EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General accounting

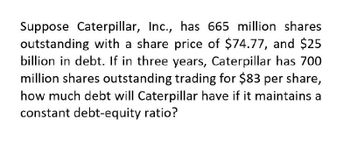

Transcribed Image Text:Suppose Caterpillar, Inc., has 665 million shares

outstanding with a share price of $74.77, and $25

billion in debt. If in three years, Caterpillar has 700

million shares outstanding trading for $83 per share,

how much debt will Caterpillar have if it maintains a

constant debt-equity ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me.arrow_forwardSuppose that Papa Bell, Inc.’s equity is currently selling for $50 per share, with 3.5 million shares outstanding. Assume the firm also has 12,000 bonds outstanding, and they are selling at 94 percent of par.What are the firm’s current capital structure weights? Capital Structure Weights Equity % Debt %arrow_forwardTime Warner shares have a market capitalization of $55 billion. The company just paid a dividend of $0.35 per share and each share trades for $35. The growth rate in dividends is expected to be 6.5% per year. Also, Time Warner has $20 billion of debt that trades with a yield to maturity of 7%. If the firm's tax rate is 30%, compute the WACC?arrow_forward

- Suppose Compco Systems pays no dividends but spent $4.95 billion on share last year. Compco's equity cost of capital is 11.9% and if the amount spent on repurchases is expected to grow by 7.8% per year, estimate Compco's market capitalization. If Compco has 5.2 billion shares outstanding, what stock price does this correspond ?arrow_forwardYou expect X-Co will pay a dividend of $76 million and repurchase $100 million of its common shares next year (Year 1) with both expected to grow 8% in Year 2 and 6% in Year 3. If you expect the company to be sold for $12 billion at the end of Year 3, and you have calculated the cost of equity to be 8.4%, what do you estimate the true value of the company’s net worth to be now? (First draw a timeline. Assume all cash flows are at the end of the year.)arrow_forwardSuppose Compco Systems pays no dividends but spent $5.15 billion on share repurchases last year. If Compco's equity cost of capital is 12.3%, and if the amount spent on repurchases is expected to grow by 8.9% per year, estimate Compco's market capitalization. If Compco has 5.9 billion shares outstanding, to what stock price does this correspond?arrow_forward

- Suppose Caterpillar, Inc., has 671 million shares outstanding with a share price of $72.97, and $25.71 billion in debt. If in three years, Caterpillar has 700 million shares outstanding trading for $83.96 per share, how much debt will Caterpillar have if it maintains a constant debt-equity ratio? Question content area bottom Part 1 The amount of debt required in three years will be $enter your response here billion. (arrow_forwardKrell Industries has a share price of $22.35 today. If Krell is expected to pay a dividend of $0.84 this year and its stock price is expected to grow to $24.51 at the end of the year, what is Krell's dividend yield and equity cost of capital? The dividend yield is 3.8%. (Round to one decimal place.) The capital gain rate is 13.42 %. (Round to one decimal place.)arrow_forwardSuppose Compco Systems pays no dividends but spent $5.16 billion on share repurchases last year. If Compco's equity cost of capital is 12.7%, and if the amount spent on repurchases is expected to grow by 8.2% per year, estimate Compco's market capitalization. If Compco has 5.7 billion shares outstanding, to what stock price does this correspond? Compco's market capitalization will be $ billion. (Round to two decimal places.)arrow_forward

- Krell Industries has a share price of $21.81 today. If Krell is expected to pay a dividend of $1.18 this year and its stock price is expected to grow to $24.71 at the end of the year, what is Krell's dividend yield and equity cost of capital? The dividend yield is%. (Round to one decimal place.)arrow_forwardSuppose that Papa Bell Inc. equity is currently selling for $41 per share, with 3.6 million shares outstanding. The firm also has 8000 bonds outstanding, which are selling at 95% of par. Assume Papa Bell was considering an active change to its capital structure so as to have a D/E ratio of 0.5. Which type of security (stocks or bonds) would the firm need to sell to accomplish this? How much would it have to sell? (Enter your answer in dollars not in millions. Do not round immendiage calculations and round your final answer to 2 decimal places.)arrow_forwardKrell Industries has a share price of $22.79 today. If Krell is expected to pay a dividend of 1.19% this year and its stock price is expected to grow to 23.33% at the end of the year, what is Krell's dividend yield and equity cost of capital? The dividend yield is _____%. (Round to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT