balance sheetarrow_forwardDescribe the process of preparing an income statement and a balance sheet, including the specific elements and formulas used in each statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education