CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

How much is Stephen's disposable income??

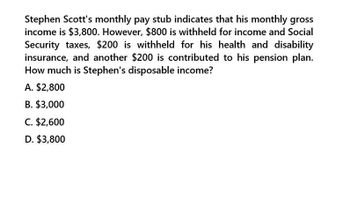

Transcribed Image Text:Stephen Scott's monthly pay stub indicates that his monthly gross

income is $3,800. However, $800 is withheld for income and Social

Security taxes, $200 is withheld for his health and disability

insurance, and another $200 is contributed to his pension plan.

How much is Stephen's disposable income?

A. $2,800

B. $3,000

C. $2,600

D. $3,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fred, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business and two days sightseeing. His expenses are 400 (airfare), 150 per day (meals), and 300 per night (lodging). What are Freds deductible expenses?arrow_forwardArthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.arrow_forwardVirginia and Richard are married taxpayers with adjusted gross income of $28,000 in 2019 If Virginia is able to make a $1,500 contribution to her IRA and Richard makes a $1,500 contribution to his IRA, what is the Saver's Credit Virginia and Richard will be eligible for? $0 $1,500 $2,000 $3,000 $4,000arrow_forward

- How much taxable income should each of the following taxpayers report? a. Kimo builds custom surfboards. During the current year, his total revenues are 90,000, and he incurs 30,000 in expenses. Included in the 30,000 is a 10,000 payment to Kimos five-year-old son for services as an assistant. b. Manu gives hula lessons at a local bar. During the current year, she receives 9,000 in salary and 8,000 in tips. In addition, she engages in illegal behavior, for which she receives 10,000.arrow_forwardLeroy and Amanda are married and have three dependent children. During the current year, they have the following income and expenses: Salaries 120,000 Interest income 45,000 Royalty income 27,000 Deductions for AGI 3,000 Deductions from AGI 9,000 a. What is Leroy and Amandas current year taxable income and income tax liability? b. Leroy and Amanda would like to lower their income tax. How much income tax will they save if they validly transfer 5,000 of the interest income to each of their children? Assume that the children have no other income and that they are entitled to a 1,050 standard deduction.arrow_forwardLinda is an employee of JRH Corporation. Which of the following would be included in Lindas gross income? a. Premiums paid by JRH Corporation for a group term life insurance policy for 50,000 of coverage for Linda. b. 1,000 of tuition paid by JRH Corporation to State University for Lindas masters degree program. c. A 2,000 trip given to Linda by JRH Corporation for meeting sales goals. d. 1,200 paid by JRH Corporation for an annual parking pass for Linda.arrow_forward

- During 2019, Carl (a single taxpayer) has a salary of $91,500 and interest income of $11,000. Calculate the maximum contribution Carl is allowed for an educational savings account. $0 $400 $1,000 $2,000 Some other amountarrow_forwardIn 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $ 400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the following amounts for Lou: Adjusted gross income $ ____________________ Standard deduction $ ____________________ Taxable income $ ____________________arrow_forwardCharles E. Bennett, age 64, will retire next year and is trying to decide whether to begin collecting his Social Security benefits at that time. His monthly benefits will increase if he defers his starting date for the benefits. He has asked you to estimate how much his income tax will increase as a result of collecting Social Security. Charles and his wife Bernice B., file a joint return, have no other dependents, and claim the standard deduction. Their only income other than the Social Security benefits are: The Social Security benefits for the year would be 12,000. a. Complete Worksheet 1, Figuring Your Taxable Benefits, included in IRS Publication 915 to determine the taxable portion of this couples taxable Social Security benefits (the publication includes a blank worksheet). b. What is the taxable portion of the 12,000 in Social Security benefits?arrow_forward

- Shoshan, age 63, retired and began receiving retirement benefits on January 1, 2021. The benefits will be paid for the joint lives of Shoshan and his wife, Aviva, age 67. Shoshan had $36,000 in after-tax contributions to his qualified plan and had received no distributions prior to retirement. How much will Shoshan and Aviva be able to exclude from each of the annuity payments? a. $100 b. $116 c. $138 d. $171 which is correct a, b, c. or d?arrow_forwardHh1. Accountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT